Region:Africa

Author(s):Geetanshi

Product Code:KRAA8135

Pages:84

Published On:September 2025

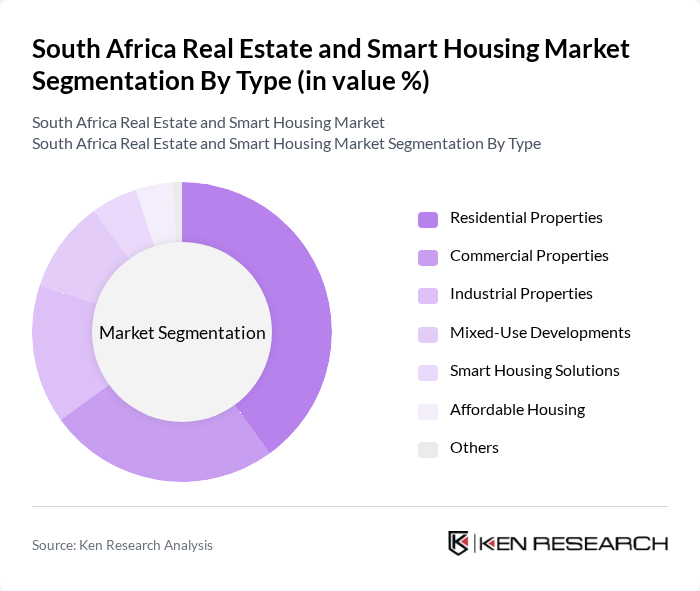

By Type:The market is segmented into various types, including Residential Properties, Commercial Properties, Industrial Properties, Mixed-Use Developments, Smart Housing Solutions, Affordable Housing, and Others. Each of these segments caters to different consumer needs and preferences, reflecting the diverse landscape of the real estate market.

The Residential Properties segment dominates the market, driven by a growing population and increasing urbanization. Consumers are increasingly seeking homes that offer modern amenities and energy efficiency, leading to a surge in demand for new residential developments. The trend towards smart housing solutions is also gaining traction, as buyers prioritize technology integration for enhanced living experiences. This segment's growth is further supported by government initiatives aimed at increasing home ownership and improving housing quality.

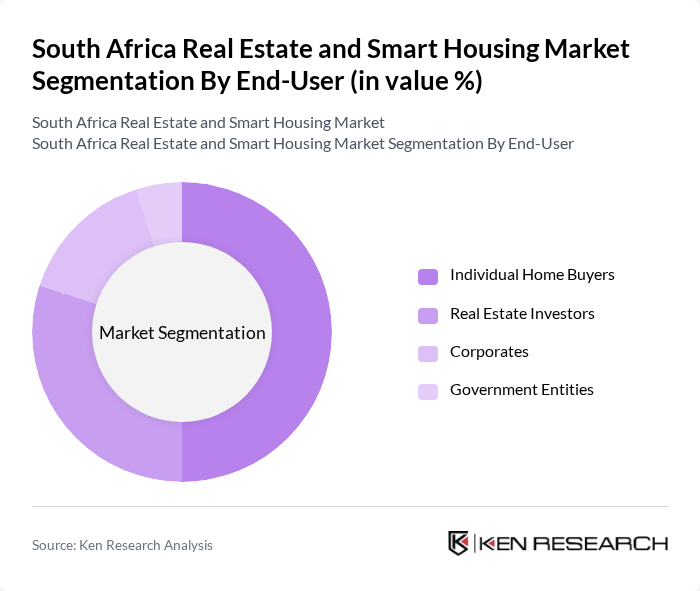

By End-User:The market is segmented by end-users, including Individual Home Buyers, Real Estate Investors, Corporates, and Government Entities. Each end-user group has distinct motivations and requirements, influencing their purchasing decisions in the real estate market.

Individual Home Buyers represent the largest segment, driven by the need for housing and the desire for home ownership. This group is increasingly influenced by factors such as affordability, location, and access to amenities. Real Estate Investors follow closely, capitalizing on the growing demand for rental properties and commercial spaces. Corporates are also significant players, often seeking office spaces and mixed-use developments to accommodate their operations. Government Entities play a crucial role in promoting affordable housing initiatives, but their market presence is comparatively smaller.

The South Africa Real Estate and Smart Housing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Growthpoint Properties, Redefine Properties, Attacq Limited, Balwin Properties, Investec Property Fund, Emira Property Fund, The Foschini Group, JSE-listed Property Companies, Pam Golding Properties, Seeff Properties, Knight Frank South Africa, Broll Property Group, Engel & Völkers South Africa, RE/MAX of Southern Africa, Pam Golding Commercial contribute to innovation, geographic expansion, and service delivery in this space.

The South African real estate and smart housing market is poised for transformation as urbanization accelerates and technology adoption increases. In the future, the integration of smart technologies and sustainable practices will likely reshape housing preferences, with a growing emphasis on eco-friendly solutions. Government initiatives aimed at promoting affordable housing will further stimulate market activity. However, economic challenges and high construction costs may temper growth. Overall, the market is expected to evolve, driven by innovation and changing consumer demands for smarter living environments.

| Segment | Sub-Segments |

|---|---|

| By Type | Residential Properties Commercial Properties Industrial Properties Mixed-Use Developments Smart Housing Solutions Affordable Housing Others |

| By End-User | Individual Home Buyers Real Estate Investors Corporates Government Entities |

| By Financing Type | Mortgages Cash Purchases Government Subsidies |

| By Location | Urban Areas Suburban Areas Rural Areas |

| By Property Size | Small Properties Medium Properties Large Properties |

| By Smart Technology Integration | Fully Integrated Smart Homes Partially Integrated Smart Homes Non-Smart Homes |

| By Policy Support | Subsidies Tax Exemptions Grants |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Smart Housing Projects | 100 | Real Estate Developers, Project Managers |

| Commercial Real Estate Trends | 80 | Property Managers, Investment Analysts |

| Urban Planning and Smart City Initiatives | 70 | Urban Planners, Local Government Officials |

| Consumer Preferences in Housing | 90 | Homebuyers, Real Estate Agents |

| Technological Adoption in Housing | 60 | Technology Providers, Smart Home Consultants |

The South Africa Real Estate and Smart Housing Market is valued at approximately USD 25 billion, driven by urbanization, housing demand, and the integration of smart technologies in properties. This market reflects a significant shift towards sustainable and energy-efficient housing solutions.