Region:Middle East

Author(s):Geetanshi

Product Code:KRAC2319

Pages:95

Published On:October 2025

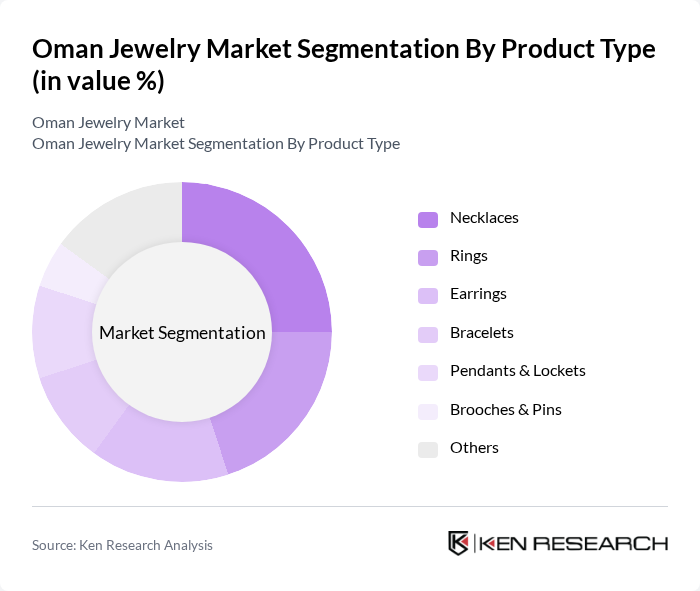

By Product Type:The product type segmentation includes various categories such as necklaces, rings, earrings, bracelets, pendants & lockets, brooches & pins, and others. Among these, necklaces and rings are particularly popular due to their versatility and significance in both everyday wear and special occasions. The demand for earrings and bracelets is also notable, driven by fashion trends, gifting practices, and increased consumer interest in personal adornment. The market also sees a rise in demand for customized and designer jewelry, reflecting evolving consumer preferences .

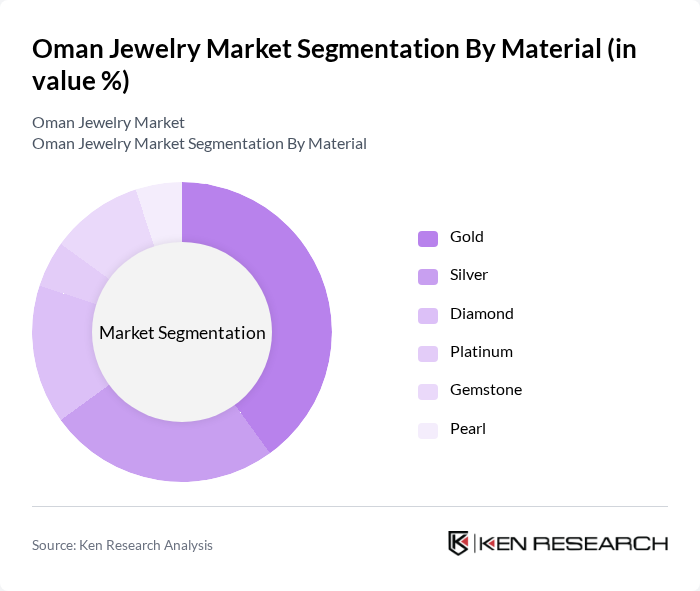

By Material:The material segmentation encompasses gold, silver, diamond, platinum, gemstone, and pearl. Gold remains the most sought-after material due to its cultural significance and investment value. Silver and diamond are also popular, especially among younger consumers who prefer trendy and affordable options. Gemstones and pearls are favored for their unique aesthetic appeal, particularly in traditional jewelry. Platinum, while a smaller segment, is gaining traction among high-end consumers seeking exclusivity and durability .

The Oman Jewelry Market is characterized by a dynamic mix of regional and international players. Leading participants such as Damas Jewellery, Malabar Gold & Diamonds, Joyalukkas, Pure Gold Jewellers, Liali Jewellery, Al Haramain Jewellery, Al Mufeed Jewellery, Al Zain Jewellery, Al Noor Jewellery, Muscat Jewellery, Al Ahlia Jewellery, Al Maktabi Jewellery, Al Shamsi Jewellery, Jawahir Oman, and Taiba Jewellery contribute to innovation, geographic expansion, and service delivery in this space .

The Oman jewelry market is poised for dynamic growth, driven by increasing disposable incomes and a strong cultural affinity for jewelry. As tourism continues to rise, local artisans and jewelers are likely to benefit from heightened visibility and demand. Additionally, the market is expected to adapt to changing consumer preferences, with a focus on sustainable practices and unique designs. This adaptability will be crucial for maintaining competitiveness and ensuring long-term growth in the evolving landscape of luxury goods.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Necklaces Rings Earrings Bracelets Pendants & Lockets Brooches & Pins Others |

| By Material | Gold Silver Diamond Platinum Gemstone Pearl |

| By End-User | Women Men Children |

| By Distribution Channel | Offline Retail (Jewelry Boutiques, Department Stores, Hypermarkets) Online Retail/E-commerce |

| By Price Range | Luxury Segment Mid-Range Segment Budget Segment |

| By Occasion | Weddings Festivals Everyday Wear Gifting |

| By Design | Traditional Designs Contemporary Designs Customized Designs |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Jewelry Sales | 120 | Store Owners, Sales Managers |

| Consumer Purchasing Behavior | 100 | Jewelry Buyers, General Consumers |

| Artisan Insights | 50 | Jewelry Designers, Craftsmen |

| Market Trends Analysis | 100 | Market Analysts, Industry Experts |

| Tourism Impact on Jewelry Sales | 80 | Tour Operators, Hotel Managers |

The Oman Jewelry Market is valued at approximately USD 180 million, reflecting a steady growth driven by increasing demand for luxury goods, cultural significance, and rising disposable income among consumers.