Region:Central and South America

Author(s):Rebecca

Product Code:KRAB2995

Pages:92

Published On:October 2025

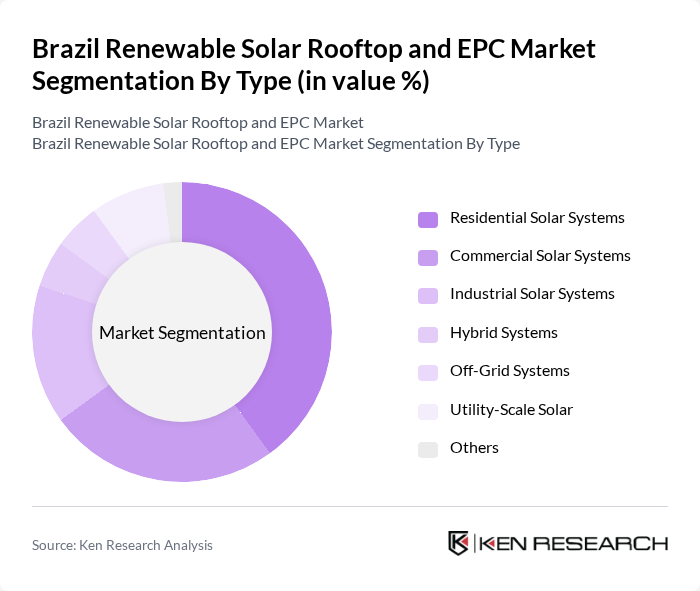

By Type:The market is segmented into various types, including Residential Solar Systems, Commercial Solar Systems, Industrial Solar Systems, Hybrid Systems, Off-Grid Systems, Utility-Scale Solar, and Others. Among these, Residential Solar Systems are currently leading the market due to the increasing number of homeowners investing in solar technology to reduce energy bills and enhance energy independence. The trend towards sustainable living and the availability of financing options have further propelled this segment's growth.

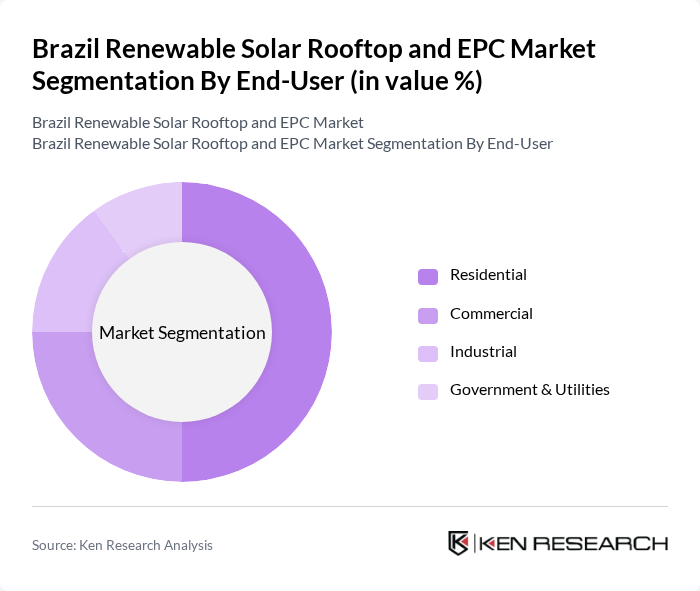

By End-User:The end-user segmentation includes Residential, Commercial, Industrial, and Government & Utilities. The Residential segment is the most significant contributor to the market, driven by the increasing number of households opting for solar energy solutions. This trend is supported by government incentives and a growing awareness of the benefits of renewable energy, leading to a substantial rise in residential installations.

The Brazil Renewable Solar Rooftop and EPC Market is characterized by a dynamic mix of regional and international players. Leading participants such as Enel Green Power Brasil, Canadian Solar Inc., Trina Solar Limited, First Solar, Inc., JinkoSolar Holding Co., Ltd., SunPower Corporation, Solaria Energia y Medio Ambiente S.A., Grupo Solar Brasil, Photon Energy N.V., Eletrobras, Solarpack, GES (Global Energy Services), Atlas Renewable Energy, TotalEnergies SE, Engie Brasil Energia S.A. contribute to innovation, geographic expansion, and service delivery in this space.

The future of Brazil's renewable solar rooftop market appears promising, driven by increasing energy demands and supportive government policies. In the future, the market is expected to witness a surge in residential installations, fueled by technological advancements and a growing emphasis on sustainability. As more consumers recognize the long-term benefits of solar energy, the market is likely to expand, fostering innovation and attracting investments. Continued collaboration between public and private sectors will be essential in overcoming existing challenges and maximizing the potential of solar energy in Brazil.

| Segment | Sub-Segments |

|---|---|

| By Type | Residential Solar Systems Commercial Solar Systems Industrial Solar Systems Hybrid Systems Off-Grid Systems Utility-Scale Solar Others |

| By End-User | Residential Commercial Industrial Government & Utilities |

| By Application | Grid-Connected Off-Grid Rooftop Installations Utility-Scale Projects |

| By Investment Source | Domestic FDI PPP Government Schemes |

| By Policy Support | Subsidies Tax Exemptions Renewable Energy Credits (RECs) |

| By Distribution Mode | Direct Sales Online Sales Distributors |

| By Price Range | Low-End Systems Mid-Range Systems High-End Systems |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Solar Rooftop Installations | 150 | Homeowners, Property Managers |

| Commercial Solar Projects | 100 | Facility Managers, Business Owners |

| Industrial Solar Solutions | 80 | Operations Directors, Energy Managers |

| EPC Contractor Insights | 70 | Project Managers, Technical Leads |

| Government Policy Impact | 60 | Regulatory Officials, Policy Advisors |

The Brazil Renewable Solar Rooftop and EPC Market is valued at approximately USD 7.5 billion, reflecting significant growth driven by increasing energy demand, government incentives, and heightened consumer awareness of environmental sustainability.