Region:Central and South America

Author(s):Dev

Product Code:KRAB6474

Pages:81

Published On:October 2025

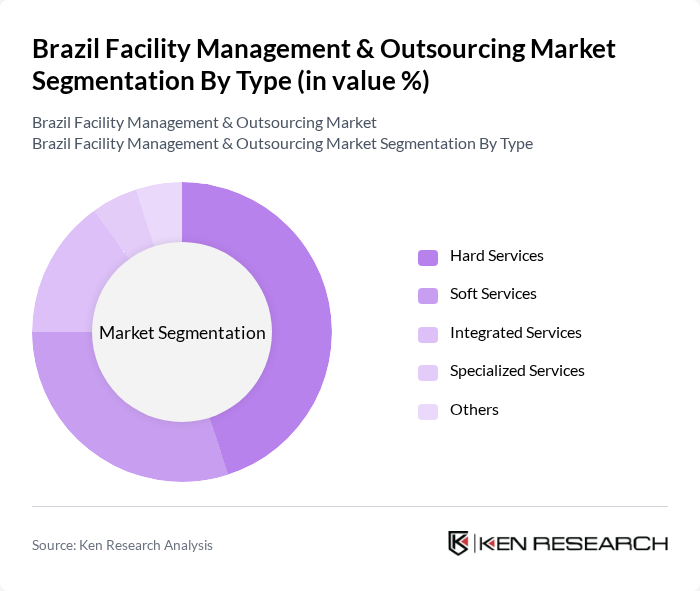

By Type:

The facility management market is segmented into various types, including Hard Services, Soft Services, Integrated Services, Specialized Services, and Others. Among these, Hard Services dominate the market due to the essential nature of maintenance and repair services in ensuring operational efficiency and safety in facilities. The increasing complexity of building systems and the need for compliance with safety regulations further drive the demand for Hard Services. Soft Services, while significant, follow closely as businesses increasingly recognize the importance of customer experience and cleanliness in enhancing their brand image.

By End-User:

The end-user segmentation includes Commercial, Industrial, Government, Healthcare, Education, and Others. The Commercial sector leads the market, driven by the rapid growth of office spaces and retail establishments that require comprehensive facility management solutions. The increasing focus on operational efficiency and cost reduction in the Commercial sector has led to a higher adoption of outsourcing services. The Healthcare sector is also witnessing significant growth due to stringent regulatory requirements and the need for specialized services to maintain hygiene and safety standards.

The Brazil Facility Management & Outsourcing Market is characterized by a dynamic mix of regional and international players. Leading participants such as ISS World, Sodexo, CBRE Group, JLL (Jones Lang LaSalle), G4S, Aramark, Compass Group, C&W Services, Mitie Group, Serco Group, ABM Industries, EMCOR Group, OCS Group, SODEXO, Transfield Services contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Brazil facility management and outsourcing market appears promising, driven by technological innovations and a growing emphasis on sustainability. As companies increasingly adopt smart building technologies, the demand for integrated facility management services is expected to rise. Additionally, the government's commitment to infrastructure development will likely create new opportunities for facility management providers, enabling them to expand their service offerings and enhance operational efficiencies across various sectors.

| Segment | Sub-Segments |

|---|---|

| By Type | Hard Services Soft Services Integrated Services Specialized Services Others |

| By End-User | Commercial Industrial Government Healthcare Education Others |

| By Service Model | Outsourced Services In-House Services Hybrid Model |

| By Contract Type | Fixed-Price Contracts Time and Materials Contracts Performance-Based Contracts |

| By Industry Vertical | Retail Hospitality Transportation Real Estate Others |

| By Geographic Coverage | Urban Areas Suburban Areas Rural Areas |

| By Pricing Model | Subscription-Based Pricing Pay-Per-Use Pricing Tiered Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Office Facility Management | 150 | Facility Managers, Operations Directors |

| Healthcare Facility Outsourcing | 100 | Healthcare Administrators, Procurement Managers |

| Educational Institution Services | 80 | Campus Facility Managers, Administrative Heads |

| Retail Space Management | 70 | Store Managers, Regional Operations Managers |

| Industrial Facility Services | 90 | Plant Managers, Supply Chain Directors |

The Brazil Facility Management & Outsourcing Market is valued at approximately USD 15 billion, reflecting a significant growth trend driven by urbanization, commercial real estate expansion, and the increasing demand for integrated facility services.