Region:Global

Author(s):Geetanshi

Product Code:KRAE2219

Pages:98

Published On:February 2026

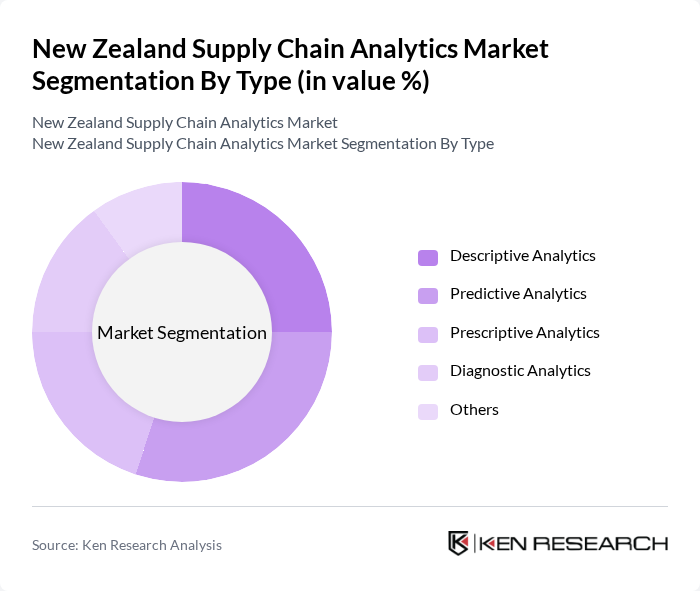

By Type:The market is segmented into various types of analytics, including Descriptive Analytics, Predictive Analytics, Prescriptive Analytics, Diagnostic Analytics, and Others. Each type serves distinct purposes, with Descriptive Analytics focusing on historical data analysis, Predictive Analytics forecasting future trends, and Prescriptive Analytics recommending actions based on data insights. The increasing complexity of supply chains has led to a growing reliance on these analytics types to enhance decision-making processes.

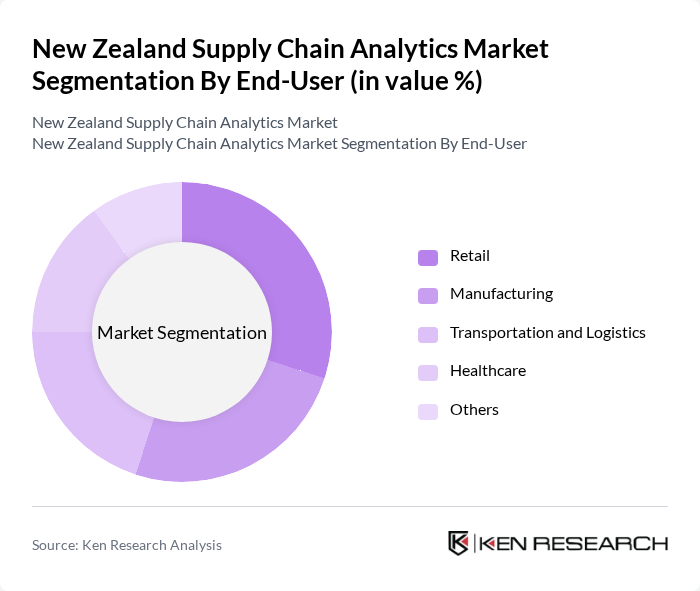

By End-User:The end-user segmentation includes Retail, Manufacturing, Transportation and Logistics, Healthcare, and Others. Retail is increasingly utilizing analytics to optimize inventory management and enhance customer experiences, while Manufacturing leverages analytics for process optimization and quality control. Transportation and Logistics are focusing on route optimization and demand forecasting, making these sectors critical for the growth of supply chain analytics.

The New Zealand Supply Chain Analytics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Xero, Fisher & Paykel Healthcare, Fliway Group, Mainfreight, Freightways, Z Energy, Contact Energy, Air New Zealand, NZ Post, The Warehouse Group, Countdown, Meridian Energy, Port of Tauranga, Silver Fern Farms, Fonterra contribute to innovation, geographic expansion, and service delivery in this space.

The future of the New Zealand supply chain analytics market appears promising, driven by technological advancements and evolving consumer expectations. As businesses increasingly adopt predictive analytics and machine learning, the ability to forecast demand and optimize inventory will enhance operational efficiency. Furthermore, the integration of blockchain technology is expected to improve transparency and traceability in supply chains, addressing consumer concerns about sustainability and ethical sourcing. These trends will likely shape the market landscape significantly in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Descriptive Analytics Predictive Analytics Prescriptive Analytics Diagnostic Analytics Others |

| By End-User | Retail Manufacturing Transportation and Logistics Healthcare Others |

| By Industry Vertical | Automotive Consumer Goods Food and Beverage Pharmaceuticals Others |

| By Deployment Model | On-Premises Cloud-Based Hybrid Others |

| By Analytics Type | Real-Time Analytics Batch Analytics Others |

| By Geographic Distribution | North Island South Island Others |

| By Policy Support | Government Initiatives Tax Incentives Grants and Funding Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Supply Chain Analytics | 100 | Supply Chain Managers, Data Analysts |

| Manufacturing Process Optimization | 80 | Operations Managers, Production Supervisors |

| Healthcare Logistics Management | 70 | Logistics Coordinators, Compliance Officers |

| Technology Adoption in Supply Chains | 90 | IT Managers, Business Analysts |

| Public Sector Supply Chain Initiatives | 60 | Policy Makers, Procurement Officers |

The New Zealand Supply Chain Analytics Market is valued at approximately USD 1.2 billion, reflecting a significant growth trend driven by the adoption of advanced analytics technologies and the demand for data-driven decision-making across various industries.