Region:Europe

Author(s):Rebecca

Product Code:KRAA1358

Pages:87

Published On:August 2025

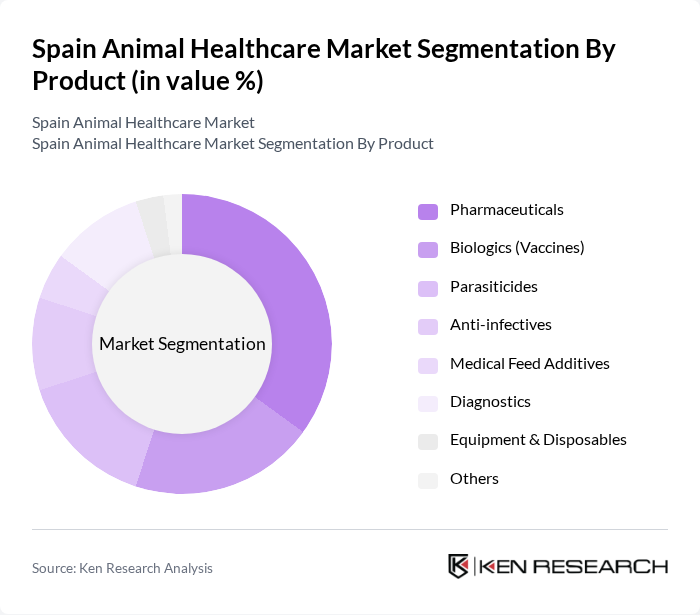

By Product:The product segmentation of the market includes Pharmaceuticals, Biologics (Vaccines), Parasiticides, Anti-infectives, Medical Feed Additives, Diagnostics, Equipment & Disposables, and Others. Among these, Pharmaceuticals are the leading sub-segment, driven by the increasing prevalence of diseases in pets and livestock and the demand for effective treatment options. Biologics (Vaccines) and Parasiticides are also significant due to the emphasis on preventive care and parasite control in both companion and food-producing animals .

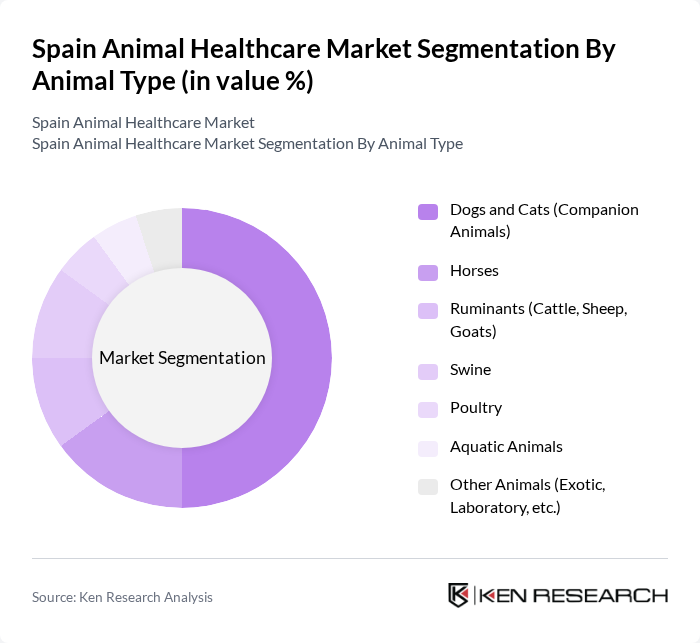

By Animal Type:The animal type segmentation includes Dogs and Cats (Companion Animals), Horses, Ruminants (Cattle, Sheep, Goats), Swine, Poultry, Aquatic Animals, and Other Animals (Exotic, Laboratory, etc.). The Companion Animals segment is the most significant contributor to the market, driven by the increasing trend of pet adoption, the humanization of pets, and the growing willingness of pet owners to spend on healthcare. Livestock segments such as ruminants, swine, and poultry remain important due to Spain's strong agricultural sector and the need for disease prevention and productivity improvements in food-producing animals .

The Spain Animal Healthcare Market is characterized by a dynamic mix of regional and international players. Leading participants such as Zoetis Inc., Merck Animal Health (MSD Animal Health), Elanco Animal Health, Boehringer Ingelheim Animal Health, Ceva Santé Animale, Vetoquinol S.A., Virbac S.A., HIPRA S.A., Laboratorios Karizoo, S.A., Syva Laboratories S.A., IDEXX Laboratories, Inc., Dechra Pharmaceuticals PLC, Laboratorios Ovejero S.A., Laboratorios Calier S.A., Neogen Corporation contribute to innovation, geographic expansion, and service delivery in this space .

The future of the animal healthcare market in Spain appears promising, driven by ongoing trends in preventive care and technological integration. As pet owners increasingly seek comprehensive health solutions, the demand for innovative veterinary services is expected to rise. Additionally, the focus on animal welfare and ethical practices will likely shape industry standards, encouraging the development of more sustainable and effective healthcare products. This evolving landscape presents significant opportunities for growth and investment in the sector.

| Segment | Sub-Segments |

|---|---|

| By Product | Pharmaceuticals Biologics (Vaccines) Parasiticides Anti-infectives Medical Feed Additives Diagnostics (Immunodiagnostic Tests, Molecular Diagnostics, Diagnostic Imaging, Clinical Chemistry) Equipment & Disposables Others |

| By Animal Type | Dogs and Cats (Companion Animals) Horses Ruminants (Cattle, Sheep, Goats) Swine Poultry Aquatic Animals Other Animals (Exotic, Laboratory, etc.) |

| By End-User | Veterinary Clinics Animal Hospitals Veterinary Laboratory Testing Centers Livestock Farmers Pet Owners Research Institutions Animal Shelters Others |

| By Distribution Channel | Veterinary Clinics Animal Hospitals Pharmacies Online Retail Direct Sales Distributors Others |

| By Region | Northern Spain Southern Spain Eastern Spain Western Spain Central Spain Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Veterinary Clinics | 100 | Veterinarians, Clinic Managers |

| Pet Owners | 150 | Pet Owners, Animal Caretakers |

| Animal Feed Distributors | 80 | Distribution Managers, Sales Representatives |

| Pharmaceutical Suppliers | 60 | Product Managers, Regulatory Affairs Specialists |

| Livestock Farmers | 90 | Farm Owners, Livestock Managers |

The Spain Animal Healthcare Market is valued at approximately USD 750 million, reflecting a significant growth trend driven by increasing pet ownership, heightened awareness of animal health, and advancements in veterinary medicine.