Region:Middle East

Author(s):Geetanshi

Product Code:KRAE2217

Pages:91

Published On:February 2026

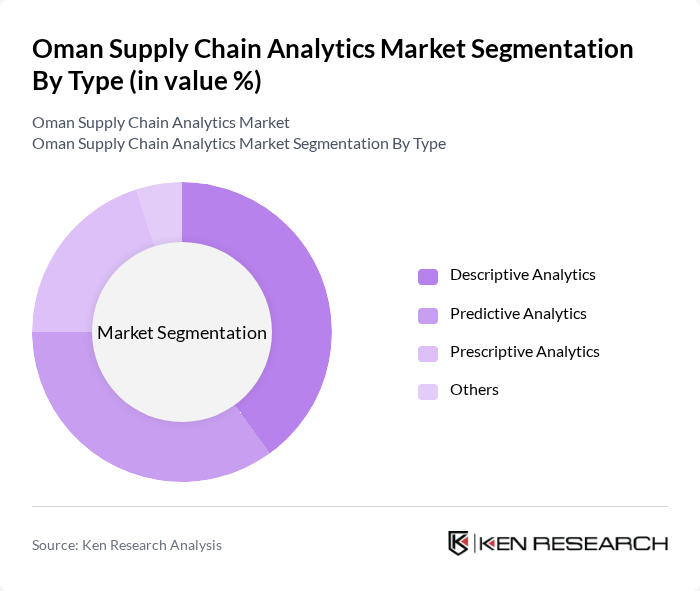

By Type:The market is segmented into Descriptive Analytics, Predictive Analytics, Prescriptive Analytics, and Others. Descriptive Analytics focuses on historical data analysis, Predictive Analytics uses statistical models to forecast future trends, Prescriptive Analytics provides recommendations for optimal decision-making, and Others include various niche analytics solutions.

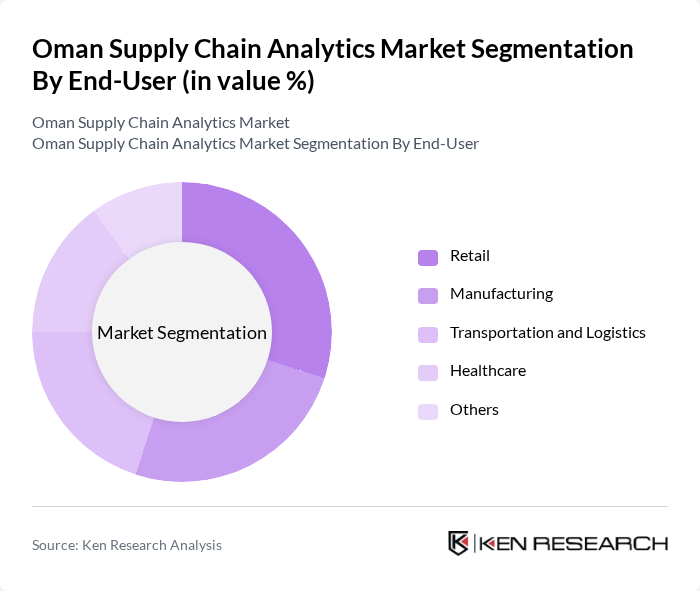

By End-User:The end-user segmentation includes Retail, Manufacturing, Transportation and Logistics, Healthcare, and Others. Retail utilizes analytics for inventory management and customer insights, Manufacturing focuses on production optimization, Transportation and Logistics enhance route planning and efficiency, Healthcare improves patient care and resource allocation, while Others encompass various sectors leveraging analytics.

The Oman Supply Chain Analytics Market is characterized by a dynamic mix of regional and international players. Leading participants such as SAP SE, Oracle Corporation, IBM Corporation, Microsoft Corporation, SAS Institute Inc., Tableau Software, QlikTech International AB, Infor, JDA Software Group, Kinaxis Inc., Manhattan Associates, Blue Yonder, Coupa Software, Anaplan, TIBCO Software contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Oman supply chain analytics market appears promising, driven by technological advancements and increasing demand for efficiency. As businesses continue to embrace digital transformation, the integration of predictive analytics and real-time data processing will become essential. Furthermore, the focus on sustainability and environmental compliance will shape supply chain strategies, compelling companies to adopt innovative solutions that align with global standards and consumer expectations, fostering a more resilient supply chain ecosystem.

| Segment | Sub-Segments |

|---|---|

| By Type | Descriptive Analytics Predictive Analytics Prescriptive Analytics Others |

| By End-User | Retail Manufacturing Transportation and Logistics Healthcare Others |

| By Industry Vertical | Automotive Consumer Goods Pharmaceuticals Others |

| By Deployment Model | On-Premises Cloud-Based Hybrid Others |

| By Analytics Type | Real-Time Analytics Batch Analytics Others |

| By Geographic Region | Muscat Salalah Sohar Others |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oil and Gas Supply Chain Analytics | 100 | Supply Chain Managers, Operations Directors |

| Retail Supply Chain Optimization | 80 | Logistics Coordinators, Inventory Managers |

| Manufacturing Process Analytics | 70 | Production Managers, Quality Assurance Leads |

| Logistics Service Provider Insights | 90 | Business Development Managers, IT Directors |

| Technology Adoption in Supply Chains | 75 | IT Managers, Data Analysts |

The Oman Supply Chain Analytics Market is valued at approximately USD 150 million, reflecting a five-year historical analysis. This growth is attributed to the increasing adoption of advanced analytics technologies and the demand for data-driven decision-making in supply chain management.