Region:Asia

Author(s):Dev

Product Code:KRAA1587

Pages:98

Published On:August 2025

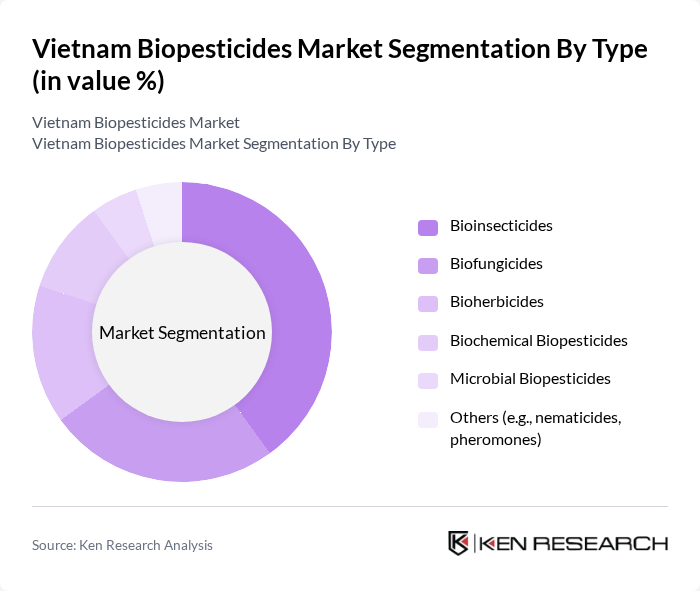

By Type:The biopesticides market can be segmented into various types, including bioinsecticides, biofungicides, bioherbicides, biochemical biopesticides, microbial biopesticides, and others such as nematicides and pheromones. Among these, bioinsecticides are widely used due to their targeted control and lower non?target impact, while microbial-based products are a core category in Vietnam’s adoption given efficacy and fit with IPM and organic systems. Rising consumer preference for residue?safe, organic produce and greater awareness of chemical risks are supporting demand across bioinsecticides and microbial solutions .

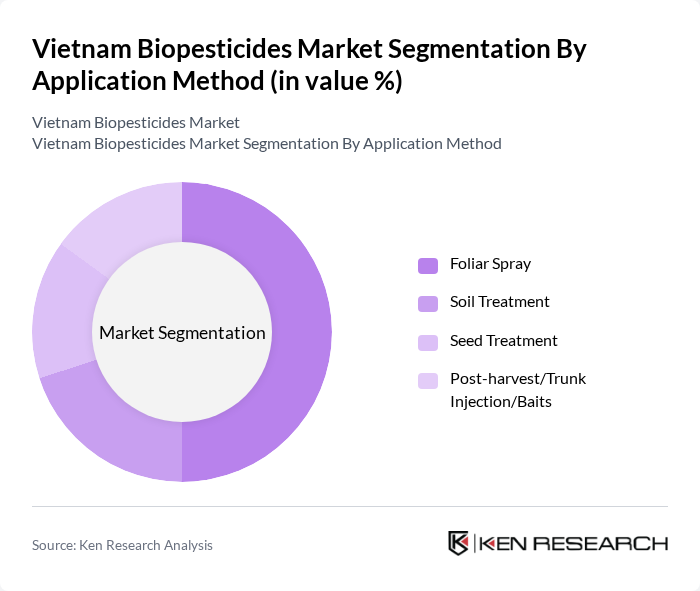

By Application Method:The application methods for biopesticides include foliar spray, soil treatment, seed treatment, and post-harvest/trunk injection/baits. Foliar spray is the most widely used method due to ease, coverage, and ability to directly target above?ground pests and diseases; precision agriculture techniques and improved formulations are further supporting foliar use and overall adoption .

The Vietnam Biopesticides Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Bayer AG, Syngenta AG, UPL Limited, Sumitomo Chemical Co., Ltd., FMC Corporation, Novozymes A/S, Koppert Biological Systems, Biobest Group NV, Certis Belchim, Andermatt Group AG, Marrone Bio Innovations, Inc. (d/b/a ProFarm Group), BioWorks, Inc. (a Biobest Company), Thái H?ng Agri JSC, An Phú Agricultural Chemistry Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Vietnam biopesticides market appears promising, driven by increasing consumer demand for organic products and government initiatives supporting sustainable agriculture. As awareness of environmental issues grows, more farmers are likely to adopt biopesticides, leading to a significant shift in pest management practices. Additionally, advancements in biopesticide formulations and distribution channels, including e-commerce, will further enhance market accessibility and growth potential in future.

| Segment | Sub-Segments |

|---|---|

| By Type | Bioinsecticides Biofungicides Bioherbicides Biochemical Biopesticides Microbial Biopesticides Others (e.g., nematicides, pheromones) |

| By Application Method | Foliar Spray Soil Treatment Seed Treatment Post-harvest/Trunk Injection/Baits |

| By Crop Type | Fruits & Vegetables Cereals & Grains (e.g., rice, maize) Oilseeds & Pulses Cash Crops (e.g., coffee, pepper, rubber, tea, cashew) Others (ornamentals, plantation crops) |

| By End-User | Smallholder Farmers Commercial Farms & Plantations Horticulture/Greenhouses Forestry & Urban Landscaping |

| By Distribution Channel | Direct Sales Agri-Input Retailers/Dealers Cooperatives & Farmer Groups Online/E-commerce |

| By Region | Northern Vietnam Central Vietnam Southern Vietnam Mekong Delta |

| By Formulation | Liquid (SC, SL, EC) Solid (WP, WG, DF) Others (GR, BR, tablets) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Biopesticide Manufacturers | 60 | Production Managers, R&D Directors |

| Agricultural Cooperatives | 80 | Cooperative Leaders, Agronomy Advisors |

| Farmers Using Biopesticides | 150 | Smallholder Farmers, Commercial Farmers |

| Distributors and Retailers | 70 | Sales Managers, Supply Chain Coordinators |

| Regulatory Bodies | 40 | Policy Makers, Environmental Officers |

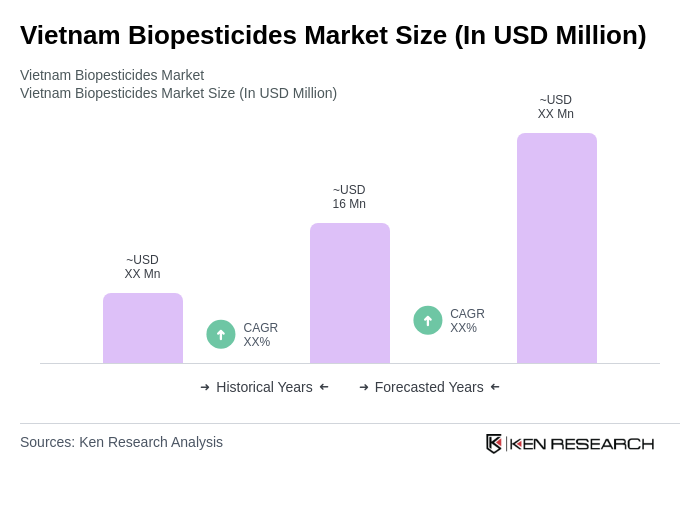

The Vietnam Biopesticides Market is valued at approximately USD 16 million, reflecting a steady growth trend driven by increasing demand for sustainable agriculture and organic farming practices.