Region:Central and South America

Author(s):Dev

Product Code:KRAD0380

Pages:93

Published On:August 2025

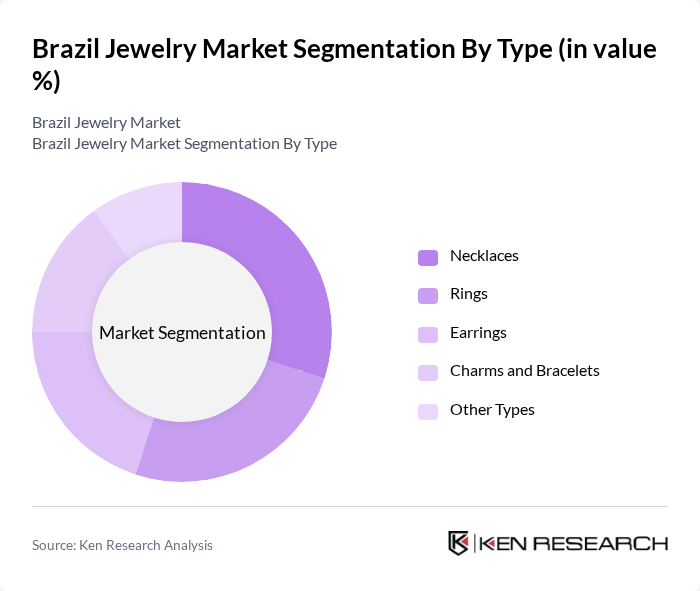

By Type:The jewelry market can be segmented into various types, including necklaces, rings, earrings, charms and bracelets, and other types. Among these, necklaces and rings are particularly popular due to their versatility and significance in cultural and personal contexts. Rings remain central for engagements and weddings, while necklaces and earrings align closely with fashion-led purchases and gifting; customization/personalization, sustainable materials, and lab-grown diamond offerings are expanding choices across these categories .

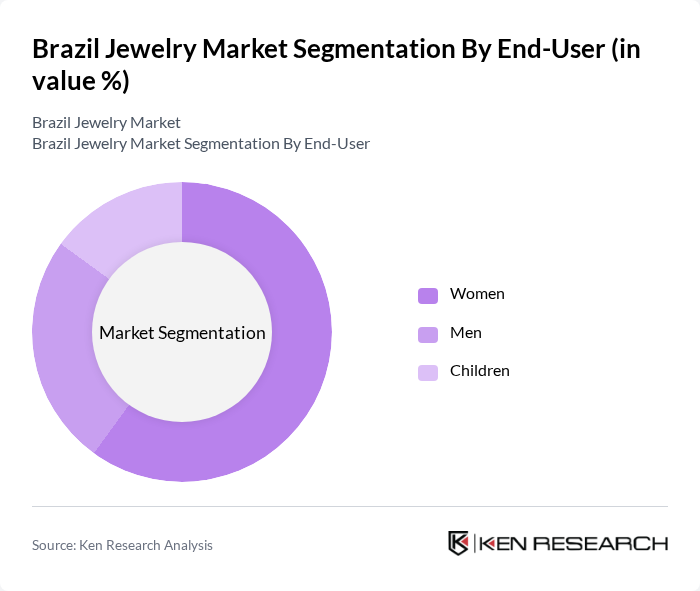

By End-User:The jewelry market is segmented by end-user demographics, including women, men, and children. Women represent the largest segment, supported by broader product ranges and purchase frequency, while men’s jewelry continues to gain traction in urban markets, aided by fashion trends and gifting. Children’s jewelry is smaller but benefits from occasion-driven purchases and family gifting .

The Brazil Jewelry Market is characterized by a dynamic mix of regional and international players. Leading participants such as H.Stern, Vivara S.A., Monte Carlo Joias, HStern Amsterdam Sauer, Pandora Brasil (Pandora Jewelry), Rommanel, Lojas Renner (Acessórios/Jewelry), C&A Brasil (Bijuterias e Acessórios), Tiffany & Co., Cartier, Swarovski, Amsterdam Sauer, Natan Joias, Antonio Bernardo, Carla Amorim contribute to innovation, geographic expansion, and service delivery in this space.

The Brazil jewelry market is poised for significant transformation, driven by evolving consumer preferences and technological advancements. As sustainability becomes a priority, brands that adopt ethical sourcing and transparent practices are likely to gain a competitive edge. Additionally, the integration of augmented reality in online shopping experiences is expected to enhance customer engagement, making the purchasing process more interactive and personalized. These trends will shape the market landscape, fostering innovation and growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Necklaces Rings Earrings Charms and Bracelets Other Types |

| By End-User | Women Men Children |

| By Sales Channel | Offline Retail Stores Online Retail Stores |

| By Material | Gold Jewelry Silver Jewelry Gemstone Jewelry Platinum & Other Precious Metals |

| By Price Range | Economy Mid-Range Premium/Luxury |

| By Category | Real Jewelry Costume/Fashion Jewelry |

| By Occasion | Weddings & Engagements Gifting (Anniversaries, Birthdays, Graduations) Everyday/Workwear |

| By Region | Southeast (São Paulo, Rio de Janeiro, Minas Gerais, Espírito Santo) South (Paraná, Santa Catarina, Rio Grande do Sul) Northeast North Central-West |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Jewelry Sales | 120 | Store Managers, Sales Associates |

| Consumer Jewelry Purchases | 140 | Jewelry Buyers, Fashion Enthusiasts |

| Jewelry Manufacturing Insights | 100 | Production Managers, Quality Control Officers |

| Market Trends and Preferences | 90 | Market Analysts, Trend Forecasters |

| Online Jewelry Shopping Behavior | 80 | E-commerce Managers, Digital Marketing Specialists |

The Brazil Jewelry Market is valued at approximately USD 3.2 billion, with estimates ranging from USD 3.0 to 3.6 billion based on various industry analyses. This growth is driven by rising disposable incomes and increased demand for both fine and fashion jewelry.