Region:Asia

Author(s):Dev

Product Code:KRAB0622

Pages:98

Published On:August 2025

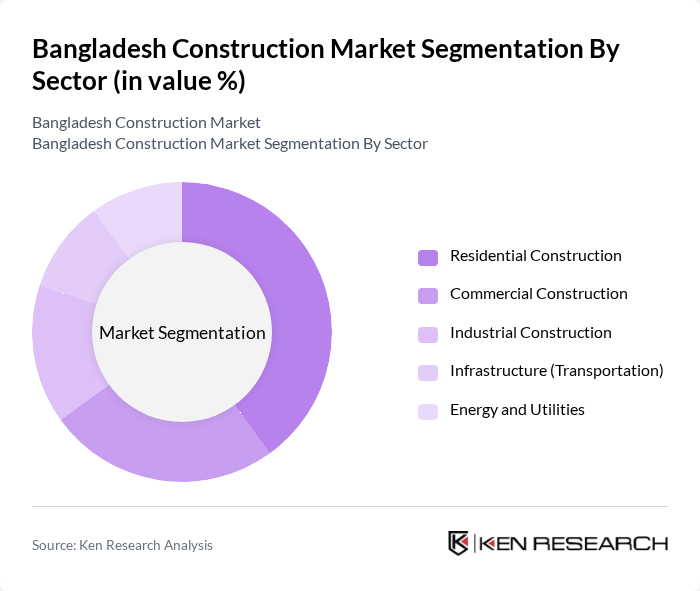

By Sector:The construction market is segmented into various sectors, includingResidential Construction, Commercial Construction, Industrial Construction, Infrastructure (Transportation), and Energy and Utilities. Among these, Residential Construction is currently the leading segment, driven by the increasing demand for housing due to urban migration and population growth. The commercial sector is also significant, fueled by the expansion of businesses and retail spaces in urban areas.

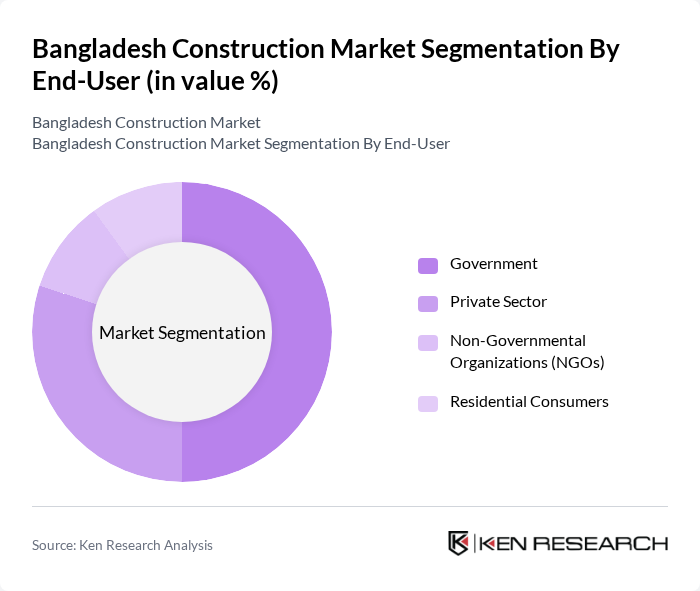

By End-User:The end-user segmentation includesGovernment, Private Sector, Non-Governmental Organizations (NGOs), and Residential Consumers. The Government is the dominant end-user, primarily due to its extensive involvement in infrastructure projects and public housing initiatives. The private sector also plays a crucial role, particularly in commercial and residential developments, reflecting the growing demand for urban housing and business facilities.

The Bangladesh Construction Market is characterized by a dynamic mix of regional and international players. Leading participants such as Mir Akhter Hossain Limited, Abdul Monem Limited, Concord Group, Max Infrastructure Limited, Mazid Sons Constructions Ltd, Sheltech (Pvt.) Ltd., Bashundhara Group, Navana Group, Unique Group, Rangs Group, Anwar Group, Summit Group, City Group, RFL Group, Berger Paints Bangladesh Limited contribute to innovation, geographic expansion, and service delivery in this space.

The Bangladesh construction market is poised for significant growth, driven by urbanization, government initiatives, and increased foreign investment. As the population continues to migrate to urban areas, the demand for housing and infrastructure will rise. Additionally, the adoption of sustainable practices and technological advancements will shape the future landscape of the industry. In future, the market is expected to witness a transformation, with a focus on smart city developments and enhanced regulatory frameworks to support sustainable growth.

| Segment | Sub-Segments |

|---|---|

| By Sector | Residential Construction Commercial Construction Industrial Construction Infrastructure (Transportation) Energy and Utilities |

| By End-User | Government Private Sector Non-Governmental Organizations (NGOs) Residential Consumers |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Funding |

| By Application | Commercial Buildings Residential Buildings Infrastructure Projects Industrial Facilities |

| By Construction Method | Traditional Construction Modular Construction Prefabricated Construction Sustainable Construction |

| By Material Type | Concrete Steel Wood Composite Materials |

| By Policy Support | Subsidies Tax Exemptions Regulatory Support Grants and Funding Programs |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Construction Projects | 120 | Project Managers, Site Engineers |

| Commercial Building Developments | 90 | Architects, Construction Supervisors |

| Infrastructure Development Initiatives | 60 | Government Officials, Urban Planners |

| Real Estate Market Trends | 50 | Real Estate Developers, Financial Analysts |

| Construction Material Suppliers | 40 | Supply Chain Managers, Procurement Officers |

The Bangladesh construction market is valued at approximately USD 34 billion, driven by rapid urbanization, government infrastructure initiatives, and increased foreign investment. This growth reflects the rising demand for residential, commercial, and infrastructure projects in the country.