Region:Middle East

Author(s):Rebecca

Product Code:KRAC3917

Pages:100

Published On:October 2025

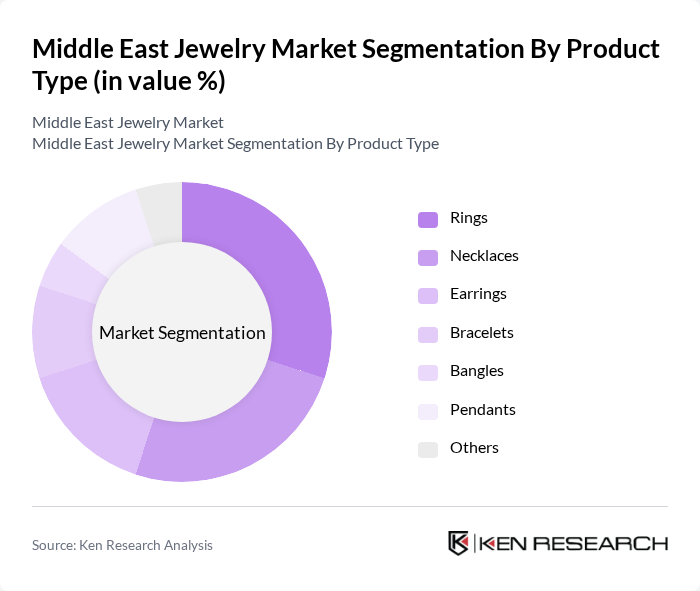

By Product Type:The product type segmentation includes rings, necklaces, earrings, bracelets, bangles, pendants, and others. Rings and necklaces are particularly popular, reflecting their versatility and cultural significance in engagement, wedding, and festive occasions. Earrings and bracelets also see strong demand, driven by fashion trends, personal expression, and the influence of global jewelry brands .

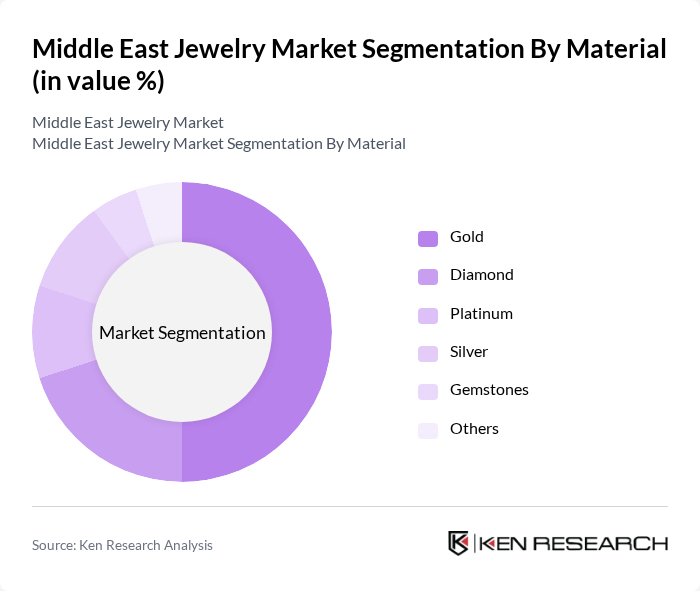

By Material:The material segmentation covers gold, diamond, platinum, silver, gemstones, and others. Gold remains the most sought-after material due to its cultural importance and investment appeal. Diamonds are highly valued, especially in bridal and luxury jewelry, while silver and platinum cater to diverse consumer preferences and price points. Gemstones and other materials are increasingly popular for personalized and fashion-forward designs .

The Middle East Jewelry Market is characterized by a dynamic mix of regional and international players. Leading participants such as L'azurde Company for Jewelry, Damas Jewelry, Malabar Gold & Diamonds, Joyalukkas, Pure Gold Jewellers, Kalyan Jewellers, Ahmed Seddiqi & Sons, Joy Alukkas, SAFA Group, Bymystique, Hand Diamond & Jewelry LLC, Tanishq (Titan Company), Chanel, LVMH (Louis Vuitton, Bulgari), Cartier (Richemont Group) contribute to innovation, geographic expansion, and service delivery in this space.

The Middle East jewelry market is poised for dynamic growth, driven by evolving consumer preferences and technological advancements. As sustainability becomes a priority, ethical jewelry is gaining traction, with consumers increasingly seeking responsibly sourced materials. Additionally, the integration of augmented reality in online shopping experiences is expected to enhance customer engagement. These trends indicate a shift towards a more personalized and responsible jewelry market, positioning local brands to capitalize on emerging consumer demands and technological innovations.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Rings Necklaces Earrings Bracelets Bangles Pendants Others |

| By Material | Gold Diamond Platinum Silver Gemstones Others |

| By End-User | Men Women Unisex |

| By Distribution Channel | Offline (Retail Stores, Souks, Boutiques) Online (E-commerce Platforms) |

| By Application | Wedding Festive/Occasions Fashion/Daily Wear |

| By Price Range | Luxury (Premium) Mid-Range Affordable |

| By Region | GCC Countries (Saudi Arabia, UAE, Qatar, Bahrain, Kuwait, Oman) Levant Region (Jordan, Lebanon) North Africa (Egypt) Turkey Rest of Middle East |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Jewelry Outlets | 120 | Store Managers, Sales Associates |

| Online Jewelry Retailers | 80 | E-commerce Managers, Digital Marketing Specialists |

| Jewelry Manufacturers | 60 | Production Managers, Supply Chain Coordinators |

| Consumer Insights | 100 | Jewelry Buyers, Fashion Enthusiasts |

| Trade Shows and Exhibitions | 50 | Exhibitors, Event Organizers |

The Middle East Jewelry Market is valued at approximately USD 20 billion, driven by increasing disposable incomes, a young population, and a strong cultural affinity for jewelry, particularly during weddings and festivals.