Region:Asia

Author(s):Shubham

Product Code:KRAA1078

Pages:90

Published On:August 2025

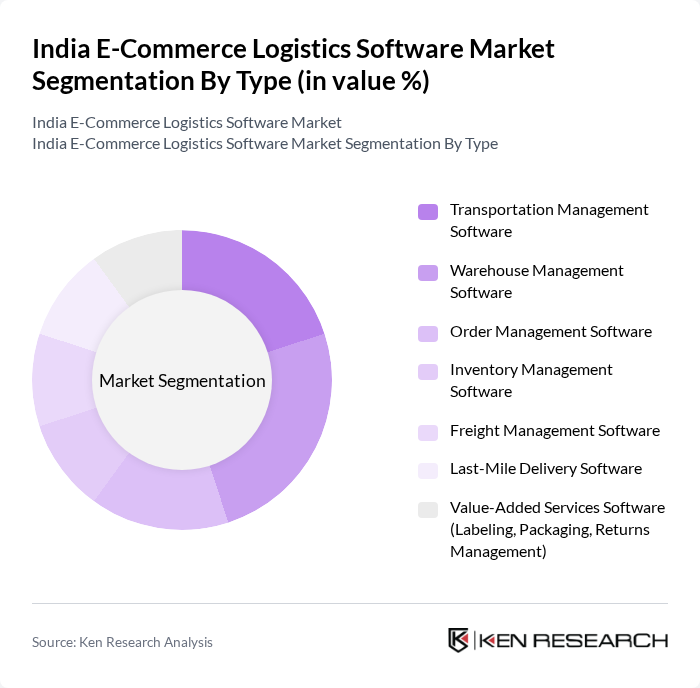

By Type:The market can be segmented into various types of software solutions that cater to different logistics needs. The primary subsegments include Transportation Management Software, Warehouse Management Software, Order Management Software, Inventory Management Software, Freight Management Software, Last-Mile Delivery Software, and Value-Added Services Software (Labeling, Packaging, Returns Management). Each of these subsegments plays a crucial role in enhancing operational efficiency and customer satisfaction .

The Warehouse Management Software segment is currently dominating the market due to the increasing need for efficient inventory management and order fulfillment processes. As e-commerce businesses expand, the demand for sophisticated warehouse solutions that optimize storage, streamline operations, and enhance accuracy has surged. This segment is particularly favored by retailers and logistics providers seeking to improve supply chain efficiency and reduce operational costs .

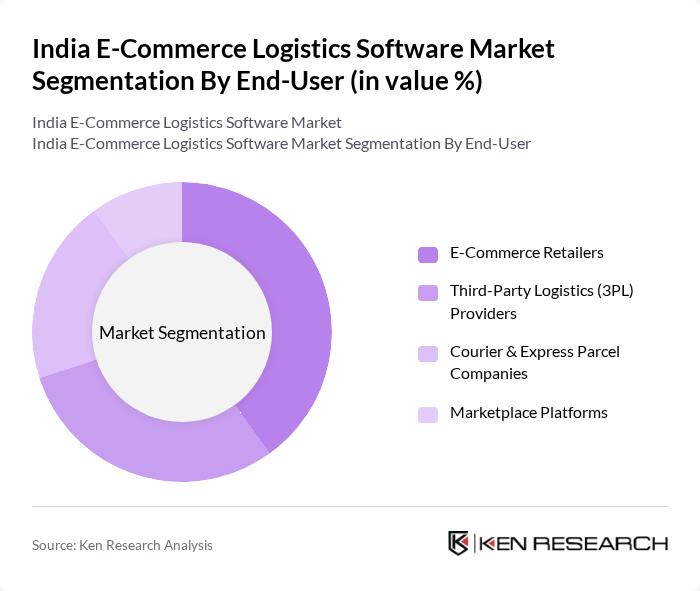

By End-User:The market can also be segmented based on end-users, which include E-Commerce Retailers, Third-Party Logistics (3PL) Providers, Courier & Express Parcel Companies, and Marketplace Platforms. Each of these end-users has unique logistics requirements, driving the demand for tailored software solutions that enhance their operational capabilities .

The E-Commerce Retailers segment is leading the market as they increasingly adopt logistics software to enhance their operational efficiency and customer service. The continued growth of online shopping and direct-to-consumer models has necessitated robust logistics solutions capable of handling high order volumes, managing inventory effectively, and ensuring timely deliveries. This segment's dominance is reinforced by the competitive e-commerce landscape, where customer satisfaction and rapid fulfillment are critical .

The India E-Commerce Logistics Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as Delhivery, Blue Dart, Ecom Express, Xpressbees, Shadowfax, Rivigo, Locus.sh, Shiprocket, Freight Tiger, LogiNext, Pickrr, Loadshare, WareIQ, FarEye, Shipsy contribute to innovation, geographic expansion, and service delivery in this space.

The future of the India e-commerce logistics software market appears promising, driven by technological advancements and evolving consumer preferences. The integration of AI and machine learning is expected to enhance operational efficiency, while the focus on sustainable logistics practices will likely reshape industry standards. Additionally, as more consumers in Tier II and III cities embrace online shopping, logistics providers will need to adapt their strategies to cater to this expanding demographic, ensuring timely and efficient delivery services.

| Segment | Sub-Segments |

|---|---|

| By Type | Transportation Management Software Warehouse Management Software Order Management Software Inventory Management Software Freight Management Software Last-Mile Delivery Software Value-Added Services Software (Labeling, Packaging, Returns Management) |

| By End-User | E-Commerce Retailers Third-Party Logistics (3PL) Providers Courier & Express Parcel Companies Marketplace Platforms |

| By Region | North India South India East India West India |

| By Application | B2B Logistics B2C Logistics C2C Logistics |

| By Sales Channel | Direct Sales Online Sales Distributors |

| By Distribution Mode | Road Transport Rail Transport Air Transport |

| By Pricing Strategy | Subscription-Based Pricing Pay-Per-Use Pricing Tiered Pricing |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| E-commerce Logistics Software Adoption | 60 | IT Managers, Logistics Coordinators |

| Last-Mile Delivery Solutions | 50 | Operations Managers, Delivery Service Providers |

| Warehouse Management Systems | 40 | Warehouse Managers, Supply Chain Analysts |

| Inventory Management Software | 45 | Inventory Control Managers, Procurement Specialists |

| Returns Management Software | 50 | Customer Service Managers, Returns Analysts |

The India E-Commerce Logistics Software Market is valued at approximately USD 4 billion, driven by the rapid growth of the e-commerce sector, increased internet and smartphone penetration, and the demand for efficient logistics solutions.