Region:Middle East

Author(s):Rebecca

Product Code:KRAD5003

Pages:93

Published On:December 2025

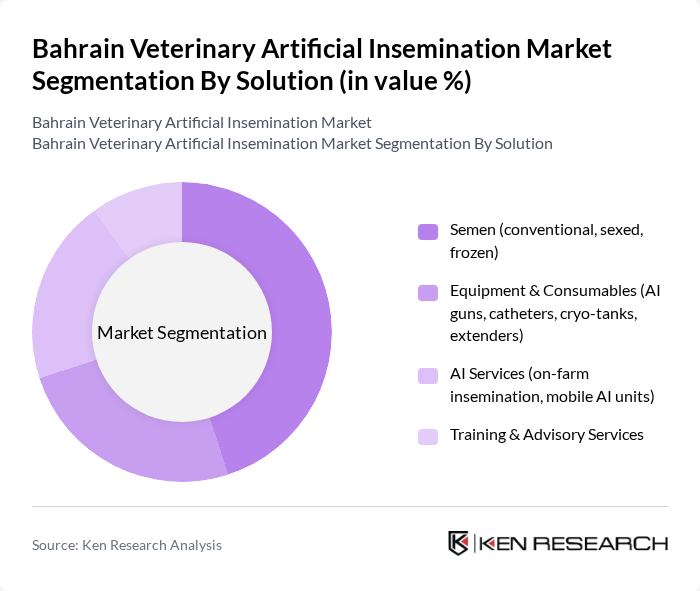

By Solution:The market is segmented into various solutions that cater to the needs of livestock farmers. The primary subsegments include Semen (conventional, sexed, frozen), Equipment & Consumables (AI guns, catheters, cryo-tanks, extenders), AI Services (on-farm insemination, mobile AI units), and Training & Advisory Services. This structure is consistent with the global veterinary artificial insemination market, where solution categories are typically reported as semen, equipment and consumables, and services. Among these, the Semen subsegment is currently leading the market due to the increasing preference for high-quality genetic material to enhance livestock productivity, with global evidence indicating semen is the fastest-growing solution type as farms seek superior genetics. The demand for sexed semen is particularly rising as farmers aim to improve herd composition and profitability by increasing the proportion of high-yielding female dairy animals and genetically superior offspring, reflecting broader adoption trends seen in bovine AI programs worldwide.

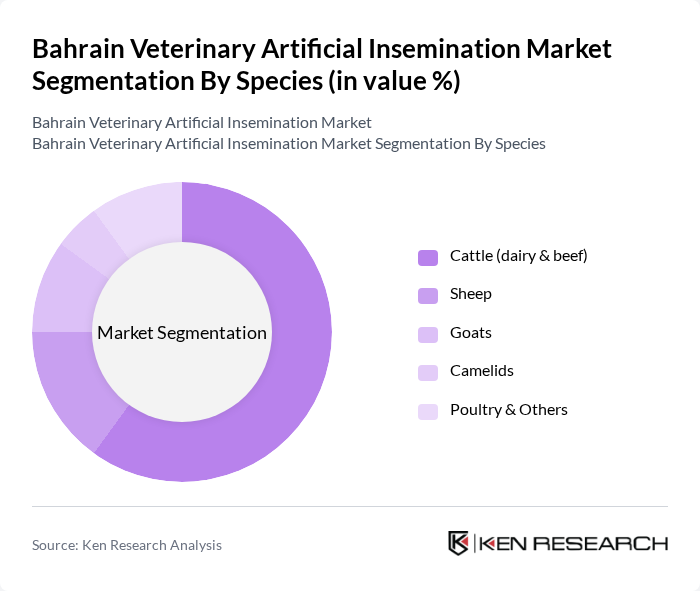

By Species:The market is also segmented by species, including Cattle (dairy & beef), Sheep, Goats, Camelids, and Poultry & Others. The Cattle subsegment dominates the market, driven by the high demand for dairy and beef production in Bahrain, which imports a significant share of its animal protein but supports local dairies and beef operations through productivity-focused interventions. Globally, the bovine segment is the leading user of veterinary artificial insemination, supported by established AI protocols and strong economic returns from improved milk and meat yields, and Bahrain follows this pattern as cattle are the primary focus of organized breeding programs. The increasing focus on improving milk yield and meat quality among farmers has led to a significant rise in the use of artificial insemination in cattle, making it the most critical species in this market, while small ruminants and camelids are increasingly served where commercial flocks and herds are present.

The Bahrain Veterinary Artificial Insemination Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bahrain Animal Production Company (Baladna Bahrain), Bahrain Livestock Company (BLC), Ministry of Municipalities Affairs and Agriculture – Directorate of Animal Wealth, Bahrain Veterinary Services (Ministry-operated government veterinary centers), Al Areen Veterinary Clinic, Dr. Nonie Coutts Veterinary Surgery, Royal Veterinary Centre, Pet Arabia Veterinary Clinic & Hospital, Bahrain Society for the Prevention of Cruelty to Animals (BSPCA) – Clinic & Animal Welfare Services, Al Jazeera Veterinary Clinic, Eurovets Veterinary Suppliers (GCC distributor active in Bahrain), Al Salam Veterinary Hospital, Al Hayat Veterinary Clinic, Al Resalah Veterinary Center, Regional & International AI Semen Suppliers Serving Bahrain (e.g., ABS Global, Semex, CRV) – aggregated overview contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Bahrain veterinary artificial insemination market appears promising, driven by increasing investments in agricultural technology and a growing emphasis on livestock quality. As farmers become more aware of the genetic benefits associated with artificial insemination, adoption rates are expected to rise. Additionally, government initiatives aimed at enhancing veterinary services will likely facilitate broader access to these technologies, ultimately contributing to improved livestock productivity and sustainability in the sector.

| Segment | Sub-Segments |

|---|---|

| By Solution | Semen (conventional, sexed, frozen) Equipment & Consumables (AI guns, catheters, cryo-tanks, extenders) AI Services (on?farm insemination, mobile AI units) Training & Advisory Services |

| By Species | Cattle (dairy & beef) Sheep Goats Camelids Poultry & Others |

| By End-User | Commercial Dairy Farms Beef & Fattening Farms Smallholder / Backyard Farmers Government & Municipal Farms Veterinary Hospitals & Clinics |

| By Technology | Conventional AI (manual estrus-based) Frozen Semen & Cryopreservation-based AI Sex-sorted Semen AI Digital / Precision Reproduction Support (estrus & pregnancy monitoring) |

| By Service Delivery Channel | Public Sector AI Programs Private Veterinary Service Providers Cooperative / Producer Association Programs Import-based Semen Distribution Partners |

| By Region | Northern Governorate Southern Governorate Capital Governorate Muharraq Governorate |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cattle Breeding Practices | 120 | Livestock Farmers, Veterinary Technicians |

| Sheep and Goat Reproduction | 90 | Farm Managers, Animal Husbandry Experts |

| Veterinary Service Providers | 70 | Veterinarians, Animal Health Consultants |

| Artificial Insemination Techniques | 85 | Reproductive Specialists, Agricultural Extension Officers |

| Market Trends and Challenges | 60 | Industry Analysts, Policy Makers |

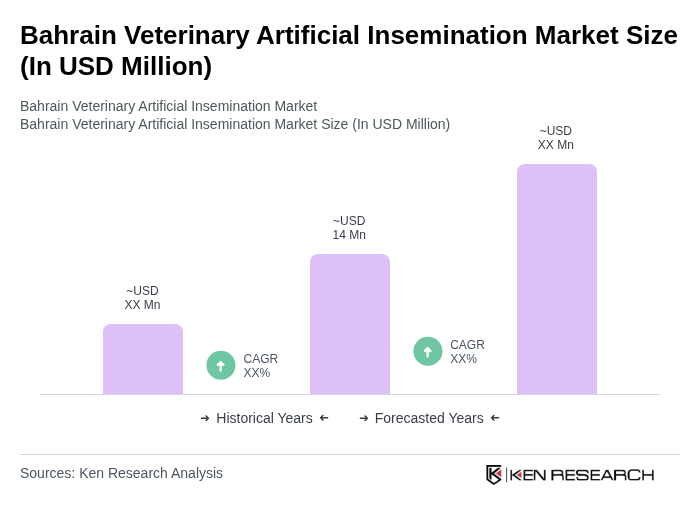

The Bahrain Veterinary Artificial Insemination Market is valued at approximately USD 14 million, reflecting its significance within the broader veterinary services market in Bahrain, which is estimated at around USD 50 million.