Region:Central and South America

Author(s):Geetanshi

Product Code:KRAA2079

Pages:82

Published On:August 2025

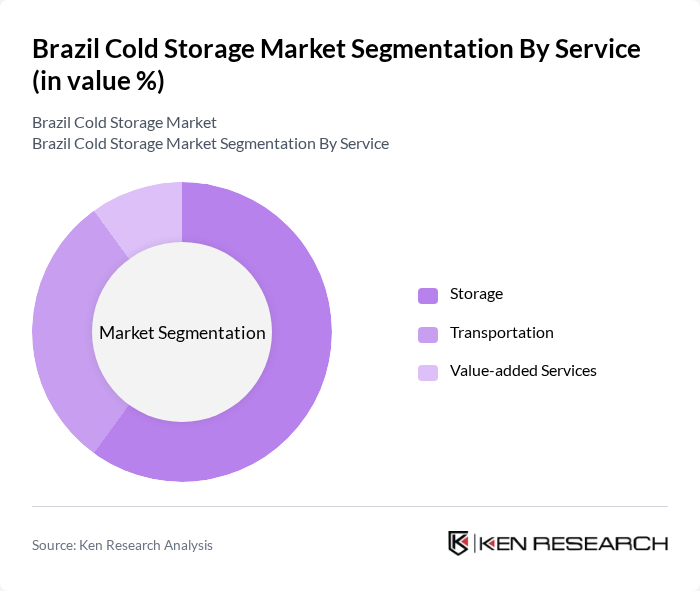

By Service:The service segmentation includesStorage, Transportation, and Value-added Services. Storage is the primary service, providing the essential infrastructure for maintaining the quality of perishable goods, especially for food and pharmaceuticals. Transportation is significant, enabling the movement of products between storage facilities and end-users, with increasing investment in refrigerated trucks and containers. Value-added services, such as packaging, inventory management, and real-time temperature monitoring, are increasingly being adopted to enhance operational efficiency and traceability .

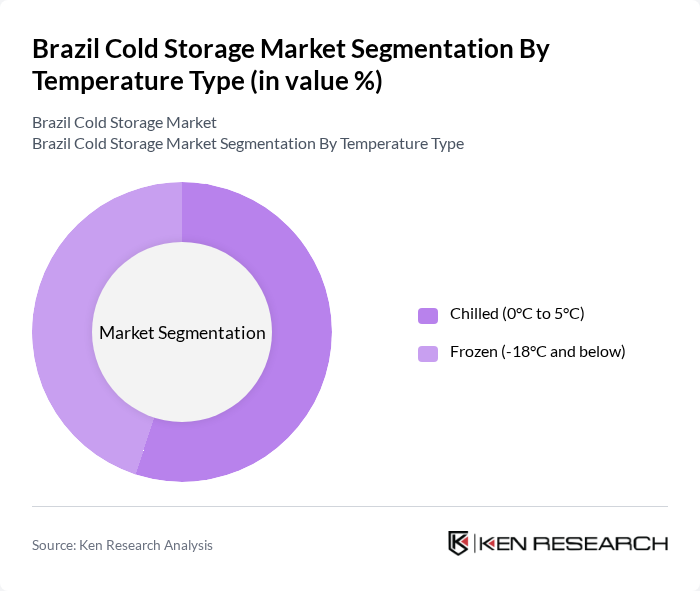

By Temperature Type:The temperature type segmentation consists ofChilled (0°C to 5°C)andFrozen (-18°C and below). The chilled segment is dominant due to the high demand for fresh produce, dairy, and pharmaceuticals, which require specific temperature controls to maintain quality. The frozen segment is also significant, particularly for meat and seafood products, which benefit from long-term preservation capabilities and are critical for both domestic consumption and export markets .

The Brazil Cold Storage Market is characterized by a dynamic mix of regional and international players. Leading participants such as Localfrio S.A., Brado Logística S.A., Friozem Armazéns Frigoríficos, Frigobras, Tegma Gestão Logística S.A., SuperFrio Armazéns Gerais S.A., JBS S.A., BRF S.A., Marfrig Global Foods S.A., Seara Alimentos Ltda., Cargill Agrícola S.A., Grupo Martins, Grupo Pão de Açúcar, Grupo Carrefour Brasil, and Coldex Logística Frigorificada contribute to innovation, geographic expansion, and service delivery in this space .

The Brazil cold storage market is poised for significant transformation, driven by technological advancements and increasing consumer demand for quality food products. The integration of IoT technologies is expected to enhance operational efficiency, while automation will streamline processes, reducing labor costs. Additionally, the focus on sustainability will lead to the adoption of energy-efficient practices, positioning the market for growth as stakeholders prioritize environmental responsibility alongside profitability.

| Segment | Sub-Segments |

|---|---|

| By Service | Storage Transportation Value-added Services |

| By Temperature Type | Chilled (0°C to 5°C) Frozen (-18°C and below) |

| By Application | Horticulture (Fruits & Vegetables) Meat Fish Poultry Dairy Products Pharmaceuticals |

| By End-User | Food and Beverage Pharmaceuticals Retail Agriculture Others |

| By Distribution Mode | Direct Distribution Third-Party Logistics E-commerce Distribution Others |

| By Storage Capacity | Small Scale (Up to 5000 pallets) Medium Scale (5000-20000 pallets) Large Scale (Above 20000 pallets) |

| By Investment Source | Private Investments Government Funding Foreign Direct Investment (FDI) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food and Beverage Cold Storage | 100 | Warehouse Managers, Supply Chain Coordinators |

| Pharmaceutical Cold Chain Logistics | 60 | Quality Assurance Managers, Logistics Directors |

| Retail Cold Storage Solutions | 50 | Operations Managers, Inventory Control Specialists |

| Cold Storage Technology Providers | 40 | Product Development Managers, Sales Executives |

| Government Regulatory Bodies | 40 | Policy Makers, Regulatory Compliance Officers |

The Brazil Cold Storage Market is valued at approximately USD 2.7 billion, driven by the increasing demand for perishable goods and advancements in cold chain technologies. This growth reflects a robust food and beverage industry and the need for efficient supply chain solutions.