Region:Africa

Author(s):Dev

Product Code:KRAB5536

Pages:82

Published On:October 2025

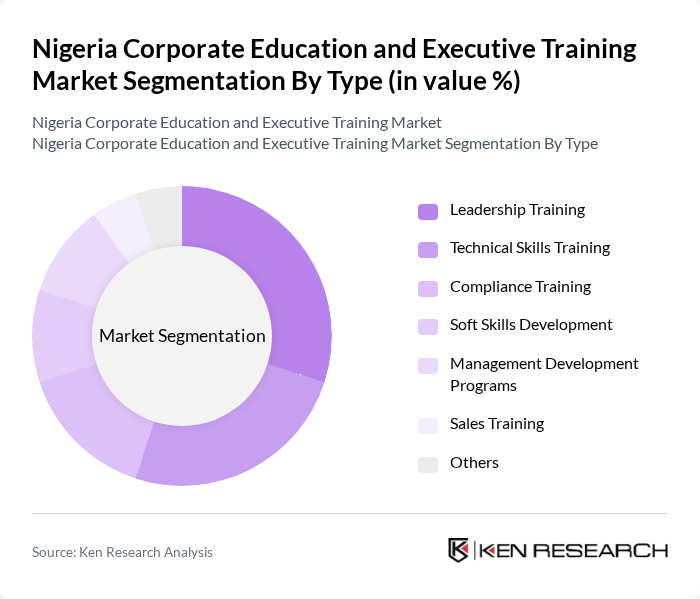

By Type:The market is segmented into various types of training programs, including Leadership Training, Technical Skills Training, Compliance Training, Soft Skills Development, Management Development Programs, Sales Training, and Others. Among these, Leadership Training is currently the most dominant segment, driven by the increasing need for effective leadership in organizations to navigate complex business environments. Companies are investing heavily in developing their leaders to enhance organizational performance and employee engagement.

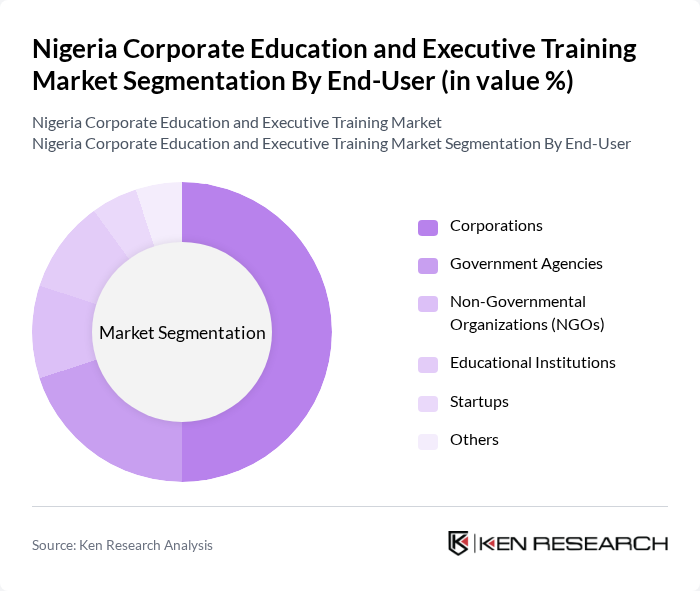

By End-User:The end-user segmentation includes Corporations, Government Agencies, Non-Governmental Organizations (NGOs), Educational Institutions, Startups, and Others. Corporations are the leading end-users, as they recognize the importance of training in enhancing employee skills and overall organizational effectiveness. The growing competition in the corporate sector has led companies to prioritize employee development, making this segment a significant contributor to market growth.

The Nigeria Corporate Education and Executive Training Market is characterized by a dynamic mix of regional and international players. Leading participants such as Lagos Business School, The Executive Academy, African Management Initiative, Skillsoft Nigeria, Learn Africa, Digital Bridge Institute, Centre for Management Development, HCM International, Global Academy of Business and Management, The Institute of Chartered Accountants of Nigeria, National Institute for Policy and Strategic Studies, Nigerian Institute of Management, Business School Netherlands, University of Lagos - Centre for Continuing Education, The Learning Place contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Nigerian corporate education and executive training market appears promising, driven by technological integration and a focus on continuous learning. As organizations increasingly recognize the value of upskilling their workforce, investments in innovative training solutions are expected to rise. Furthermore, the collaboration between local training providers and international organizations will enhance the quality and relevance of training programs, ensuring they meet the evolving needs of the workforce in a dynamic economic environment.

| Segment | Sub-Segments |

|---|---|

| By Type | Leadership Training Technical Skills Training Compliance Training Soft Skills Development Management Development Programs Sales Training Others |

| By End-User | Corporations Government Agencies Non-Governmental Organizations (NGOs) Educational Institutions Startups Others |

| By Delivery Mode | In-Person Training Online Training Blended Learning Workshops and Seminars Others |

| By Duration | Short Courses (1-3 days) Medium Courses (1-4 weeks) Long Courses (1-6 months) Others |

| By Certification Type | Professional Certifications Diplomas Degrees Others |

| By Industry Focus | Financial Services Healthcare Information Technology Manufacturing Others |

| By Pricing Model | Subscription-Based Pay-Per-Course Corporate Packages Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Training Providers | 100 | CEOs, Training Directors, Program Managers |

| Human Resource Departments | 150 | HR Managers, Learning and Development Specialists |

| Participants of Executive Training Programs | 80 | Mid-level Managers, Senior Executives |

| Industry Associations and Regulatory Bodies | 50 | Policy Makers, Education Consultants |

| Corporate Clients of Training Services | 120 | Business Owners, Operations Managers |

The Nigeria Corporate Education and Executive Training Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by the demand for skilled labor and the importance of continuous professional development in enhancing employee performance.