Saudi Arabia Athleisure Market Overview

- The Saudi Arabia Athleisure Market is valued at USD 3.7 billion, based on a five-year historical analysis. This growth is primarily driven by increasing health and wellness consciousness, a surge in fitness activities, and the widespread adoption of casual wear in everyday life. The market has experienced a significant shift towards comfortable and stylish clothing that can be worn both for exercise and casual outings, with brands responding by offering collections that combine high-performance fabrics and modern design sensibilities .

- Key cities such as Riyadh, Jeddah, and Dammam dominate the market due to their large urban populations and rising disposable incomes. These cities are witnessing a notable increase in fitness centers, sports events, and active lifestyle initiatives, further fueling demand for athleisure products. The cultural shift towards a more active lifestyle, especially among youth and professionals, has made these urban areas pivotal in the growth of the athleisure segment .

- The Saudi government, under the Vision 2030 initiative, has implemented binding regulations and strategic programs to promote sports and physical activities. The “Sports Sector Strategy” (issued by the Ministry of Sport, 2020) mandates the development of sports infrastructure, establishment of fitness facilities, and the organization of national sports events. These measures require compliance with facility standards and promote widespread participation, directly supporting the growth of the athleisure market by stimulating demand for related apparel .

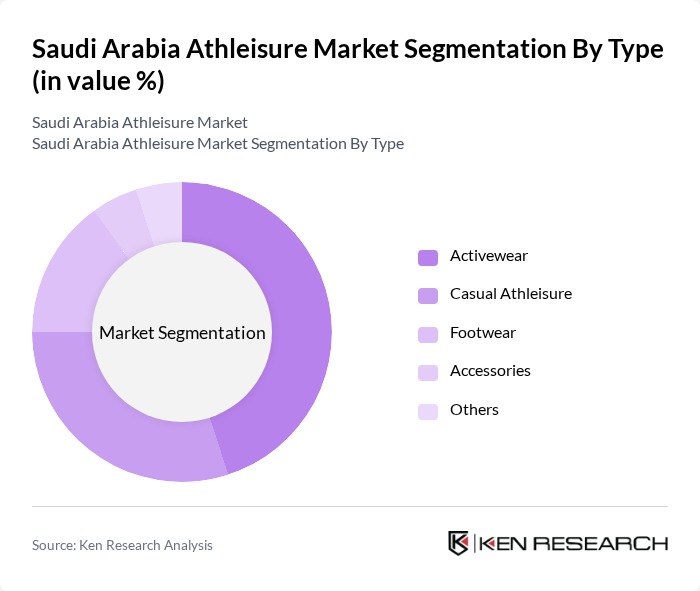

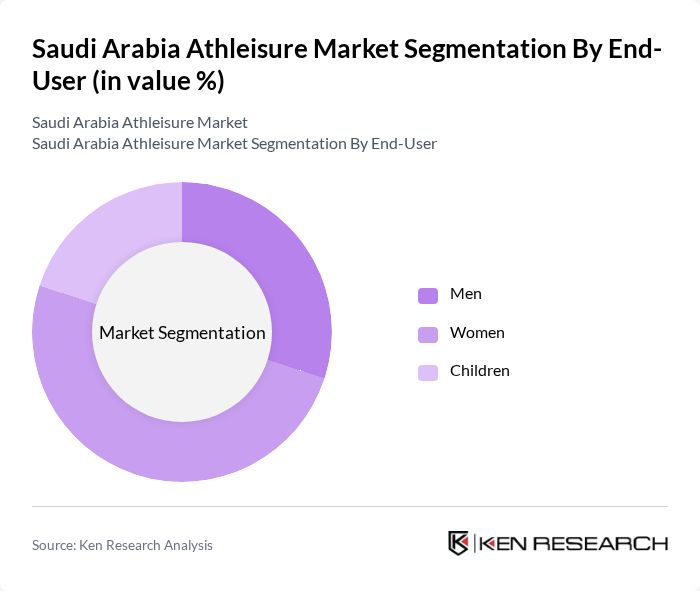

Saudi Arabia Athleisure Market Segmentation

By Type:The athleisure market can be segmented into several types, including Activewear, Casual Athleisure, Footwear, Accessories, and Others. Among these, Activewear is the leading sub-segment, driven by the increasing participation in fitness activities and sports. Consumers are seeking high-performance apparel that combines advanced textile technology, such as moisture-wicking and stretchability, with contemporary style, making Activewear a dominant choice in the market .

By End-User:The market is segmented by end-user into Men, Women, and Children. Women represent the largest segment, driven by a growing trend of fitness and wellness among females. The increasing availability of stylish and functional athleisure options tailored for women, including modest activewear, has significantly contributed to their dominance in the market .

Saudi Arabia Athleisure Market Competitive Landscape

The Saudi Arabia Athleisure Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nike, Inc., Adidas AG, Under Armour, Inc., Puma SE, Lululemon Athletica Inc., Reebok International Ltd., New Balance Athletics, Inc., ASICS Corporation, Columbia Sportswear Company, Gymshark Ltd., Fabletics, Inc., Decathlon S.A., Skechers USA, Inc., H&M Group, Al Hokair Group, Sun & Sand Sports (GMG Group), Namshi (Emaar Malls PJSC), Redtag, Centrepoint (Landmark Group), and Al-Haramain Sports contribute to innovation, geographic expansion, and service delivery in this space.

Saudi Arabia Athleisure Market Industry Analysis

Growth Drivers

- Increasing Health Consciousness:The Saudi Arabian population is becoming increasingly health-conscious, with a reported 65% of adults engaging in regular physical activity. This shift is supported by government initiatives promoting fitness, such as the "30 Minutes a Day" campaign, which aims to encourage daily exercise. The World Health Organization indicates that physical inactivity costs the economy approximately SAR 2.5 billion annually in healthcare expenses, highlighting the need for athleisure products that cater to this growing demographic.

- Rise of Fitness Culture:The fitness culture in Saudi Arabia is rapidly evolving, with over 1,200 gyms and fitness centers operating across the country. This growth is fueled by a younger population, with approximately 63% under the age of 30, who are increasingly prioritizing fitness and wellness. The Saudi Vision 2030 initiative aims to increase sports participation to 40% in future, further driving demand for athleisure apparel that aligns with this lifestyle shift and supports active living.

- Expansion of E-commerce Platforms:E-commerce in Saudi Arabia is projected to reach SAR 50 billion in future, driven by a significant increase in online shopping habits among consumers. The COVID-19 pandemic accelerated this trend, with 70% of consumers now preferring online shopping for athleisure products. Major platforms like Souq.com and Noon.com are expanding their athleisure offerings, making it easier for consumers to access a variety of brands and styles, thus boosting market growth.

Market Challenges

- Intense Competition:The Saudi athleisure market is characterized by intense competition, with over 200 brands vying for market share. Established global brands like Nike and Adidas dominate, while local brands struggle to differentiate themselves. This saturation leads to aggressive pricing strategies, which can erode profit margins. As a result, new entrants face significant barriers to entry, making it challenging to establish a foothold in this competitive landscape.

- Price Sensitivity Among Consumers:Price sensitivity is a significant challenge in the Saudi athleisure market, with 65% of consumers indicating that price is a primary factor in their purchasing decisions. The average disposable income in Saudi Arabia is approximately SAR 6,000 per month, leading consumers to seek affordable options. This sensitivity can limit the ability of brands to introduce premium products, impacting overall market growth and profitability.

Saudi Arabia Athleisure Market Future Outlook

The future of the Saudi Arabia athleisure market appears promising, driven by a growing emphasis on health and fitness among the population. As the government continues to promote active lifestyles through initiatives and events, the demand for athleisure products is expected to rise. Additionally, the integration of technology in apparel, such as smart fabrics, will likely enhance consumer engagement and product appeal, further solidifying the market's growth trajectory in the coming years.

Market Opportunities

- Growth in Online Retail:The surge in online retail presents a significant opportunity for athleisure brands. With e-commerce projected to grow by 20% annually, brands can leverage digital platforms to reach a broader audience. This shift allows for targeted marketing strategies and personalized shopping experiences, enhancing customer engagement and driving sales in the athleisure segment.

- Development of Sustainable Products:There is a growing consumer preference for sustainable products, with 45% of shoppers willing to pay more for eco-friendly athleisure. Brands that invest in sustainable materials and ethical production practices can tap into this trend, appealing to environmentally conscious consumers. This focus on sustainability not only enhances brand loyalty but also aligns with global shifts towards responsible consumption.