Region:Europe

Author(s):Geetanshi

Product Code:KRAB0147

Pages:93

Published On:August 2025

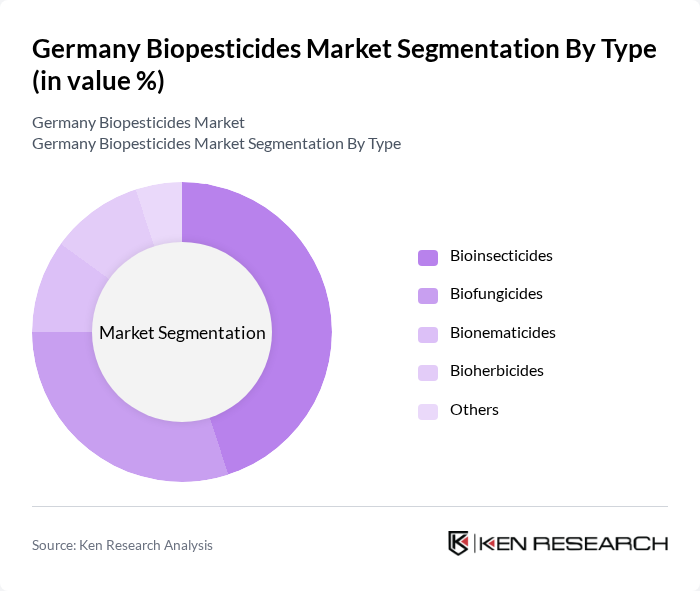

By Type:The biopesticides market can be segmented into various types, including bioinsecticides, biofungicides, bionematicides, bioherbicides, and others. Among these, bioinsecticides are gaining significant traction due to their effectiveness in pest control and minimal impact on non-target organisms. Biofungicides are also witnessing increased adoption as they help manage plant diseases without harming the environment. The demand for these products is driven by the growing preference for organic farming and the need for sustainable agricultural practices.

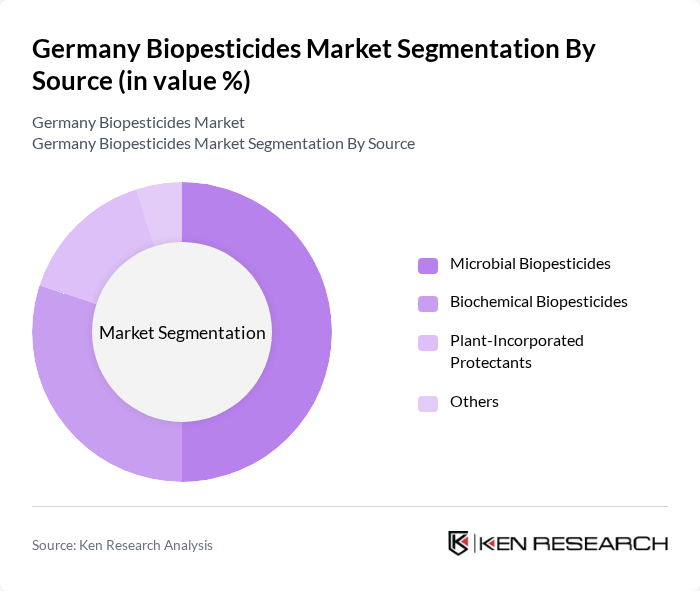

By Source:The biopesticides market is categorized based on the source of the products, including microbial biopesticides, biochemical biopesticides, plant-incorporated protectants, and others. Microbial biopesticides are leading the market due to their natural origin and effectiveness in pest management. The increasing focus on organic farming and the need for environmentally safe pest control methods are driving the demand for microbial solutions, making them a preferred choice among farmers.

The Germany Biopesticides Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Bayer AG, Syngenta AG, Certis Belchim BV, Koppert Biological Systems, Biobest Group NV, Marrone Bio Innovations, Inc., Novozymes A/S, FMC Corporation, UPL Limited, Sumitomo Chemical Co., Ltd., Arysta LifeScience Corporation, Valent BioSciences LLC, Andermatt Biocontrol AG, Biofa GmbH contribute to innovation, geographic expansion, and service delivery in this space.

The future of the biopesticides market in Germany appears promising, driven by increasing investments in research and development, which reached approximately €200 million. The shift towards integrated pest management (IPM) practices is also gaining traction, with approximately 60% of farmers adopting IPM strategies. As consumer preferences continue to favor sustainable agricultural practices, the biopesticides market is expected to expand, supported by ongoing technological advancements and regulatory frameworks that promote eco-friendly solutions.

| Segment | Sub-Segments |

|---|---|

| By Type | Bioinsecticides Biofungicides Bionematicides Bioherbicides Others |

| By Source | Microbial Biopesticides Biochemical Biopesticides Plant-Incorporated Protectants Others |

| By Application | Foliar Application Soil Treatment Seed Treatment Fertigation Others |

| By End-User | Agriculture Horticulture Turf & Ornamental Forestry Others |

| By Distribution Channel | Direct Sales Retail Online Sales Others |

| By Formulation | Liquid Formulations Dry Formulations Granular Formulations Powder Formulations Suspension Concentrate Others |

| By Crop Type | Fruits and Vegetables Cereals and Grains Oilseeds & Pulses Turf & Ornamental Others |

| By Region | Northern Germany Southern Germany Eastern Germany Western Germany |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cereal Crop Producers | 100 | Agricultural Managers, Crop Scientists |

| Fruit and Vegetable Growers | 80 | Farm Owners, Horticulturists |

| Biopesticide Distributors | 50 | Sales Managers, Distribution Coordinators |

| Research Institutions | 40 | Research Scientists, Policy Analysts |

| Organic Farming Associations | 60 | Association Leaders, Sustainability Advocates |

The Germany Biopesticides Market is valued at approximately USD 1.2 billion, reflecting a significant growth trend driven by the increasing demand for sustainable agricultural practices and organic produce, alongside stringent regulations on chemical pesticides.