Region:Middle East

Author(s):Rebecca

Product Code:KRAD6180

Pages:94

Published On:December 2025

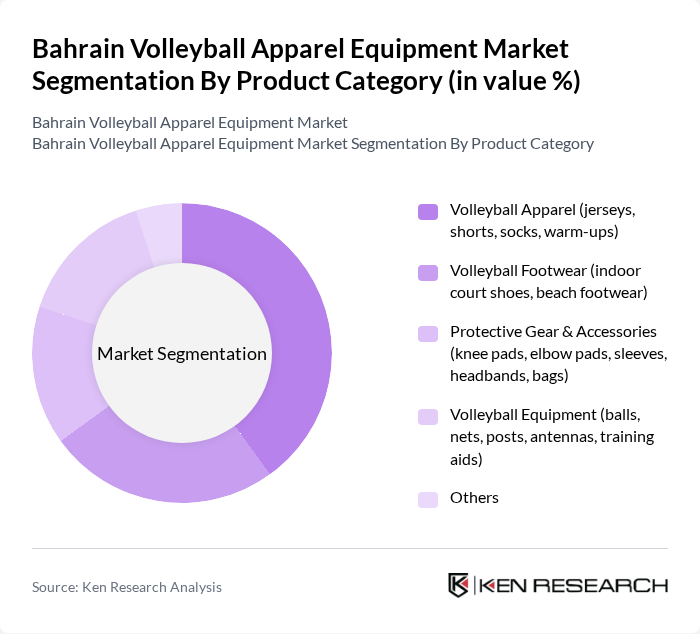

By Product Category:The product category segmentation includes various subsegments such as Volleyball Apparel, Volleyball Footwear, Protective Gear & Accessories, Volleyball Equipment, and Others. Among these, Volleyball Apparel is the leading subsegment, driven by the increasing demand for jerseys, shorts, and warm-ups among players and enthusiasts. The trend towards personalized and branded apparel has also contributed to its dominance, as consumers seek high-quality and stylish options for both performance and leisure.

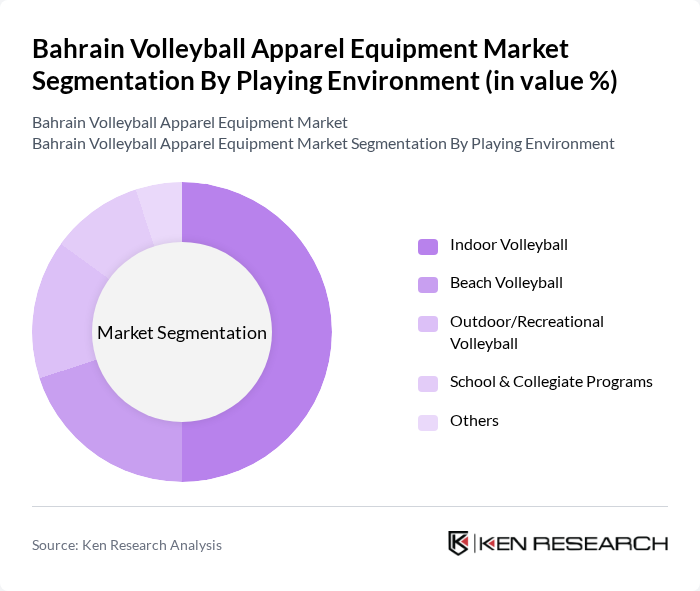

By Playing Environment:The playing environment segmentation includes Indoor Volleyball, Beach Volleyball, Outdoor/Recreational Volleyball, School & Collegiate Programs, and Others. Indoor Volleyball is the dominant subsegment, as it is widely played in schools and sports clubs across Bahrain. The increasing number of indoor facilities and organized leagues has led to a higher demand for related apparel and equipment, making it a key focus area for manufacturers and retailers.

The Bahrain Volleyball Apparel Equipment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nike, Inc., Adidas AG, Mizuno Corporation, ASICS Corporation, PUMA SE, Under Armour, Inc., Decathlon S.A. (Kipsta), Mikasa Corporation, Molten Corporation, Wilson Sporting Goods Co., Baden Sports, Inc., Hummel International Sport & Leisure A/S, Joma Sport, S.A., Li-Ning Company Limited, Al Salam Sports (Bahrain) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Bahrain volleyball apparel market appears promising, driven by increasing participation rates and a growing health-conscious population. As more individuals engage in volleyball, the demand for specialized apparel is expected to rise. Additionally, the integration of technology in fabric production and the expansion of e-commerce platforms will likely enhance accessibility and consumer engagement, fostering a more robust market environment. Strategic partnerships with local sports clubs will further solidify market presence and brand loyalty.

| Segment | Sub-Segments |

|---|---|

| By Product Category | Volleyball Apparel (jerseys, shorts, socks, warm-ups) Volleyball Footwear (indoor court shoes, beach footwear) Protective Gear & Accessories (knee pads, elbow pads, sleeves, headbands, bags) Volleyball Equipment (balls, nets, posts, antennas, training aids) Others |

| By Playing Environment | Indoor Volleyball Beach Volleyball Outdoor/Recreational Volleyball School & Collegiate Programs Others |

| By Distribution Channel | Online Retail & Marketplaces Organized Sports Retail Stores General Sporting Goods & Department Stores Brand-owned Stores & Team Direct Sales Others |

| By Material | High-performance Synthetics (polyester, nylon, elastane blends) Cotton & Natural Fibers Performance Blends (moisture-wicking, antimicrobial) Eco-friendly & Recycled Materials Others |

| By Price Range | Entry-level / Budget Mid-range Performance / Premium Professional / Elite Others |

| By Brand Origin | Local & Regional Brands International Global Brands Private-label & Retailer Brands Niche & Specialist Volleyball Brands Others |

| By Consumer Demographics | Youth (Under 15) Juniors (15–18) Adults (19–40) Masters (Above 40) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Local Volleyball Clubs | 100 | Coaches, Club Managers |

| Sports Retailers | 50 | Store Owners, Sales Managers |

| Volleyball Players | 120 | Amateur and Semi-Professional Players |

| Sports Event Organizers | 40 | Event Coordinators, Marketing Managers |

| Fitness and Sports Academies | 50 | Academy Directors, Trainers |

The Bahrain Volleyball Apparel Equipment Market is valued at approximately USD 30 million, reflecting a five-year historical analysis that indicates growth driven by increased participation in volleyball and a rising trend in fitness and wellness among the population.