Region:Europe

Author(s):Rebecca

Product Code:KRAB2990

Pages:83

Published On:October 2025

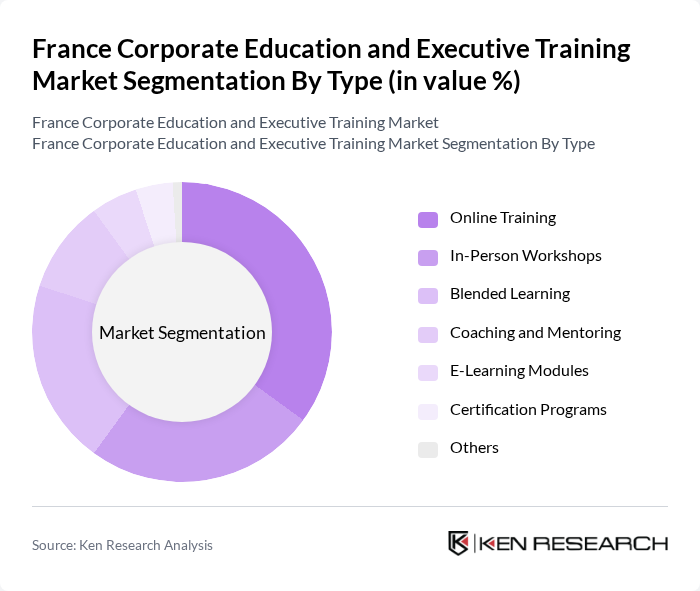

By Type:The market is segmented into various types of training methods, including Online Training, In-Person Workshops, Blended Learning, Coaching and Mentoring, E-Learning Modules, Certification Programs, and Others. Among these, Online Training has gained significant traction due to its flexibility and accessibility, allowing professionals to learn at their own pace. In-Person Workshops remain popular for hands-on learning experiences, while Blended Learning combines the best of both worlds, catering to diverse learning preferences.

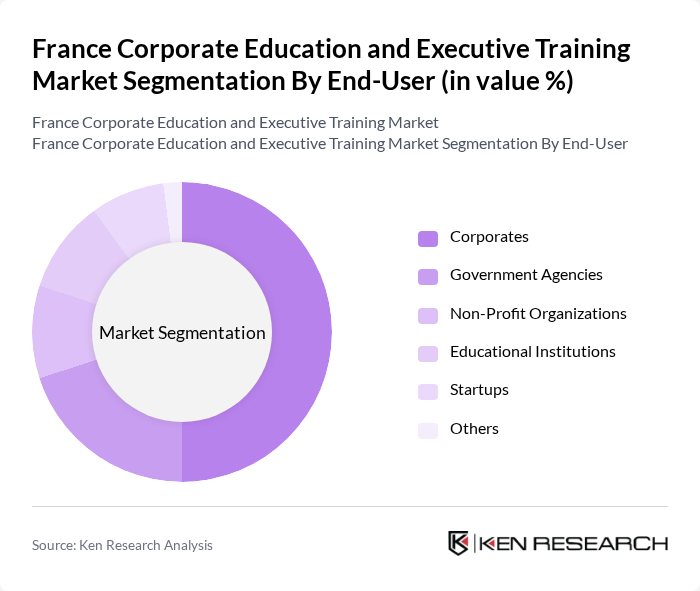

By End-User:The end-user segmentation includes Corporates, Government Agencies, Non-Profit Organizations, Educational Institutions, Startups, and Others. Corporates are the dominant end-users, driven by the need for continuous employee development and competitive advantage in the market. Government Agencies also play a significant role, focusing on workforce development and public sector training initiatives.

The France Corporate Education and Executive Training Market is characterized by a dynamic mix of regional and international players. Leading participants such as Cegos, Demos, Skillsoft, CrossKnowledge, OpenClassrooms, Talentsoft, MySkillCamp, Learnlight, Edflex, 360Learning, Ecole Supérieure de Commerce de Paris (ESCP), HEC Paris, INSEAD, Université Paris-Dauphine, Grenoble Ecole de Management contribute to innovation, geographic expansion, and service delivery in this space.

The future of the corporate education and executive training market in France is poised for transformation, driven by the increasing integration of technology and a focus on personalized learning experiences. As companies continue to prioritize employee development, the demand for innovative training solutions will rise. Additionally, the emphasis on soft skills and experiential learning will shape program offerings, ensuring that training remains relevant and effective in addressing the dynamic needs of the workforce.

| Segment | Sub-Segments |

|---|---|

| By Type | Online Training In-Person Workshops Blended Learning Coaching and Mentoring E-Learning Modules Certification Programs Others |

| By End-User | Corporates Government Agencies Non-Profit Organizations Educational Institutions Startups Others |

| By Industry Sector | Information Technology Healthcare Finance Manufacturing Retail Others |

| By Training Format | Workshops Seminars Webinars Conferences Others |

| By Duration | Short-term Courses Long-term Programs Ongoing Training Others |

| By Delivery Method | Instructor-led Training Self-paced Learning Hybrid Learning Others |

| By Certification Type | Professional Certifications Academic Certifications Industry-specific Certifications Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Training Programs | 150 | HR Managers, Training Coordinators |

| Executive Education Participants | 100 | Mid to Senior-Level Executives, Program Alumni |

| Online Learning Platforms | 80 | Learning & Development Specialists, IT Managers |

| Industry-Specific Training | 70 | Sector Experts, Training Consultants |

| Corporate Partnerships with Educational Institutions | 60 | University Liaison Officers, Corporate Relations Managers |

The France Corporate Education and Executive Training Market is valued at approximately USD 7 billion, reflecting a significant growth trend driven by the increasing demand for upskilling and reskilling in a rapidly evolving job market.