Region:North America

Author(s):Shubham

Product Code:KRAC0781

Pages:85

Published On:August 2025

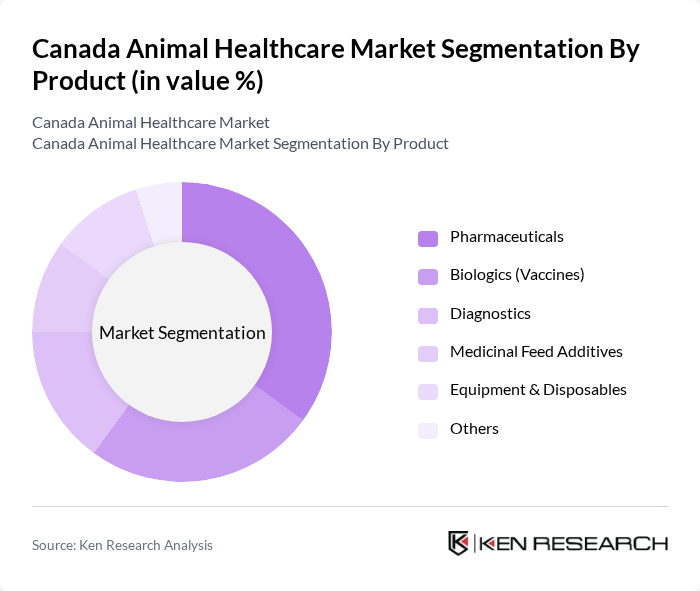

By Product:The product segmentation includes various categories such as Pharmaceuticals, Biologics (Vaccines), Diagnostics, Medicinal Feed Additives, Equipment & Disposables, and Others. Each of these subsegments plays a crucial role in the overall market, with specific products catering to different animal health needs. Pharmaceuticals remain the largest segment, driven by the need for effective treatments for both companion and livestock animals. Biologics, including vaccines, are increasingly important due to the focus on disease prevention and control, while diagnostics benefit from technological advancements and the emphasis on early disease detection .

The Pharmaceuticals subsegment is currently dominating the market due to the increasing prevalence of diseases among pets and livestock, leading to a higher demand for effective treatment options. Pet owners are becoming more proactive about their animals' health, resulting in a surge in the purchase of medications and preventive care products. This trend is further supported by advancements in veterinary pharmaceuticals, which offer more effective and targeted treatments. The growth in biologics and diagnostics is also notable, reflecting the market’s shift toward preventive and precision animal healthcare .

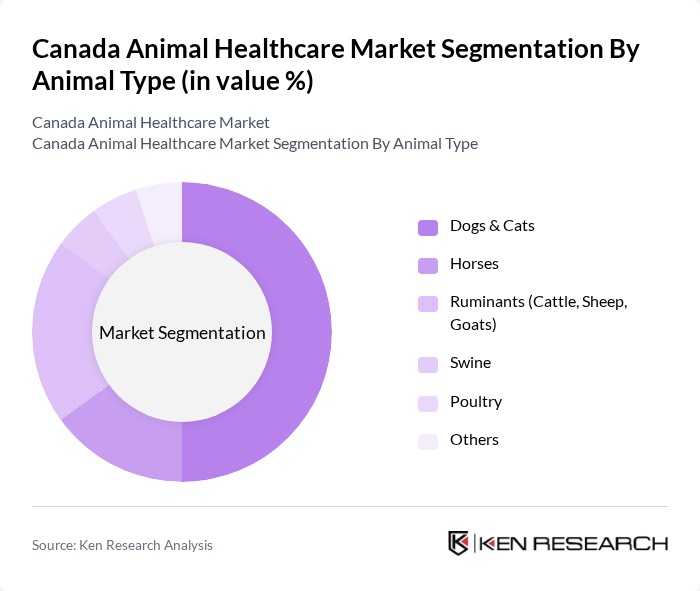

By Animal Type:The animal type segmentation includes Dogs & Cats, Horses, Ruminants (Cattle, Sheep, Goats), Swine, Poultry, and Others. Each category addresses the specific healthcare needs of different animal species, reflecting the diverse nature of the animal healthcare market. Dogs & Cats account for the largest share, reflecting the high rate of pet ownership and the increasing willingness of Canadians to invest in companion animal health. Livestock segments such as ruminants and poultry remain significant due to the importance of food safety and production animal health .

Among the animal types, Dogs & Cats represent the largest segment, driven by the increasing trend of pet ownership and the growing willingness of owners to invest in their pets' health. This segment benefits from a wide range of healthcare products and services, including preventive care, vaccinations, and specialized treatments, reflecting the strong emotional bond between pet owners and their animals. The livestock segment continues to be supported by investments in herd health, biosecurity, and productivity improvements .

The Canada Animal Healthcare Market is characterized by a dynamic mix of regional and international players. Leading participants such as Zoetis Inc., Merck Animal Health (Merck & Co., Inc.), Elanco Animal Health Incorporated, Boehringer Ingelheim Animal Health Canada Inc., Ceva Santé Animale, Vetoquinol Canada Inc., IDEXX Laboratories, Inc., Neogen Corporation, Virbac Canada Inc., Phibro Animal Health Corporation, Alltech Canada, PetIQ, Inc., Trupanion, Inc., PetMed Express, Inc., Bimeda-MTC Animal Health Inc. contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Canada animal healthcare market appears promising, driven by ongoing trends in pet ownership and advancements in veterinary care. As pet humanization continues to rise, owners are increasingly willing to invest in high-quality healthcare for their animals. Additionally, the integration of technology in veterinary practices is expected to enhance service delivery and accessibility, particularly in underserved areas. These factors will likely contribute to a robust growth trajectory for the market in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Product | Pharmaceuticals Biologics (Vaccines) Diagnostics Medicinal Feed Additives Equipment & Disposables Others |

| By Animal Type | Dogs & Cats Horses Ruminants (Cattle, Sheep, Goats) Swine Poultry Others |

| By End-User | Veterinary Clinics & Hospitals Livestock Farmers Pet Owners Research & Academic Institutions |

| By Distribution Channel | Veterinary Clinics Pharmacies Online Retail Direct Sales |

| By Region | Western Canada Central Canada Eastern Canada |

| By Price Range | Budget Mid-Range Premium |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Veterinary Clinics | 150 | Veterinarians, Clinic Managers |

| Pet Owners | 150 | Dog and Cat Owners, Pet Care Enthusiasts |

| Animal Health Product Distributors | 100 | Sales Managers, Distribution Coordinators |

| Livestock Farmers | 80 | Farm Owners, Animal Husbandry Experts |

| Animal Welfare Organizations | 60 | Program Directors, Outreach Coordinators |

The Canada Animal Healthcare Market is valued at approximately USD 2.8 billion, reflecting a significant growth driven by increasing pet ownership, heightened awareness of animal health, and advancements in veterinary medicine.