Region:Central and South America

Author(s):Dev

Product Code:KRAB6530

Pages:97

Published On:October 2025

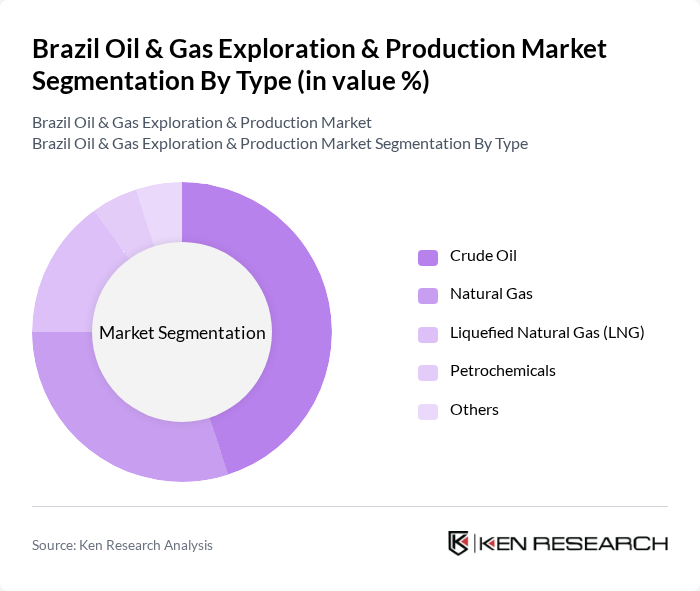

By Type:The market is segmented into various types, including Crude Oil, Natural Gas, Liquefied Natural Gas (LNG), Petrochemicals, and Others. Each of these segments plays a crucial role in the overall market dynamics, with specific applications and consumer demands driving their growth.

The Crude Oil segment dominates the market, accounting for a significant portion of the overall revenue. This is largely due to Brazil's rich offshore reserves, particularly in the pre-salt layer, which has attracted substantial investment from both domestic and international companies. The demand for crude oil remains robust, driven by both local consumption and export opportunities, making it a critical component of Brazil's energy landscape.

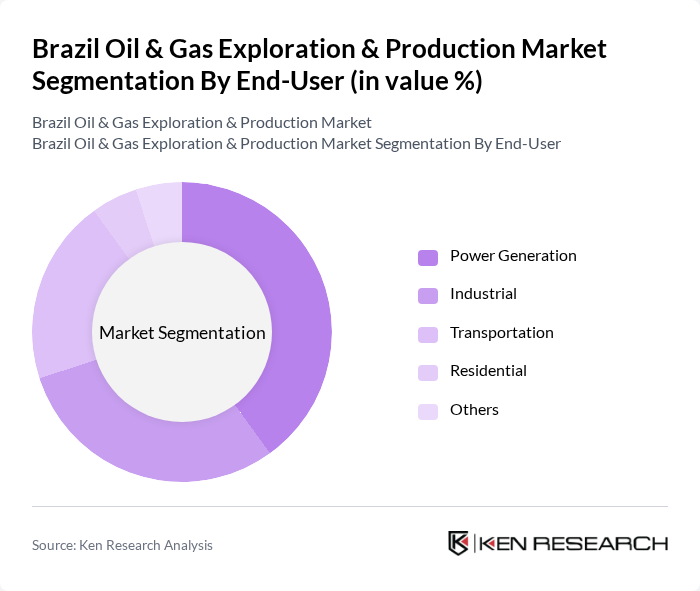

By End-User:The market is segmented by end-users, including Power Generation, Industrial, Transportation, Residential, and Others. Each segment has distinct requirements and contributes differently to the overall market dynamics.

The Power Generation segment is the largest end-user, driven by Brazil's increasing energy demands and the shift towards cleaner energy sources. The industrial sector also plays a significant role, utilizing oil and gas for various manufacturing processes. The transportation sector is gradually increasing its share as more vehicles are adapted to use natural gas, reflecting a broader trend towards sustainable energy solutions.

The Brazil Oil & Gas Exploration & Production Market is characterized by a dynamic mix of regional and international players. Leading participants such as Petrobras, Shell Brasil, Chevron Brasil, TotalEnergies Brasil, Equinor Brasil, Repsol Sinopec Brasil, Galp Energia Brasil, Enauta Participações S.A., PetroRio S.A., Karoon Energy Ltd., Petrogal Brasil, Ponta do Lobo, Ouro Preto Energia, 3R Petroleum, Prio S.A. contribute to innovation, geographic expansion, and service delivery in this space.

The future of Brazil's oil and gas exploration and production market appears promising, driven by technological advancements and a growing focus on sustainability. As the country aims to balance energy needs with environmental responsibilities, investments in cleaner extraction methods and renewable energy integration are expected to rise. Additionally, the ongoing development of offshore resources will likely enhance Brazil's position as a key player in the global energy market, fostering economic growth and energy security.

| Segment | Sub-Segments |

|---|---|

| By Type | Crude Oil Natural Gas Liquefied Natural Gas (LNG) Petrochemicals Others |

| By End-User | Power Generation Industrial Transportation Residential Others |

| By Region | Southeast Brazil Northeast Brazil South Brazil Central-West Brazil Others |

| By Application | Exploration Production Refining Distribution Others |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Funding Others |

| By Policy Support | Subsidies Tax Exemptions Regulatory Support Incentives for Renewable Integration Others |

| By Pricing Strategy | Cost-Plus Pricing Competitive Pricing Value-Based Pricing Dynamic Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oil Exploration Companies | 100 | CEOs, Exploration Managers |

| Gas Production Firms | 80 | Production Supervisors, Operations Directors |

| Regulatory Bodies | 50 | Policy Analysts, Regulatory Affairs Managers |

| Environmental Consultants | 60 | Sustainability Managers, Environmental Engineers |

| Investment Analysts in Energy Sector | 70 | Financial Analysts, Investment Managers |

The Brazil Oil & Gas Exploration & Production Market is valued at approximately USD 120 billion, driven by significant offshore reserves, technological advancements, and increasing energy demand both domestically and internationally.