Region:Central and South America

Author(s):Shubham

Product Code:KRAA4941

Pages:99

Published On:September 2025

By Type:The market is segmented into various types, including Casual Wear, Sportswear, Accessories, Footwear, Outerwear, Streetwear Collections, and Others. Among these, Casual Wear and Streetwear Collections are particularly popular due to their alignment with the lifestyle and preferences of Gen Z consumers. Casual Wear is favored for its comfort and versatility, while Streetwear Collections resonate with the youth's desire for unique and expressive fashion statements.

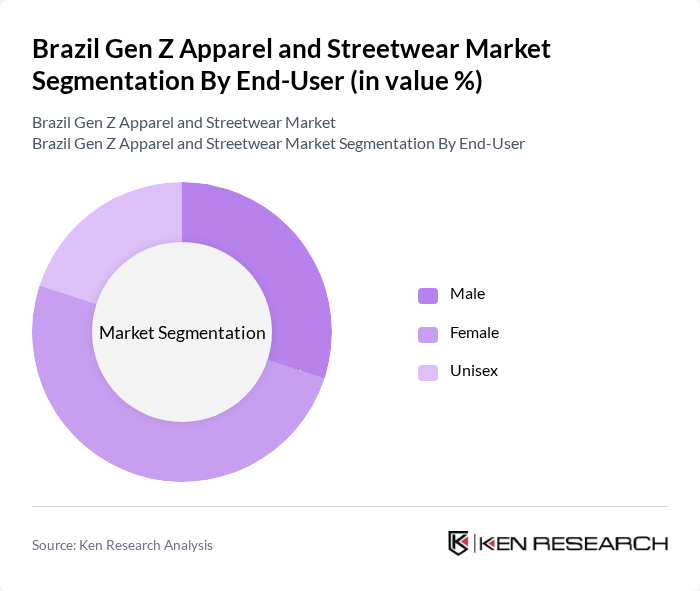

By End-User:The market is segmented by end-user into Male, Female, and Unisex categories. The Female segment is currently leading the market, driven by a strong inclination towards fashion and a diverse range of options available for women. Male consumers are also increasingly engaging with fashion trends, particularly in streetwear, while Unisex options are gaining traction as inclusivity becomes a priority for brands.

The Brazil Gen Z Apparel and Streetwear Market is characterized by a dynamic mix of regional and international players. Leading participants such as Hering S.A., C&A Modas Ltda., Riachuelo S.A., Renner S.A., Amaro, Osklen, Farm Rio, Reserva, Colcci, Levis Brasil, Adidas do Brasil, Nike do Brasil, Vans do Brasil, Converse Brasil, Supreme Brasil contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Brazil Gen Z apparel and streetwear market appears promising, driven by the ongoing digital transformation and evolving consumer preferences. As e-commerce continues to expand, brands that effectively utilize social media and influencer partnerships will likely thrive. Additionally, the increasing focus on sustainability will push companies to innovate in eco-friendly practices. The integration of technology, such as virtual try-ons, will enhance the shopping experience, making it more engaging for Gen Z consumers, who value convenience and personalization.

| Segment | Sub-Segments |

|---|---|

| By Type | Casual Wear Sportswear Accessories Footwear Outerwear Streetwear Collections Others |

| By End-User | Male Female Unisex |

| By Sales Channel | Online Retail Brick-and-Mortar Stores Pop-up Shops |

| By Price Range | Budget Mid-range Premium |

| By Brand Loyalty | Established Brands Emerging Brands Private Labels |

| By Fashion Trend | Fast Fashion Slow Fashion Street Style |

| By Sustainability Focus | Eco-friendly Brands Conventional Brands Upcycled Fashion |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Gen Z Streetwear Consumers | 150 | Fashion Enthusiasts, College Students |

| Retailers in Urban Areas | 100 | Store Managers, Brand Representatives |

| Fashion Influencers and Bloggers | 80 | Content Creators, Social Media Influencers |

| Designers Focused on Youth Fashion | 60 | Independent Designers, Brand Founders |

| Market Analysts and Trend Forecasters | 50 | Industry Analysts, Fashion Researchers |

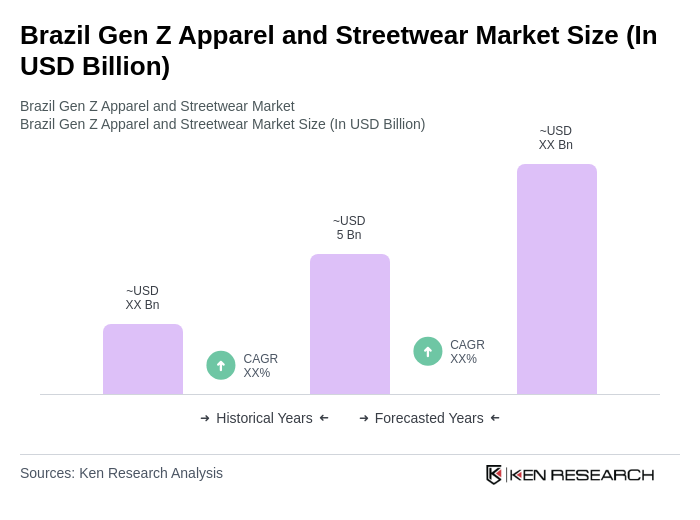

The Brazil Gen Z Apparel and Streetwear Market is valued at approximately USD 5 billion, reflecting a significant growth trend driven by social media influence, e-commerce expansion, and a preference for casual and streetwear styles among younger consumers.