Region:Central and South America

Author(s):Dev

Product Code:KRAB6112

Pages:90

Published On:October 2025

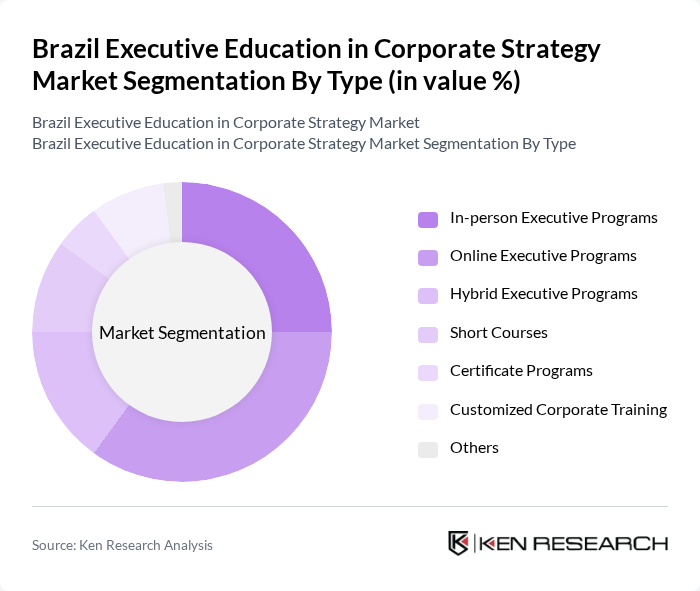

By Type:The market is segmented into various types of executive education programs, including In-person Executive Programs, Online Executive Programs, Hybrid Executive Programs, Short Courses, Certificate Programs, Customized Corporate Training, and Others. Among these, Online Executive Programs have gained significant traction due to their flexibility and accessibility, catering to a diverse audience of professionals seeking to enhance their skills without geographical constraints.

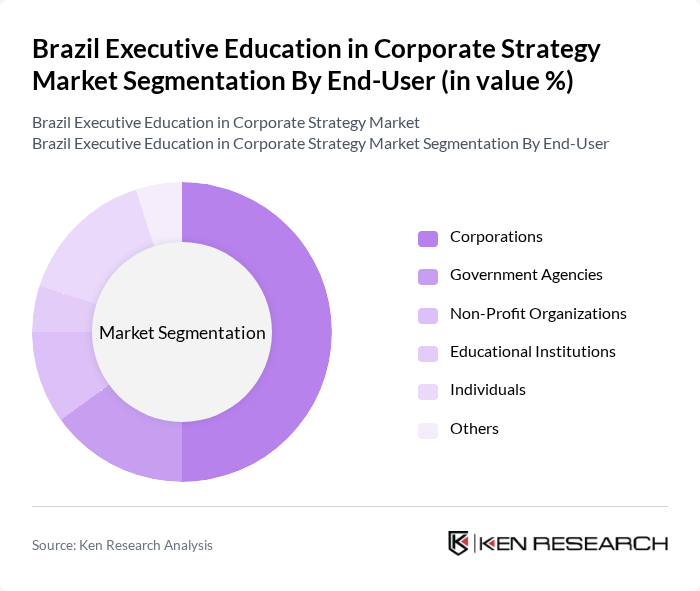

By End-User:The end-user segmentation includes Corporations, Government Agencies, Non-Profit Organizations, Educational Institutions, Individuals, and Others. Corporations are the dominant end-user segment, as they invest heavily in executive education to upskill their workforce and drive organizational growth. The increasing focus on leadership development and strategic management within corporate settings has led to a surge in demand for tailored executive programs.

The Brazil Executive Education in Corporate Strategy Market is characterized by a dynamic mix of regional and international players. Leading participants such as Fundação Getulio Vargas (FGV), INSPER, Escola Superior de Propaganda e Marketing (ESPM), Pontifícia Universidade Católica (PUC), Universidade de São Paulo (USP), HSM Educação, FIA - Fundação Instituto de Administração, Dom Cabral Foundation, Instituto Brasileiro de Mercado de Capitais (IBMEC), Universidade Federal do Rio de Janeiro (UFRJ), Universidade Estadual de Campinas (UNICAMP), Fundação Dom Cabral, Escola de Negócios da PUCRS, Centro Universitário FEI, Escola de Negócios da FGV contribute to innovation, geographic expansion, and service delivery in this space.

The future of the executive education market in Brazil appears promising, driven by the increasing emphasis on leadership development and digital skills. As organizations adapt to rapid technological changes, there will be a growing need for innovative educational programs that incorporate experiential learning and technology integration. Additionally, the focus on sustainability in corporate strategies will likely shape curriculum development, ensuring that future leaders are equipped to address environmental challenges while driving business success.

| Segment | Sub-Segments |

|---|---|

| By Type | In-person Executive Programs Online Executive Programs Hybrid Executive Programs Short Courses Certificate Programs Customized Corporate Training Others |

| By End-User | Corporations Government Agencies Non-Profit Organizations Educational Institutions Individuals Others |

| By Delivery Mode | Classroom Learning Online Learning Blended Learning Corporate Workshops Others |

| By Duration | Short-term Programs (1-3 months) Medium-term Programs (3-6 months) Long-term Programs (6-12 months) Executive MBAs Others |

| By Industry Focus | Technology Finance Healthcare Manufacturing Retail Others |

| By Certification Type | Accredited Programs Non-accredited Programs Industry-recognized Certifications Others |

| By Price Range | Low-cost Programs Mid-range Programs Premium Programs Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Training Needs Assessment | 150 | HR Managers, Learning & Development Directors |

| Executive Education Program Feedback | 100 | Program Alumni, Corporate Executives |

| Market Trends in Corporate Strategy Training | 80 | Industry Analysts, Educational Consultants |

| Digital Learning Adoption in Executive Education | 70 | IT Managers, E-learning Specialists |

| Impact of Economic Factors on Training Budgets | 90 | CFOs, Financial Analysts |

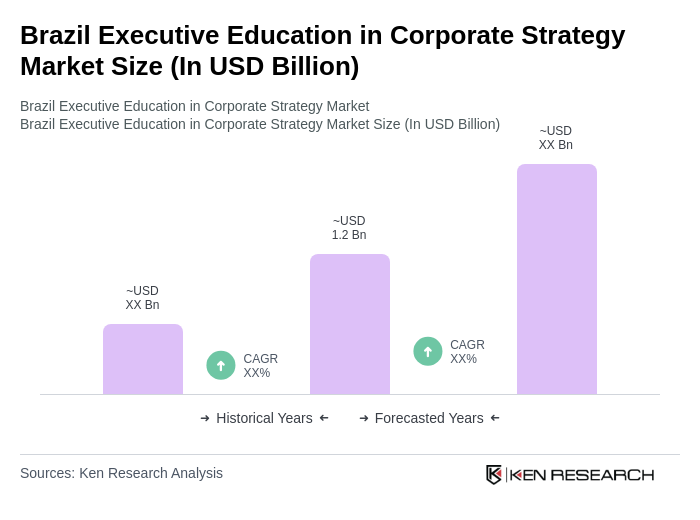

The Brazil Executive Education in Corporate Strategy Market is valued at approximately USD 1.2 billion, reflecting a growing demand for skilled professionals in corporate strategy roles as organizations adapt to a rapidly changing business environment.