Region:Central and South America

Author(s):Geetanshi

Product Code:KRAA7881

Pages:84

Published On:September 2025

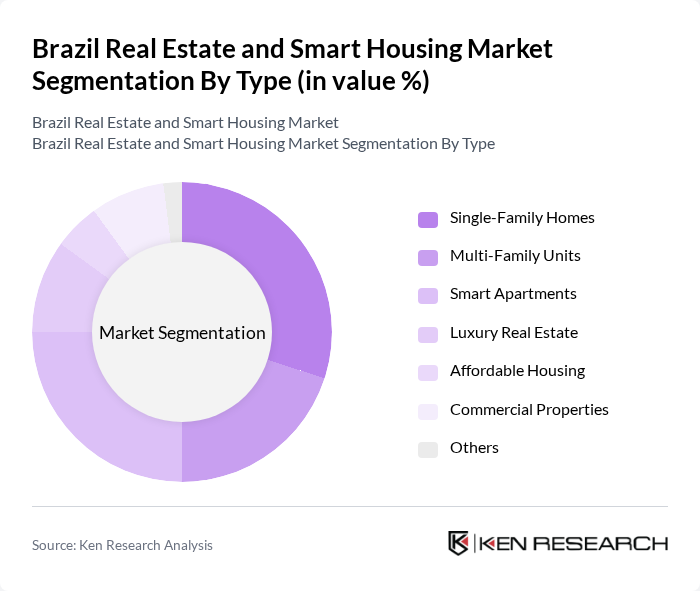

By Type:The market is segmented into various types, including Single-Family Homes, Multi-Family Units, Smart Apartments, Luxury Real Estate, Affordable Housing, Commercial Properties, and Others. Among these, Single-Family Homes and Smart Apartments are particularly prominent due to the increasing preference for personalized living spaces and the integration of technology in residential properties. The demand for Smart Apartments is rising as consumers seek energy-efficient and technologically advanced homes.

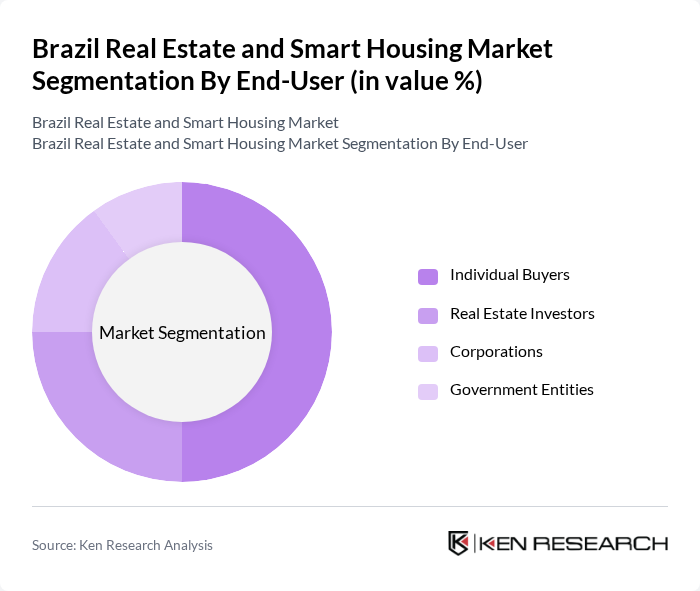

By End-User:The end-user segmentation includes Individual Buyers, Real Estate Investors, Corporations, and Government Entities. Individual Buyers dominate the market as they seek homes for personal use, while Real Estate Investors are increasingly interested in properties that promise high returns. The trend towards smart housing has also attracted Corporations looking to invest in sustainable and technologically advanced properties.

The Brazil Real Estate and Smart Housing Market is characterized by a dynamic mix of regional and international players. Leading participants such as MRV Engenharia e Participações S.A., Cyrela Brazil Realty S.A., Gafisa S.A., Even Construtora e Incorporadora S.A., JHSF Participações S.A., Tecnisa S.A., Direcional Engenharia S.A., Tenda S.A., Grupo Viver S.A., Grupo Zaffari, MRV Engenharia e Participações S.A., Grupo SBF S.A., Grupo Pão de Açúcar, Grupo J. Malucelli, Grupo Águia Branca contribute to innovation, geographic expansion, and service delivery in this space.

The future of Brazil's real estate and smart housing market appears promising, driven by urbanization and technological advancements. As the population continues to migrate to urban areas, the demand for innovative housing solutions will rise. Additionally, government initiatives aimed at affordable housing will likely bolster market growth. The integration of smart technologies and sustainable practices will further enhance the appeal of new developments, positioning Brazil as a leader in the smart housing sector in Latin America.

| Segment | Sub-Segments |

|---|---|

| By Type | Single-Family Homes Multi-Family Units Smart Apartments Luxury Real Estate Affordable Housing Commercial Properties Others |

| By End-User | Individual Buyers Real Estate Investors Corporations Government Entities |

| By Financing Type | Mortgages Cash Purchases Investment Loans Government Subsidies |

| By Property Size | Small Properties Medium Properties Large Properties |

| By Location | Urban Areas Suburban Areas Rural Areas |

| By Smart Features | Home Automation Energy Management Systems Security Systems |

| By Price Range | Low-End Mid-Range High-End |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Real Estate Buyers | 150 | First-time Homebuyers, Investors |

| Smart Housing Technology Providers | 100 | Product Managers, Technology Developers |

| Real Estate Developers | 80 | Project Managers, Business Development Heads |

| Property Management Firms | 70 | Operations Managers, Facility Managers |

| Urban Planning Experts | 60 | City Planners, Policy Advisors |

The Brazil Real Estate and Smart Housing Market is valued at approximately USD 50 billion, driven by urbanization, rising disposable incomes, and increasing demand for smart housing solutions that enhance energy efficiency and security.