Region:Asia

Author(s):Dev

Product Code:KRAB1707

Pages:93

Published On:January 2026

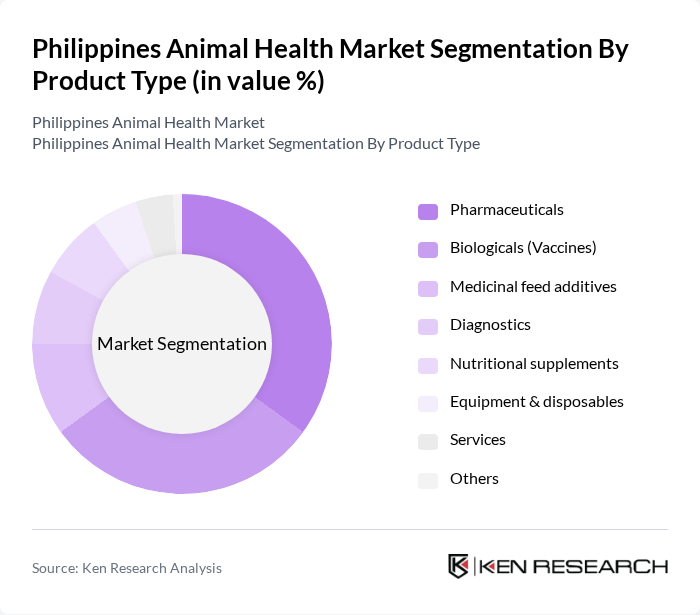

By Product Type:The product type segmentation includes various categories such as pharmaceuticals, biologicals (vaccines), medicinal feed additives, diagnostics, nutritional supplements, equipment and disposables, services, and others. This structure is consistent with leading industry taxonomies for the Philippines animal health market, where pharmaceuticals, biologics, diagnostics, equipment and disposables, and medicinal feed additives form the core product clusters. Among these, pharmaceuticals and biologicals are the leading segments due to their critical role in disease prevention and treatment in both companion animals and livestock, with pharmaceuticals representing the largest revenue share in the country. The increasing prevalence and surveillance of zoonotic diseases such as rabies, avian influenza, and African swine fever, alongside government and private vaccination programs and heightened biosecurity measures, are driving sustained demand for vaccines, anti-infectives, antiparasitics, and related preventive products.

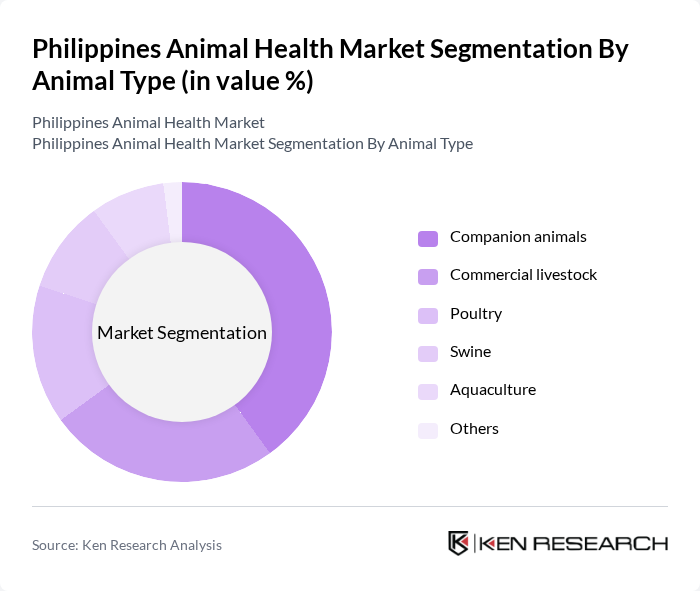

By Animal Type:The animal type segmentation encompasses companion animals, commercial livestock, poultry, swine, aquaculture, and others. This reflects the structure of the Philippines animal health and broader animal protein sectors, where companion animals (dogs and cats) are gaining importance alongside traditional livestock and poultry. Companion animals, particularly dogs and cats, are experiencing a surge in ownership in urban and peri-urban areas, leading to increased spending on veterinary care, preventive health (vaccinations, deworming), diagnostics, and premium pet food, supported by the rapid growth of the pet food and pet supplies markets. Commercial livestock, including cattle and pigs, as well as poultry, represent a significant portion of the market due to the Philippines’ robust agriculture and meat sectors, which focus on pork, chicken, and, to a lesser extent, dairy production, while aquaculture (fish and shrimp) also contributes to demand for health products and biosecurity solutions.

The Philippines Animal Health Market is characterized by a dynamic mix of regional and international players. Leading participants such as Zoetis Philippines, Inc., Merck Animal Health (MSD Animal Health), Elanco Animal Health Inc., Boehringer Ingelheim Animal Health, Virbac SA, Ceva Santé Animale, Vetoquinol SA, IDEXX Laboratories, Inc., Alltech, Phibro Animal Health Corporation, Neogen Corporation, ADM Animal Nutrition, Nutreco N.V., and local and regional players contribute to innovation, geographic expansion, and service delivery in this space, supplying pharmaceuticals, vaccines, diagnostics, feed additives, and nutrition solutions to both companion animal and livestock segments.

The future of the Philippines animal health market appears promising, driven by increasing pet ownership and a growing livestock sector. As awareness of animal welfare and preventive healthcare rises, the demand for innovative veterinary solutions is expected to grow. Additionally, the integration of digital health technologies will likely enhance service delivery, making veterinary care more accessible. These trends indicate a robust market evolution, with potential for significant advancements in animal health management and product offerings.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Pharmaceuticals Biologicals (Vaccines) Medicinal feed additives Diagnostics Nutritional supplements Equipment & disposables Services Others |

| By Animal Type | Companion animals Commercial livestock Poultry Swine Aquaculture Others |

| By Distribution Channel | Veterinary hospitals & clinics Retail pharmacies Agricultural & feed stores Online / e-commerce Distributors & wholesalers Others |

| By Region | Luzon Visayas Mindanao |

| By Application | Therapeutic (treatment) Preventive (prophylactic) Diagnostic Nutritional & performance enhancement Others |

| By Customer Type | Individual pet owners Commercial farms Integrators & producer cooperatives Veterinary hospitals & clinics Government & research institutions Others |

| By Product Formulation | Injectable Oral Topical Premix / feed-integrated Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Livestock Health Management | 120 | Livestock Farmers, Veterinary Technicians |

| Pet Health Products | 90 | Pet Owners, Veterinary Clinic Managers |

| Animal Feed Additives | 70 | Feed Mill Operators, Agricultural Extension Workers |

| Veterinary Services | 60 | Veterinarians, Animal Health Consultants |

| Regulatory Compliance in Animal Health | 50 | Regulatory Affairs Specialists, Industry Association Representatives |

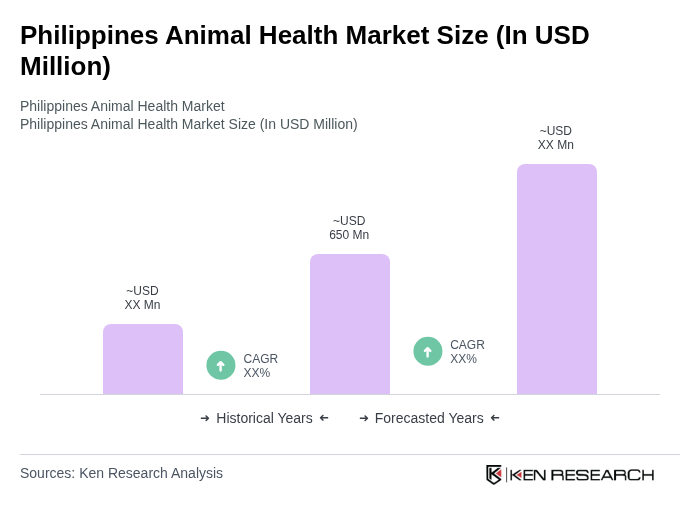

The Philippines Animal Health Market is valued at approximately USD 650 million, reflecting significant growth driven by increased pet ownership, awareness of animal health, and the expansion of livestock and poultry farming.