Region:Central and South America

Author(s):Shubham

Product Code:KRAA1156

Pages:86

Published On:August 2025

By Type:The market is segmented into various types of logistics software, including Transportation Management Software, Warehouse Management Software, Order Management Software, Inventory Management Software, Last-Mile Delivery Solutions, Freight Management Software, Route Optimization Software, Returns Management Software, and Others. Among these, Transportation Management Software is the leading segment due to its critical role in optimizing shipping routes and reducing transportation costs. The increasing complexity of supply chains and the need for real-time tracking have further propelled its adoption. The adoption of digital platforms and automation tools is also accelerating across warehouse and last-mile delivery segments to meet rising consumer expectations for speed and transparency .

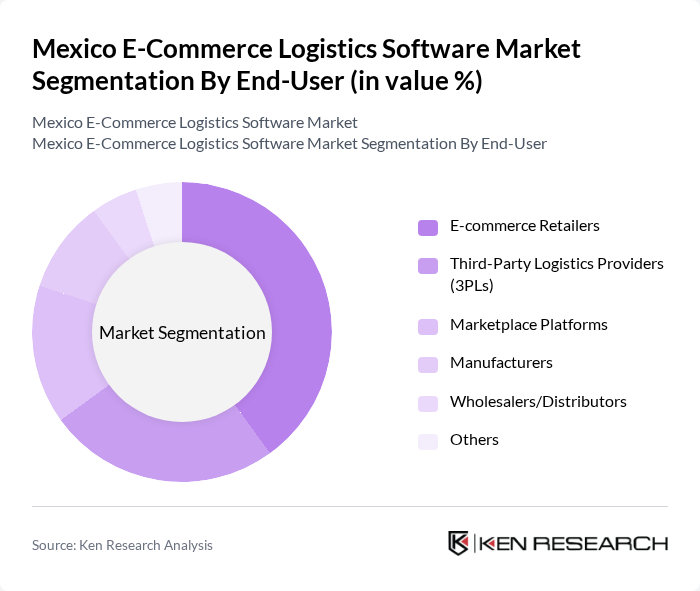

By End-User:The end-user segmentation includes E-commerce Retailers, Third-Party Logistics Providers (3PLs), Marketplace Platforms, Manufacturers, Wholesalers/Distributors, and Others. E-commerce Retailers represent the largest segment, driven by the explosive growth of online shopping and the need for integrated logistics solutions to manage order fulfillment and delivery. The increasing reliance on technology to enhance customer experience and operational efficiency has further solidified this segment's dominance. Third-party logistics providers are also expanding their technology adoption to offer value-added services and meet the growing demand for flexible, scalable logistics solutions .

The Mexico E-Commerce Logistics Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as Estafeta, 99minutos, SkydropX, Cargamos, Envia.com, Flexport, ShipStation, Onfleet, ShipHero, Locus.sh, ProShip, Freightos, Transporeon, Project44, Easyship contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Mexico e-commerce logistics software market appears promising, driven by technological advancements and evolving consumer preferences. As businesses increasingly adopt AI and automation, operational efficiencies are expected to improve significantly. Additionally, the emphasis on sustainability will likely shape logistics strategies, with companies seeking eco-friendly solutions. The integration of real-time tracking technologies will enhance transparency and customer satisfaction, positioning the market for continued growth and innovation in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Transportation Management Software Warehouse Management Software Order Management Software Inventory Management Software Last-Mile Delivery Solutions Freight Management Software Route Optimization Software Returns Management Software Others |

| By End-User | E-commerce Retailers Third-Party Logistics Providers (3PLs) Marketplace Platforms Manufacturers Wholesalers/Distributors Others |

| By Sales Channel | Direct Sales Online Sales Distributors Resellers System Integrators Others |

| By Deployment Model | Cloud-Based On-Premises Hybrid |

| By Industry Vertical | Consumer Goods Healthcare Automotive Electronics Fashion & Apparel Others |

| By Geographic Coverage | Central Mexico Northern Mexico Southern Mexico Others |

| By Pricing Model | Subscription-Based Pay-Per-Use One-Time License Fee Freemium Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| E-commerce Logistics Software Adoption | 120 | IT Managers, Operations Directors |

| Last-Mile Delivery Solutions | 90 | Logistics Coordinators, Supply Chain Analysts |

| Inventory Management Systems | 60 | Warehouse Managers, Inventory Control Specialists |

| Returns Management Software | 50 | Customer Service Managers, E-commerce Directors |

| Integration of Logistics Platforms | 40 | Software Developers, System Integrators |

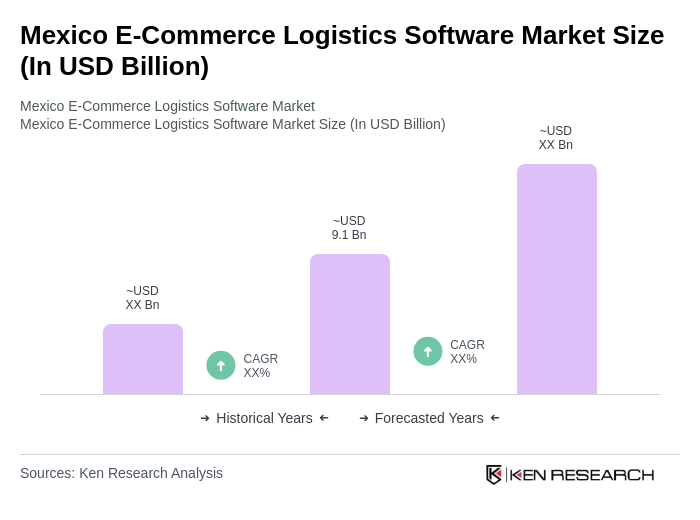

The Mexico E-Commerce Logistics Software Market is valued at approximately USD 9.1 billion, reflecting significant growth driven by the expansion of the e-commerce sector, increased internet penetration, and the demand for efficient logistics solutions.