Region:Asia

Author(s):Shubham

Product Code:KRAB6563

Pages:83

Published On:October 2025

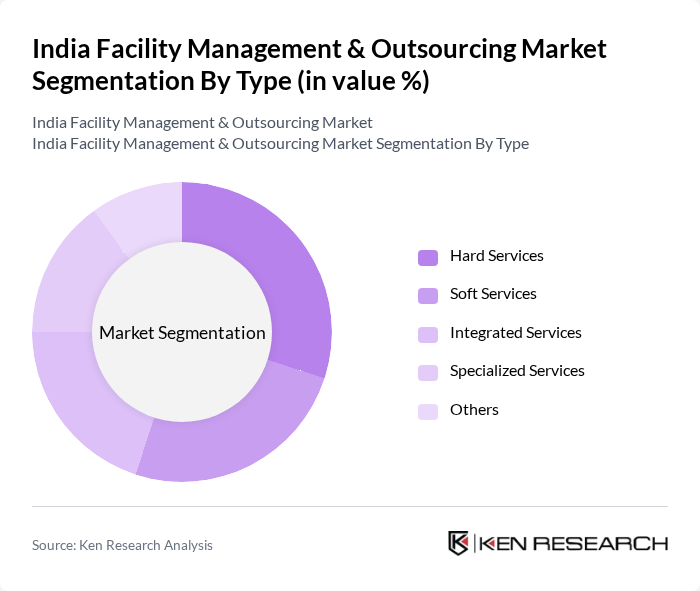

By Type:The market is segmented into various types, including Hard Services, Soft Services, Integrated Services, Specialized Services, and Others. Hard Services encompass essential maintenance and repair tasks, while Soft Services include cleaning and security. Integrated Services combine both hard and soft services for comprehensive management. Specialized Services cater to niche requirements, and Others cover additional offerings.

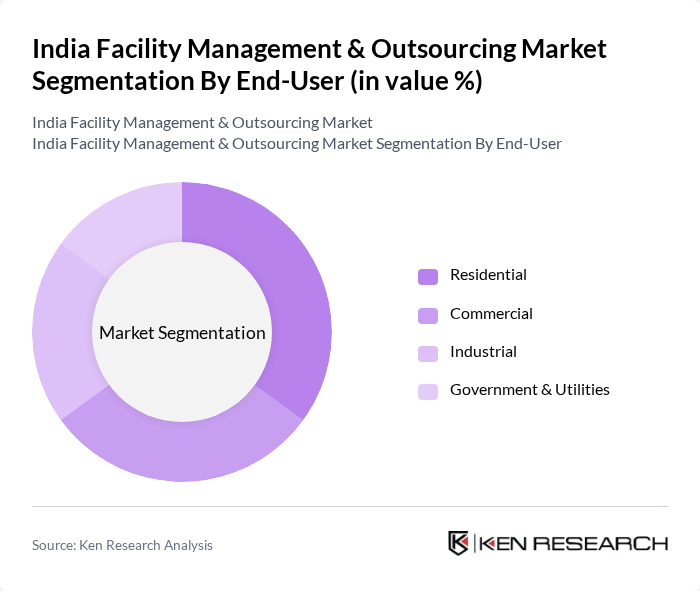

By End-User:The end-user segmentation includes Residential, Commercial, Industrial, and Government & Utilities. The Residential segment is driven by the growing urban population and the need for maintenance services in housing complexes. The Commercial sector demands comprehensive facility management for office spaces, while Industrial users require specialized services for manufacturing facilities. Government & Utilities focus on maintaining public infrastructure and services.

The India Facility Management & Outsourcing Market is characterized by a dynamic mix of regional and international players. Leading participants such as ISS Facility Services, JLL (Jones Lang LaSalle), CBRE Group, Inc., G4S plc, Sodexo, Knight Frank, Cushman & Wakefield, Aegis Facilities Services, Aon plc, ManpowerGroup, Quess Corp, A2Z Group, Aegis Logistics, Aegis Services, Aegis Facility Management contribute to innovation, geographic expansion, and service delivery in this space.

The future of the India facility management and outsourcing market appears promising, driven by technological advancements and increasing demand for integrated services. The adoption of smart technologies, such as IoT and AI, is expected to enhance operational efficiency and service delivery. Additionally, as businesses continue to focus on sustainability and cost reduction, the trend towards outsourcing non-core activities will likely persist, creating new opportunities for service providers to innovate and expand their offerings in the market.

| Segment | Sub-Segments |

|---|---|

| By Type | Hard Services Soft Services Integrated Services Specialized Services Others |

| By End-User | Residential Commercial Industrial Government & Utilities |

| By Region | North India South India East India West India |

| By Service Model | On-site Services Off-site Services Hybrid Services |

| By Application | Facility Maintenance Cleaning Services Security Services Landscaping Services |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes |

| By Policy Support | Subsidies Tax Exemptions Regulatory Compliance Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Facility Management | 150 | Facility Managers, Operations Directors |

| Outsourcing Service Providers | 100 | Business Development Managers, Service Delivery Heads |

| Healthcare Facility Management | 80 | Healthcare Administrators, Facility Operations Managers |

| IT Sector Facility Services | 70 | IT Facility Managers, Real Estate Executives |

| Manufacturing Facility Operations | 90 | Production Managers, Maintenance Supervisors |

The India Facility Management & Outsourcing Market is valued at approximately USD 20 billion, driven by urbanization, demand for efficient facility management, and the rise of outsourcing services across various sectors.