Region:Central and South America

Author(s):Shubham

Product Code:KRAB5625

Pages:90

Published On:October 2025

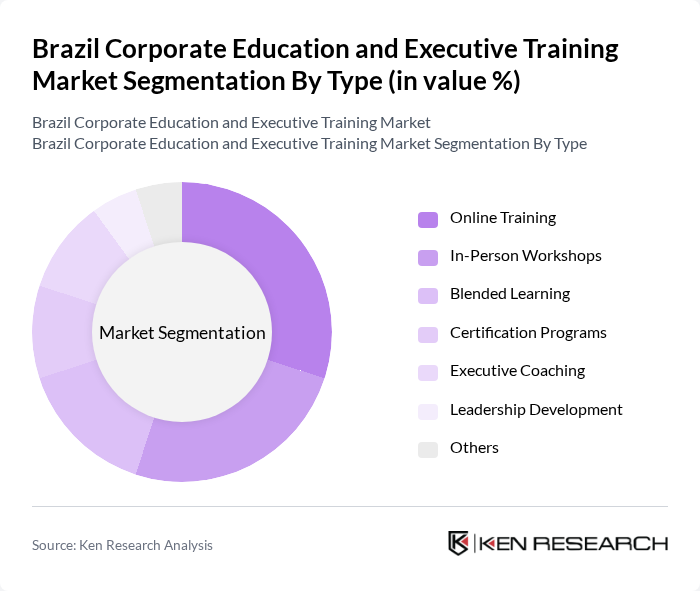

By Type:The market is segmented into various types of training programs, including Online Training, In-Person Workshops, Blended Learning, Certification Programs, Executive Coaching, Leadership Development, and Others. Online Training has gained significant traction due to its flexibility and accessibility, allowing employees to learn at their own pace. In-Person Workshops remain popular for hands-on learning experiences, while Blended Learning combines the best of both worlds. Certification Programs are increasingly sought after for professional advancement, and Executive Coaching is valued for personalized development. Leadership Development programs are essential for nurturing future leaders within organizations.

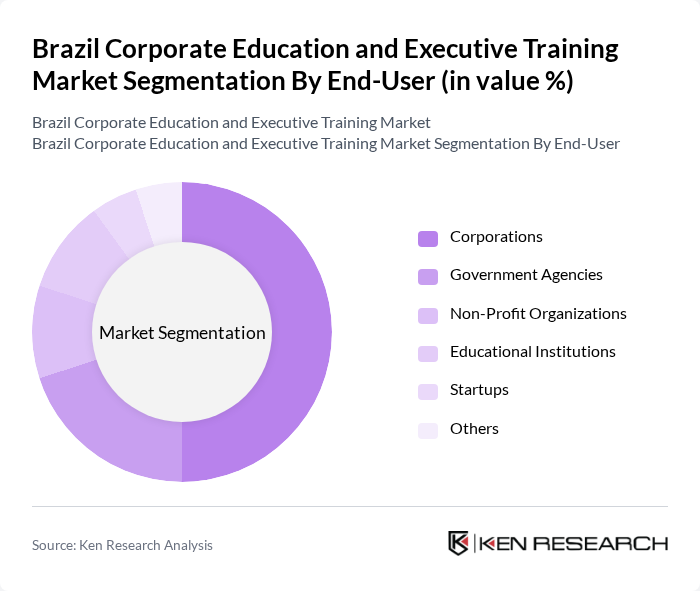

By End-User:The end-user segmentation includes Corporations, Government Agencies, Non-Profit Organizations, Educational Institutions, Startups, and Others. Corporations are the largest consumers of corporate education services, driven by the need to upskill employees and improve overall performance. Government Agencies are increasingly investing in training to enhance public service delivery. Non-Profit Organizations and Educational Institutions also play a role in promoting workforce development, while Startups are focusing on agility and innovation through targeted training programs.

The Brazil Corporate Education and Executive Training Market is characterized by a dynamic mix of regional and international players. Leading participants such as Grupo Ser Educacional, Kroton Educacional S.A., Estácio Participações S.A., SENAI (National Service for Industrial Training), Fundação Getulio Vargas (FGV), Sebrae (Brazilian Micro and Small Business Support Service), HSM Educação, Dom Cabral Foundation, Impacta Tecnologia, PUC-Rio (Pontifical Catholic University of Rio de Janeiro), Instituto de Ensino e Pesquisa (Insper), Trevisan Escola de Negócios, Escola Superior de Propaganda e Marketing (ESPM), Universidade de São Paulo (USP), Universidade Federal do Rio de Janeiro (UFRJ) contribute to innovation, geographic expansion, and service delivery in this space.

The future of Brazil's corporate education and executive training market appears promising, driven by technological advancements and a growing emphasis on employee development. As companies increasingly recognize the importance of upskilling their workforce, the demand for innovative training solutions will likely rise. Additionally, the integration of artificial intelligence and data analytics into training programs is expected to enhance personalization and effectiveness, making learning more relevant and impactful for employees across various sectors.

| Segment | Sub-Segments |

|---|---|

| By Type | Online Training In-Person Workshops Blended Learning Certification Programs Executive Coaching Leadership Development Others |

| By End-User | Corporations Government Agencies Non-Profit Organizations Educational Institutions Startups Others |

| By Delivery Mode | Virtual Classrooms On-Site Training Mobile Learning Self-Paced Learning Others |

| By Industry | Information Technology Finance Healthcare Manufacturing Retail Others |

| By Training Focus | Technical Skills Soft Skills Compliance Training Management Training Others |

| By Duration | Short Courses Long-Term Programs Workshops Seminars Others |

| By Pricing Model | Subscription-Based Pay-Per-Course Corporate Packages Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Training Providers | 100 | Training Managers, Business Development Executives |

| HR Executives in Large Corporations | 80 | HR Directors, Learning and Development Managers |

| Participants of Executive Training Programs | 75 | Mid to Senior-Level Managers, Executives |

| Industry Experts and Consultants | 50 | Education Consultants, Corporate Trainers |

| Government Officials in Education Sector | 30 | Policy Makers, Education Administrators |

The Brazil Corporate Education and Executive Training Market is valued at approximately USD 2.5 billion, reflecting significant growth driven by the increasing demand for skilled professionals and the necessity for continuous learning in a dynamic job market.