Region:Central and South America

Author(s):Geetanshi

Product Code:KRAB1374

Pages:82

Published On:October 2025

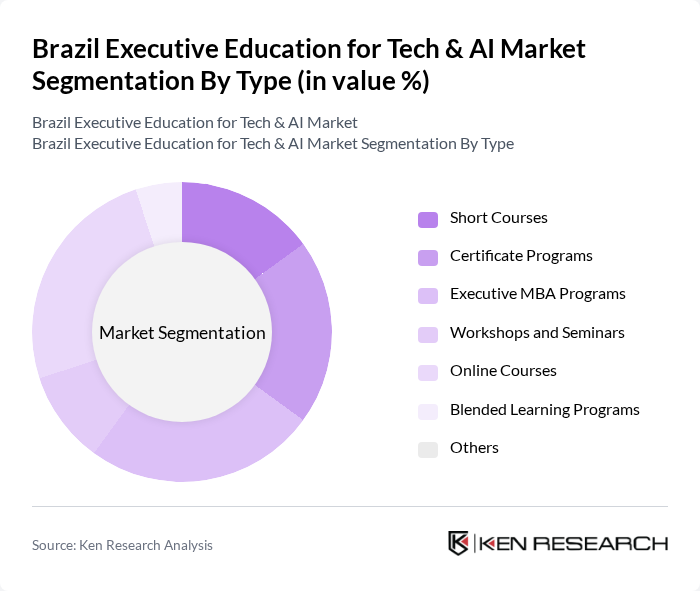

By Type:The market is segmented into various types of educational offerings, including Short Courses, Certificate Programs, Executive MBA Programs, Workshops and Seminars, Online Courses, Blended Learning Programs, and Others. Among these, Online Courses have gained significant traction due to their flexibility, accessibility, and ability to deliver up-to-date content, catering to a diverse audience seeking to upskill in technology and AI. The adoption of blended and hybrid learning models is also rising, reflecting the demand for both virtual and in-person executive learning experiences .

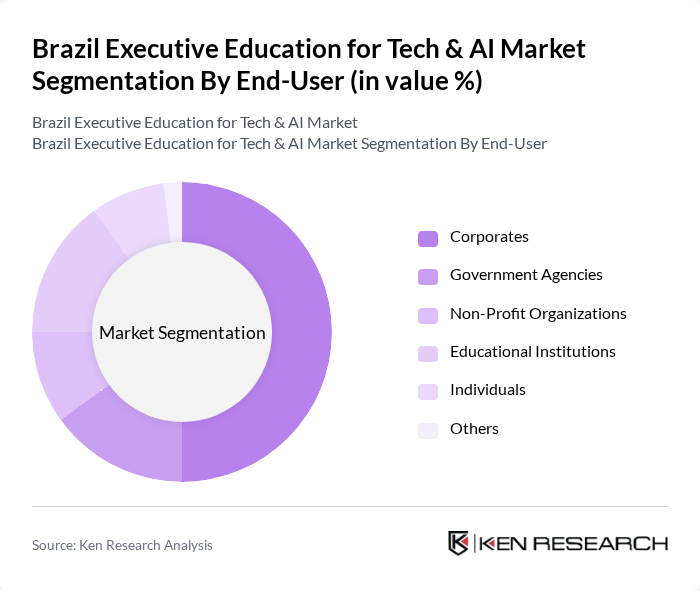

By End-User:This segmentation includes Corporates, Government Agencies, Non-Profit Organizations, Educational Institutions, Individuals, and Others. Corporates are the leading end-users, as they increasingly invest in executive education to upskill their workforce in technology and AI, ensuring they remain competitive in a digital economy. Government agencies and educational institutions are also expanding their participation, driven by national digital strategies and public-private partnerships .

The Brazil Executive Education for Tech & AI Market is characterized by a dynamic mix of regional and international players. Leading participants such as Fundação Getulio Vargas (FGV), Insper, Escola Superior de Propaganda e Marketing (ESPM), Pontifícia Universidade Católica do Rio de Janeiro (PUC-Rio), Universidade de São Paulo (USP), FIA Business School, HSM Educação, Trevisan Escola de Negócios, Universidade Federal do Rio de Janeiro (UFRJ), Universidade Estadual de Campinas (UNICAMP), Fundação Dom Cabral, Universidade Federal de Minas Gerais (UFMG), Universidade de Brasília (UnB), Centro Universitário de Brasília (UniCEUB), IBM Brasil, Microsoft Brasil, Google Brasil, Amazon Web Services (AWS) Brasil, Cognizant Technology Solutions Brasil, Pearson Brasil contribute to innovation, geographic expansion, and service delivery in this space .

As Brazil continues to embrace digital transformation, the executive education market for tech and AI is poised for significant evolution. The integration of hybrid learning models is expected to enhance accessibility, allowing professionals to balance work and study effectively. Additionally, the emphasis on soft skills alongside technical training will become increasingly important, as organizations seek well-rounded leaders. The ongoing collaboration between educational institutions and tech companies will further ensure that curricula remain relevant, preparing the workforce for future challenges in an ever-evolving digital landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Short Courses Certificate Programs Executive MBA Programs Workshops and Seminars Online Courses Blended Learning Programs Others |

| By End-User | Corporates Government Agencies Non-Profit Organizations Educational Institutions Individuals Others |

| By Delivery Mode | In-Person Training Online Learning Hybrid Learning Corporate Training Programs Others |

| By Duration | Short-Term (Less than 3 months) Medium-Term (3 to 6 months) Long-Term (More than 6 months) Others |

| By Industry Focus | Technology Finance Healthcare Manufacturing Retail Others |

| By Certification Type | Accredited Programs Non-Accredited Programs Industry-Specific Certifications Others |

| By Price Range | Low-End (Under $500) Mid-Range ($500 - $2000) High-End (Above $2000) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Training Programs in Tech | 100 | HR Managers, Learning & Development Directors |

| AI Executive Education Participants | 80 | Mid to Senior-Level Executives, Program Alumni |

| Technology Adoption in SMEs | 60 | Business Owners, Operations Managers |

| Government Initiatives in Tech Education | 40 | Policy Makers, Educational Administrators |

| Market Trends in AI and Tech Education | 50 | Industry Analysts, Academic Researchers |

The Brazil Executive Education for Tech & AI Market is valued at approximately USD 1.2 billion, reflecting a significant demand for skilled professionals in technology and artificial intelligence as organizations pursue digital transformation and continuous upskilling.