Region:Europe

Author(s):Geetanshi

Product Code:KRAB2832

Pages:80

Published On:October 2025

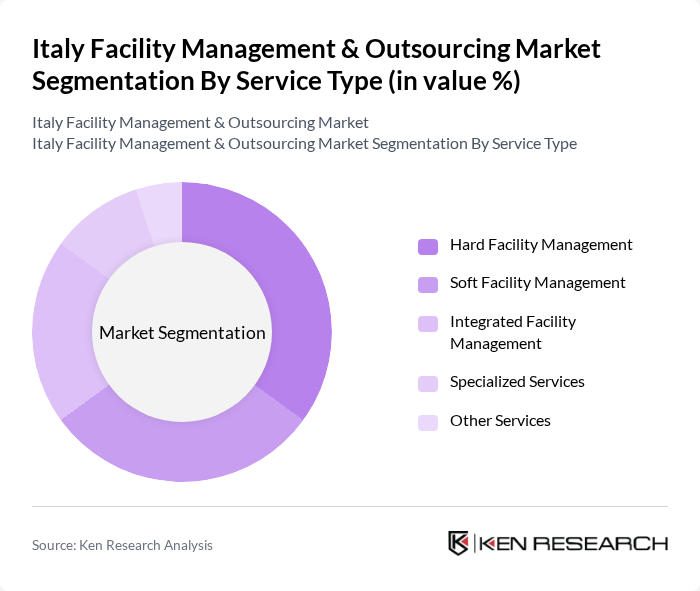

By Service Type:The service type segmentation includes various categories such as Hard Facility Management, Soft Facility Management, Integrated Facility Management, Specialized Services, and Other Services. Hard Facility Management encompasses essential maintenance services, including fire-safety inspections, MEP upgrades, and HVAC retrofits, driven by regulatory compliance and the need to modernize aging assets, especially in healthcare and public buildings. Soft Facility Management focuses on services like cleaning, security, catering, and guest experience, with growth accelerated by the revival of tourism and heightened hygiene standards post-pandemic. Integrated Facility Management combines both hard and soft services, providing a comprehensive solution that is gaining traction due to demand for cost efficiency and unified service delivery, particularly in sectors with dispersed footprints such as banking and retail. Specialized Services cater to specific needs such as energy management and waste management, while Other Services cover additional offerings not classified elsewhere.

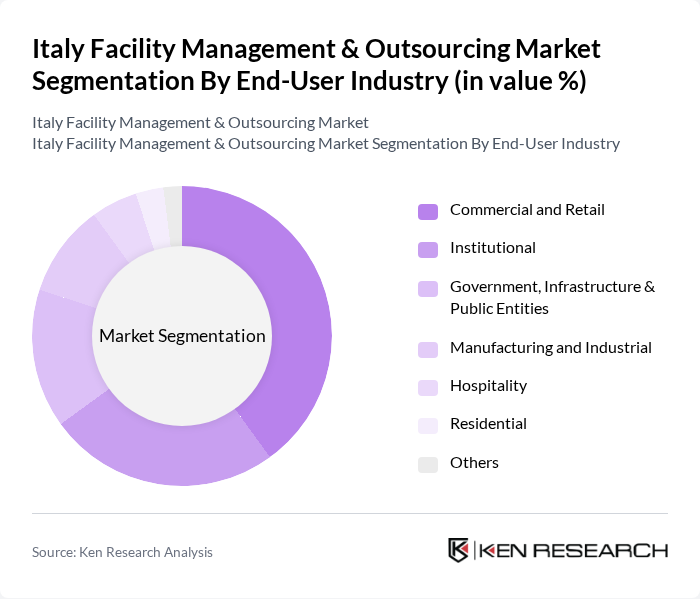

By End-User Industry:The end-user industry segmentation includes Commercial and Retail, Institutional (including education and healthcare), Government, Infrastructure & Public Entities, Manufacturing and Industrial, Hospitality, Residential, and Others. The Commercial and Retail sector is a significant contributor due to the high demand for facility management services in shopping centers, office buildings, and mixed-use developments, supported by robust commercial real estate investment. Institutional sectors, particularly healthcare and education, require extensive management services to maintain hygiene, safety, and regulatory compliance, with healthcare emerging as the fastest-growing segment. Government, Infrastructure & Public Entities are increasingly outsourcing facility management to comply with new regulations and optimize public spending. The hospitality industry focuses on maintaining high service standards to support Italy’s tourism recovery, while manufacturing, industrial, and residential sectors also contribute to overall market demand.

The Italy Facility Management & Outsourcing Market is characterized by a dynamic mix of regional and international players. Leading participants such as ISS Facility Services S.p.A., Sodexo Italia S.p.A., CBRE GWS Italy S.p.A., Aramark Italia S.r.l., G4S Secure Solutions S.p.A., Manutencoop Facility Management S.p.A. (now Rekeep S.p.A.), Dussmann Service Italia S.r.l., Coopservice S.Coop.p.A., Engie Servizi S.p.A., Compass Group Italia S.p.A., Rekeep S.p.A., Atalian Global Services Italia S.p.A., Ecolab S.r.l., Servizi Integrati S.r.l., PFE S.p.A. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the facility management and outsourcing market in Italy appears promising, driven by technological advancements and a growing emphasis on sustainability. As businesses increasingly adopt integrated facility management solutions, the demand for smart technologies will continue to rise. Additionally, the focus on employee well-being and workplace experience is expected to shape service offerings, leading to enhanced customer satisfaction. Companies that adapt to these trends will likely gain a competitive edge in the evolving market landscape.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Hard Facility Management (e.g., maintenance, MEP, HVAC, fire safety) Soft Facility Management (e.g., cleaning, security, catering, landscaping) Integrated Facility Management (bundled hard and soft services) Specialized Services (e.g., energy management, waste management, IT & telecom support) Other Services |

| By End-User Industry | Commercial and Retail Institutional (including education and healthcare) Government, Infrastructure & Public Entities Manufacturing and Industrial Hospitality Residential Others |

| By Facility Management Type | In-House Facility Management Outsourced Facility Management Hybrid Model |

| By Contract Type | Single Facility Management Bundled Facility Management Integrated Facility Management |

| By Geographic Coverage | Northern Italy Central Italy Southern Italy Islands |

| By Investment Source | Private Investment Public Funding Foreign Direct Investment Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Facility Management | 100 | Facility Managers, Operations Directors |

| Healthcare Facility Outsourcing | 60 | Healthcare Administrators, Procurement Managers |

| Educational Institution Services | 50 | Campus Facility Managers, Administrative Heads |

| Retail Space Management | 40 | Store Managers, Regional Operations Managers |

| Industrial Facility Services | 50 | Plant Managers, Safety Officers |

The Italy Facility Management & Outsourcing Market is valued at approximately USD 39.5 billion, reflecting a significant growth driven by the demand for efficient facility management and the trend of outsourcing non-core activities, particularly in the public sector.