Kuwait Asset Management Market Overview

- The Kuwait Asset Management Market is valued at USD 20 billion, based on a five-year historical analysis. This growth is primarily driven by increasing foreign investments, a growing number of high-net-worth individuals, and the expansion of financial services. The market has seen a significant rise in demand for diversified investment products, reflecting a shift in investor preferences towards more sophisticated asset management solutions.

- Kuwait City is the dominant hub in the asset management market, benefiting from its strategic location, robust financial infrastructure, and a well-established banking sector. The presence of major financial institutions and investment firms in the city enhances its attractiveness for both local and international investors. Additionally, the country's economic stability and regulatory framework further solidify its position as a leading market in the region.

- In 2023, the Kuwaiti government implemented a new regulation aimed at enhancing transparency in the asset management sector. This regulation mandates that all asset management firms disclose their fee structures and performance metrics to clients, ensuring that investors have access to clear and comprehensive information. This initiative is designed to foster trust and confidence among investors, ultimately contributing to the growth of the asset management market.

Kuwait Asset Management Market Segmentation

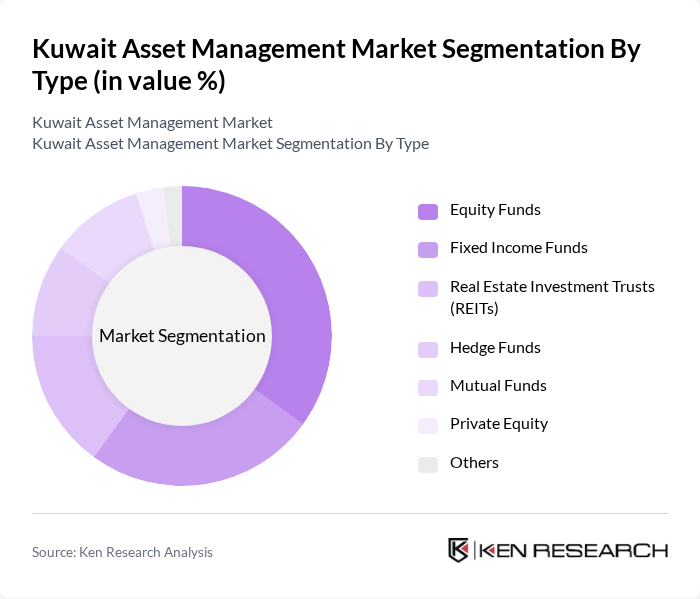

By Type:The asset management market can be segmented into various types, including Equity Funds, Fixed Income Funds, Real Estate Investment Trusts (REITs), Hedge Funds, Mutual Funds, Private Equity, and Others. Each of these subsegments caters to different investor needs and preferences, with varying risk profiles and return expectations. Among these, Equity Funds have gained significant traction due to their potential for high returns, attracting both individual and institutional investors.

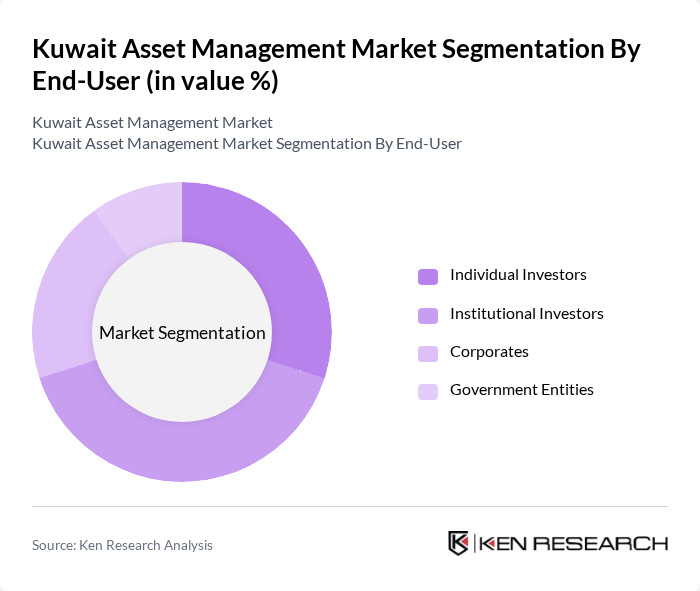

By End-User:The end-user segmentation includes Individual Investors, Institutional Investors, Corporates, and Government Entities. Each of these groups has distinct investment goals and strategies, influencing their participation in the asset management market. Institutional Investors, in particular, dominate the market due to their substantial capital and long-term investment horizons, driving demand for various asset management products.

Kuwait Asset Management Market Competitive Landscape

The Kuwait Asset Management Market is characterized by a dynamic mix of regional and international players. Leading participants such as Kuwait Finance House, National Bank of Kuwait, Gulf Bank, KAMCO Investment Company, Al Ahli Bank of Kuwait, Boubyan Bank, Warba Bank, Al Mal Investment Company, Global Investment House, Al Ahli Capital, Al-Dar Investment Company, Al-Salam Bank, First Investment Company, Al-Masraf, Noor Financial Investment Company contribute to innovation, geographic expansion, and service delivery in this space.

Kuwait Asset Management Market Industry Analysis

Growth Drivers

- Increasing Foreign Investment:In future, Kuwait is projected to attract approximately $3.9 billion in foreign direct investment (FDI), driven by its strategic location and economic reforms. The government’s initiatives to enhance the investment climate, including the Kuwait Direct Investment Promotion Authority's efforts, are pivotal. This influx of capital is expected to bolster the asset management sector, as foreign investors seek local asset management firms to navigate the market effectively.

- Rising Demand for Diversified Investment Products:The demand for diversified investment products in Kuwait is on the rise, with the number of investment funds increasing by 17% in future. Investors are increasingly looking for options that mitigate risk and enhance returns. This trend is supported by the growing awareness of alternative investments, such as private equity and real estate, which are becoming more mainstream among Kuwaiti investors, thus driving asset management growth.

- Government Initiatives to Boost Financial Services:The Kuwaiti government has launched several initiatives aimed at enhancing the financial services sector, including the Financial Sector Development Plan, which allocates $1.2 billion for infrastructure improvements. These initiatives are designed to modernize the financial landscape, making it more attractive for both local and international investors, thereby stimulating growth in the asset management market as firms adapt to new regulations and opportunities.

Market Challenges

- Regulatory Compliance Issues:Asset management firms in Kuwait face significant regulatory compliance challenges, with over 55 new regulations introduced in the past year alone. These regulations often require substantial resources for compliance, diverting attention from core business activities. The complexity of these regulations can hinder the agility of asset managers, making it difficult to respond to market changes and investor needs effectively.

- Limited Awareness Among Retail Investors:Despite the growth of the asset management sector, there remains a significant knowledge gap among retail investors in Kuwait. Approximately 62% of the population lacks awareness of available investment products and services. This limited understanding restricts market participation and growth, as many potential investors remain hesitant to engage with asset management firms due to a lack of information and education on investment options.

Kuwait Asset Management Market Future Outlook

The future of the Kuwait asset management market appears promising, driven by increasing foreign investments and a growing appetite for diversified financial products. As the government continues to implement reforms and enhance the regulatory framework, the sector is likely to attract more participants. Additionally, the integration of technology in asset management practices will facilitate better service delivery, enabling firms to meet evolving investor demands and capitalize on emerging trends in sustainable and digital investments.

Market Opportunities

- Growth of Islamic Finance:The Islamic finance sector in Kuwait is expected to grow significantly, with assets projected to reach $120 billion in future. This growth presents a unique opportunity for asset management firms to develop Sharia-compliant investment products, catering to the increasing demand from both local and international investors seeking ethical investment options.

- Expansion of Digital Asset Management Solutions:The digital asset management market in Kuwait is anticipated to expand, with investments in fintech solutions expected to exceed $600 million in future. This trend offers asset management firms the chance to leverage technology to enhance client engagement, streamline operations, and provide innovative investment solutions that meet the needs of tech-savvy investors.