Region:Europe

Author(s):Dev

Product Code:KRAB3088

Pages:93

Published On:October 2025

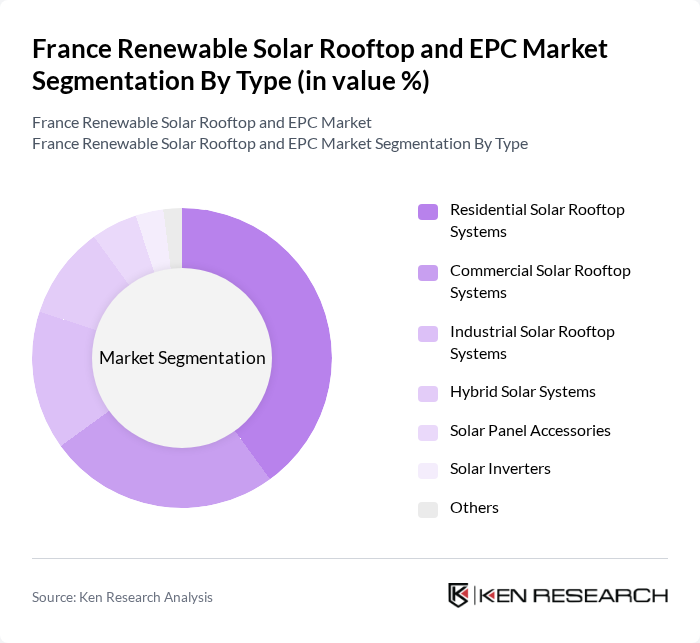

By Type:The market is segmented into various types, including Residential Solar Rooftop Systems, Commercial Solar Rooftop Systems, Industrial Solar Rooftop Systems, Hybrid Solar Systems, Solar Panel Accessories, Solar Inverters, and Others. Among these, Residential Solar Rooftop Systems are currently leading the market due to the increasing number of homeowners opting for solar energy solutions to reduce electricity bills and enhance energy independence. The trend towards sustainable living and government incentives further support this segment's growth.

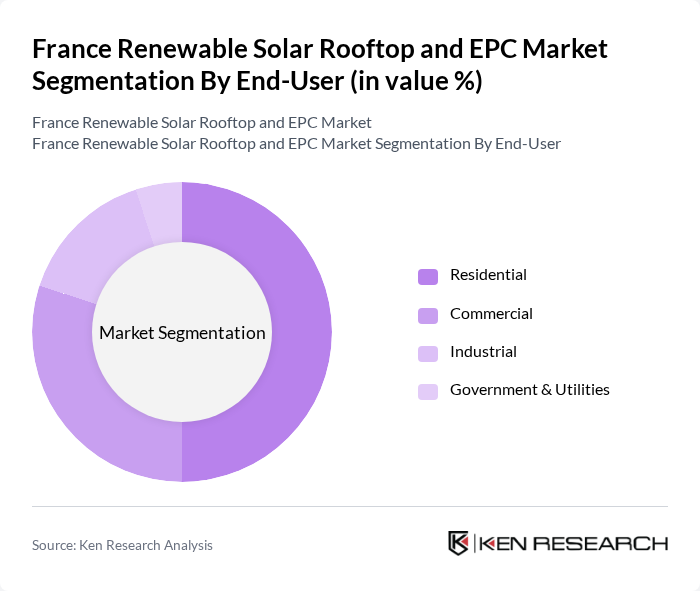

By End-User:The market is categorized into Residential, Commercial, Industrial, and Government & Utilities. The Residential segment is the most significant contributor, driven by the increasing number of households investing in solar energy systems for self-consumption and energy savings. The growing trend of energy independence and the rising cost of electricity are key factors propelling this segment's growth, making it a focal point for solar energy providers.

The France Renewable Solar Rooftop and EPC Market is characterized by a dynamic mix of regional and international players. Leading participants such as TotalEnergies SE, EDF Renewables, Engie SA, Akuo Energy, Neoen S.A., Eni S.p.A., Voltalia S.A., Solairedirect, Q CELLS, SunPower Corporation, Canadian Solar Inc., Trina Solar Limited, First Solar, Inc., JinkoSolar Holding Co., Ltd., REC Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the France Renewable Solar Rooftop and EPC market appears promising, driven by increasing investments in renewable energy and technological advancements. In the future, the integration of smart solar technologies and energy storage solutions is expected to enhance system efficiency and reliability. Additionally, the rise of community solar projects will facilitate broader access to solar energy, particularly in urban areas. These trends indicate a robust growth trajectory for the solar rooftop sector, aligning with France's sustainability goals and energy transition strategies.

| Segment | Sub-Segments |

|---|---|

| By Type | Residential Solar Rooftop Systems Commercial Solar Rooftop Systems Industrial Solar Rooftop Systems Hybrid Solar Systems Solar Panel Accessories Solar Inverters Others |

| By End-User | Residential Commercial Industrial Government & Utilities |

| By Application | Grid-Connected Systems Off-Grid Systems Rooftop Installations Utility-Scale Projects |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes |

| By Policy Support | Subsidies Tax Exemptions Renewable Energy Certificates (RECs) |

| By Distribution Mode | Direct Sales Online Sales Distributors Retail Outlets |

| By Price Range | Budget-Friendly Options Mid-Range Options Premium Options |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Solar Rooftop Installations | 150 | Homeowners, Property Managers |

| Commercial Solar Projects | 100 | Facility Managers, Business Owners |

| Industrial Solar Solutions | 80 | Operations Directors, Sustainability Managers |

| Government Incentive Programs | 60 | Policy Makers, Energy Regulators |

| Solar EPC Contractors | 70 | Project Managers, Technical Leads |

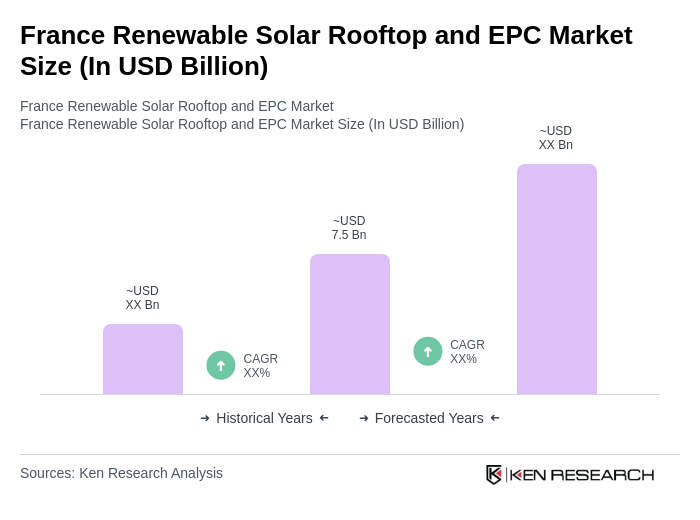

The France Renewable Solar Rooftop and EPC Market is valued at approximately USD 7.5 billion, driven by increased investments in renewable energy, government incentives, and heightened consumer awareness regarding environmental sustainability.