Region:Central and South America

Author(s):Shubham

Product Code:KRAA0738

Pages:86

Published On:August 2025

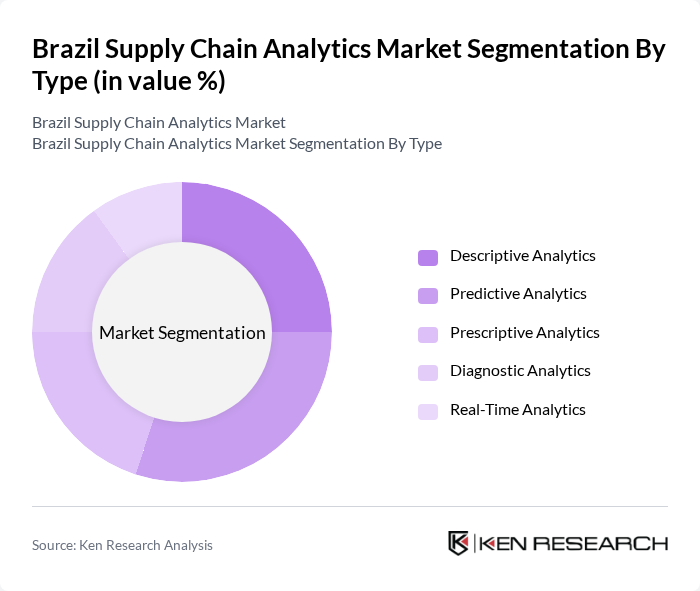

By Type:The market can be segmented into various types of analytics solutions, including Descriptive Analytics, Predictive Analytics, Prescriptive Analytics, Diagnostic Analytics, and Real-Time Analytics. Each of these sub-segments plays a crucial role in enhancing supply chain efficiency and decision-making by enabling organizations to analyze historical data, forecast future trends, recommend optimal actions, identify root causes of issues, and provide immediate insights for agile responses .

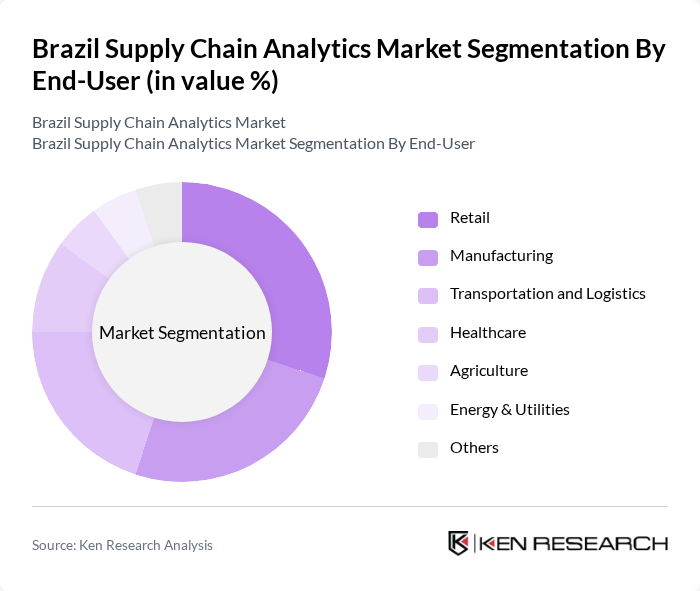

By End-User:The end-user segmentation includes Retail, Manufacturing, Transportation and Logistics, Healthcare, Agriculture, Energy & Utilities, and Others. Each sector utilizes supply chain analytics to address specific challenges and improve operational performance. Retail and manufacturing leverage analytics for inventory optimization and demand forecasting, transportation and logistics focus on route and network optimization, healthcare applies analytics for inventory and demand planning, while agriculture and energy sectors use analytics for supply-demand balancing and efficiency improvements .

The Brazil Supply Chain Analytics Market is characterized by a dynamic mix of regional and international players. Leading participants such as SAP SE, Oracle Corporation, IBM Corporation, Microsoft Corporation, Blue Yonder (formerly JDA Software Group, Inc.), Kinaxis Inc., Infor, Inc., SAS Institute Inc., Tableau Software, LLC, QlikTech International AB, Coupa Software Incorporated, E2open, LLC, Llamasoft, Inc. (now part of Coupa Software), Logility, Inc., Neogrid Participações S.A., TOTVS S.A., Senior Sistemas S.A. contribute to innovation, geographic expansion, and service delivery in this space .

The future of Brazil's supply chain analytics market appears promising, driven by technological advancements and evolving consumer expectations. As companies increasingly prioritize data-driven decision-making, the integration of artificial intelligence and machine learning into analytics tools is expected to enhance predictive capabilities. Furthermore, the emphasis on sustainability will likely lead to the development of innovative solutions that optimize resource use and minimize waste, positioning analytics as a vital component of resilient supply chains in Brazil.

| Segment | Sub-Segments |

|---|---|

| By Type | Descriptive Analytics Predictive Analytics Prescriptive Analytics Diagnostic Analytics Real-Time Analytics |

| By End-User | Retail Manufacturing Transportation and Logistics Healthcare Agriculture Energy & Utilities Others |

| By Application | Demand Forecasting Inventory Management Supplier Performance Evaluation Risk Management Transportation & Logistics Optimization Order & Fulfillment Analytics Sustainability & ESG Analytics Others |

| By Deployment Model | On-Premises Cloud-Based Hybrid |

| By Industry Vertical | Automotive Consumer Goods Food and Beverage Pharmaceuticals Oil & Gas Others |

| By Sales Channel | Direct Sales Distributors Online Sales |

| By Pricing Model | Subscription-Based Pay-Per-Use One-Time License Fee |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Manufacturing Sector Analytics Adoption | 100 | Supply Chain Managers, IT Directors |

| Retail Supply Chain Optimization | 80 | Logistics Coordinators, Operations Managers |

| Food and Beverage Supply Chain Analytics | 60 | Procurement Managers, Quality Assurance Heads |

| Pharmaceutical Supply Chain Management | 50 | Regulatory Affairs Managers, Supply Chain Analysts |

| Technology Adoption in Logistics | 40 | Chief Technology Officers, Data Analysts |

The Brazil Supply Chain Analytics Market is valued at approximately USD 830 million, driven by the increasing adoption of advanced analytics technologies and the demand for data-driven decision-making across various industries.