Region:Africa

Author(s):Geetanshi

Product Code:KRAB1418

Pages:95

Published On:October 2025

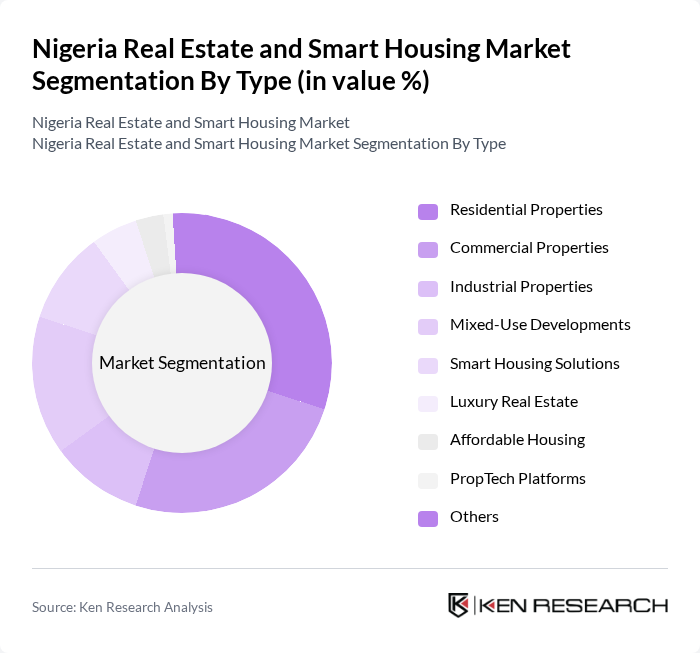

By Type:The market is segmented into Residential Properties, Commercial Properties, Industrial Properties, Mixed-Use Developments, Smart Housing Solutions, Luxury Properties, and Short-Let and Serviced Apartments. Residential Properties dominate the market, reflecting high demand driven by urban migration, population growth, and a persistent housing deficit. The trend toward smart housing solutions is accelerating, supported by consumer preferences for energy-efficient, technologically advanced living spaces and increased adoption of proptech platforms .

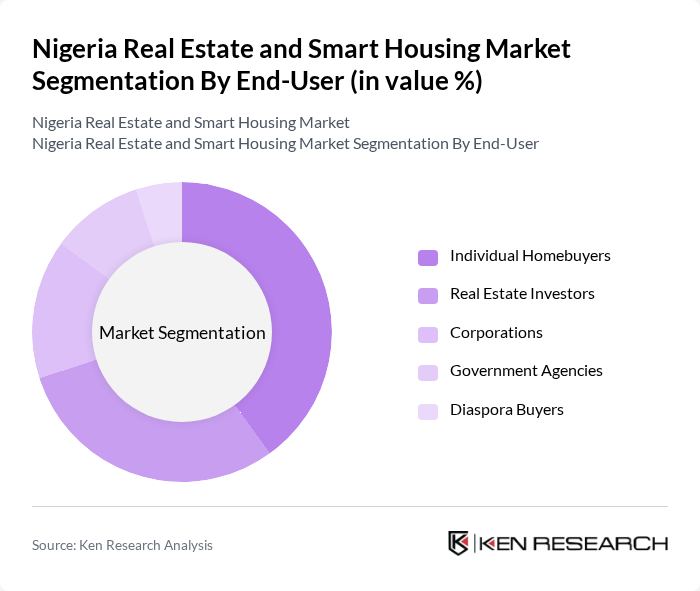

By End-User:The end-user segmentation includes Individual Homebuyers, Real Estate Investors (Domestic & Diaspora), Corporations, and Government Agencies. Individual Homebuyers represent the largest segment, driven by the increasing need for housing among the growing population and the rising trend of urban migration. Real estate investors, including diaspora investors, are significant contributors, seeking opportunities in both residential and commercial properties, especially in high-growth urban areas .

The Nigeria Real Estate and Smart Housing Market is characterized by a dynamic mix of regional and international players. Leading participants such as PropertyPro.ng, LandWey Investment Limited, Adron Homes & Properties, Eko Atlantic City, Mixta Africa, UACN Property Development Company Plc, First World Communities Ltd, Alpha Mead Group, RevolutionPlus Property Development Company, Nigerian Mortgage Refinance Company (NMRC), Dangote Group (Real Estate Division), FBNQuest Trustees (Real Estate Investment), Zenith Bank Plc (Mortgage & Real Estate Financing), Union Bank of Nigeria Plc (Real Estate Financing), Urban Shelter Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of Nigeria's real estate and smart housing market appears promising, driven by urbanization and technological advancements. As the population continues to grow, the demand for innovative housing solutions will increase. The integration of smart technologies and sustainable practices is expected to reshape the market landscape, attracting investments. Additionally, government initiatives aimed at improving infrastructure and providing affordable housing will further stimulate growth, creating a dynamic environment for real estate development in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Residential Properties Commercial Properties Industrial Properties Mixed-Use Developments Smart Housing Solutions Luxury Properties Short-Let and Serviced Apartments |

| By End-User | Individual Homebuyers Real Estate Investors (Domestic & Diaspora) Corporations Government Agencies |

| By Sales Channel | Direct Sales Real Estate Agents/Brokers Online Property Platforms Auctions |

| By Financing Type | Mortgages Cash Purchases Government-Backed Loans Private Equity/Institutional Investment |

| By Property Size | Small Scale (e.g., Apartments, Mini-Flats) Medium Scale (e.g., Duplexes, Townhouses) Large Scale (e.g., Estates, Commercial Complexes) |

| By Location | Urban Areas (e.g., Lagos, Abuja, Port Harcourt) Suburban Areas Rural Areas |

| By Price Range | Low-End (Affordable Housing) Mid-Range High-End (Luxury Segment) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Real Estate Developers | 100 | Project Managers, Business Development Executives |

| Smart Housing Technology Providers | 70 | Product Managers, Technology Officers |

| Potential Homebuyers | 120 | First-time Buyers, Investors |

| Urban Planners and Architects | 60 | City Planners, Design Consultants |

| Government Housing Officials | 40 | Policy Makers, Regulatory Officers |

The Nigeria Real Estate and Smart Housing Market is valued at approximately USD 2 trillion, driven by rapid urbanization, a population exceeding 220 million, and a significant demand for affordable housing solutions, with a housing deficit estimated at over 22 million units.