Region:Central and South America

Author(s):Shubham

Product Code:KRAA1124

Pages:88

Published On:August 2025

By Solution Type:The solution type segmentation comprises a range of software platforms designed to address specific logistics management needs. Transportation Management Software (TMS) is essential for route optimization, carrier management, and freight cost control. Warehouse Management Software (WMS) focuses on inventory accuracy, space utilization, and order fulfillment efficiency. The increasing complexity of e-commerce supply chains is driving demand for integrated solutions, including Order Management Software (OMS), Inventory Management Software, Last-Mile Delivery Optimization Platforms, Freight Management Software, Returns Management Solutions, and Cross-Border Logistics Software. The adoption of these solutions is propelled by the need for real-time data, automation, and scalability in logistics operations .

By End-User Industry:The end-user industry segmentation reflects the diverse sectors leveraging logistics software solutions. E-commerce retailers and third-party logistics providers (3PLs) are the primary adopters, driven by the surge in online sales and the need for agile, scalable logistics operations. Wholesale and distribution companies utilize these platforms to streamline supply chain processes and enhance inventory visibility. Other sectors such as manufacturing, food and beverage, and healthcare are increasingly adopting logistics software to improve compliance, traceability, and delivery performance in response to evolving consumer and regulatory demands .

The Brazil E-Commerce Logistics Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as TOTVS, Linx, Movile, Mercado Livre (Mercado Envios), VTEX, Loggi, Frete Rápido, Kangu, Intelipost, Mandaê, Jadlog, B2W Digital (Americanas S.A.), Cnova, Grupo Pão de Açúcar, Sequoia Logística contribute to innovation, geographic expansion, and service delivery in this space.

The future of Brazil's e-commerce logistics software market appears promising, driven by technological advancements and evolving consumer preferences. As businesses increasingly adopt AI and automation, logistics operations will become more efficient, reducing costs and improving service delivery. Additionally, the expansion of e-commerce platforms will create new opportunities for logistics providers to innovate and enhance their offerings, ensuring they meet the growing demands of Brazilian consumers in a competitive landscape.

| Segment | Sub-Segments |

|---|---|

| By Solution Type | Transportation Management Software (TMS) Warehouse Management Software (WMS) Order Management Software (OMS) Inventory Management Software Last-Mile Delivery Optimization Platforms Freight Management Software Returns Management Solutions Cross-Border Logistics Software Others |

| By End-User Industry | E-Commerce Retailers Third-Party Logistics Providers (3PLs) Wholesale & Distribution Manufacturing Food & Beverage Healthcare Others |

| By Sales Channel | Direct (Vendor) Sales Online Marketplaces Value-Added Resellers (VARs) System Integrators Others |

| By Logistics Model | First-Party Logistics (1PL) Third-Party Logistics (3PL) Fourth-Party Logistics (4PL) Others |

| By Pricing Model | Subscription-Based (SaaS) Pay-Per-Use Perpetual License Freemium/Trial Others |

| By Customer Size | Small Enterprises Medium Enterprises Large Enterprises |

| By Region | Southeast Brazil South Brazil Northeast Brazil North Brazil Central-West Brazil Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| E-commerce Logistics Software Adoption | 100 | IT Managers, Logistics Coordinators |

| Inventory Management Solutions | 60 | Warehouse Managers, Supply Chain Analysts |

| Order Fulfillment Software | 50 | Operations Managers, E-commerce Directors |

| Last-Mile Delivery Solutions | 40 | Logistics Executives, Delivery Managers |

| Returns Management Systems | 50 | Customer Service Managers, Returns Analysts |

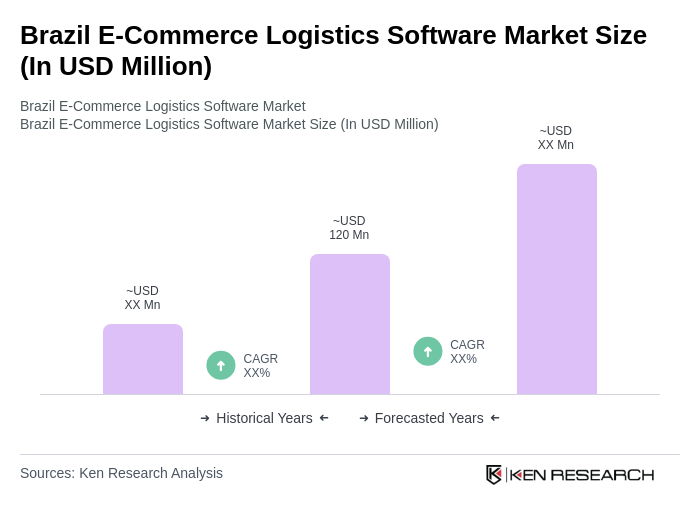

The Brazil E-Commerce Logistics Software Market is valued at approximately USD 120 million, reflecting significant growth driven by the expansion of the e-commerce sector and advancements in logistics technologies such as AI and cloud-based solutions.