Region:North America

Author(s):Shubham

Product Code:KRAA2255

Pages:80

Published On:August 2025

By Asset Class:The asset class segmentation includes various types of funds that cater to different investment strategies and risk profiles. The dominant sub-segment in this category is Equity Funds, which have gained popularity due to their potential for high returns and the increasing interest of retail investors in stock markets. Fixed Income Funds also hold a significant share, appealing to conservative investors seeking stable income. Alternative Investments are on the rise as investors look for diversification beyond traditional assets. Cash Management/Money Market Funds have recently seen accelerated growth, reflecting increased demand for liquidity and capital preservation among both institutional and retail investors .

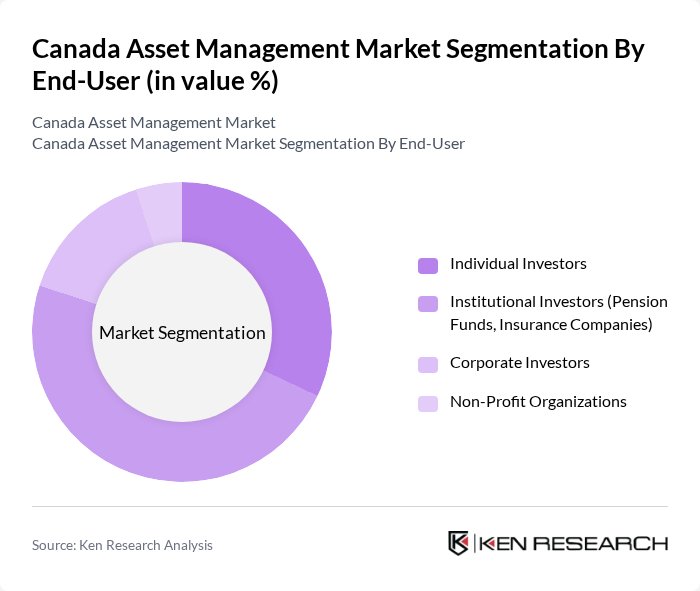

By End-User:The end-user segmentation highlights the various types of investors in the asset management market. Institutional Investors, including pension funds and insurance companies, dominate the market due to their substantial capital and long-term investment horizons. Individual Investors are increasingly participating in the market, driven by the rise of digital platforms and financial literacy initiatives. Corporate Investors and Non-Profit Organizations also contribute to the market, albeit to a lesser extent. Recent trends show a steady increase in individual investor participation, supported by the proliferation of online investment solutions and enhanced investor education programs .

The Canada Asset Management Market is characterized by a dynamic mix of regional and international players. Leading participants such as RBC Global Asset Management, TD Asset Management, BMO Global Asset Management, CIBC Asset Management, Manulife Investment Management, Fidelity Investments Canada, Invesco Canada, Franklin Templeton Investments, BlackRock Canada, AGF Investments, Mackenzie Investments, CI Global Asset Management, Scotia Wealth Management, Desjardins Investments, Sun Life Global Investments contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Canadian asset management market appears promising, driven by technological advancements and a growing focus on sustainable investing. As firms increasingly adopt digital solutions, operational efficiencies are expected to improve, allowing for better client service and engagement. Additionally, the rising interest in ESG investments is likely to reshape portfolio strategies, attracting a new generation of investors. Overall, the market is poised for transformation, with innovation and sustainability at the forefront of its evolution.

| Segment | Sub-Segments |

|---|---|

| By Asset Class | Equity Funds Fixed Income Funds Alternative Investments (Private Equity, Real Estate, Infrastructure, Hedge Funds) Hybrid/Balanced Funds Cash Management/Money Market Funds Index Funds Exchange-Traded Funds (ETFs) Other Specialized Funds |

| By End-User | Individual Investors Institutional Investors (Pension Funds, Insurance Companies) Corporate Investors Non-Profit Organizations |

| By Investment Strategy | Active Management Passive Management Tactical Asset Allocation Strategic Asset Allocation |

| By Distribution Channel | Direct Sales Financial Advisors Online Platforms (Robo-Advisors, Digital Platforms) Banks and Financial Institutions |

| By Fund Size | Small Cap Funds Mid Cap Funds Large Cap Funds Multi-Cap Funds |

| By Risk Profile | Low Risk Medium Risk High Risk |

| By Geographic Focus | Domestic Investments International Investments Emerging Markets Developed Markets |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Asset Management | 120 | Financial Advisors, Wealth Managers |

| Institutional Investment Strategies | 100 | Pension Fund Managers, Endowment Fund Directors |

| Alternative Investments | 60 | Hedge Fund Managers, Private Equity Executives |

| Regulatory Compliance in Asset Management | 50 | Compliance Officers, Risk Management Executives |

| Market Trends and Investor Behavior | 70 | Market Analysts, Research Directors |

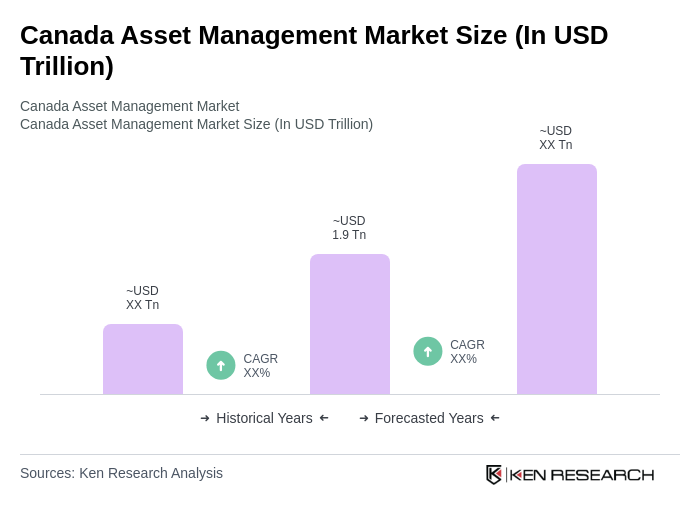

The Canada Asset Management Market is valued at approximately USD 1.9 trillion, reflecting significant growth driven by increasing investor confidence, a robust financial services sector, and a rising demand for diversified investment options.