Region:North America

Author(s):Rebecca

Product Code:KRAB1763

Pages:89

Published On:October 2025

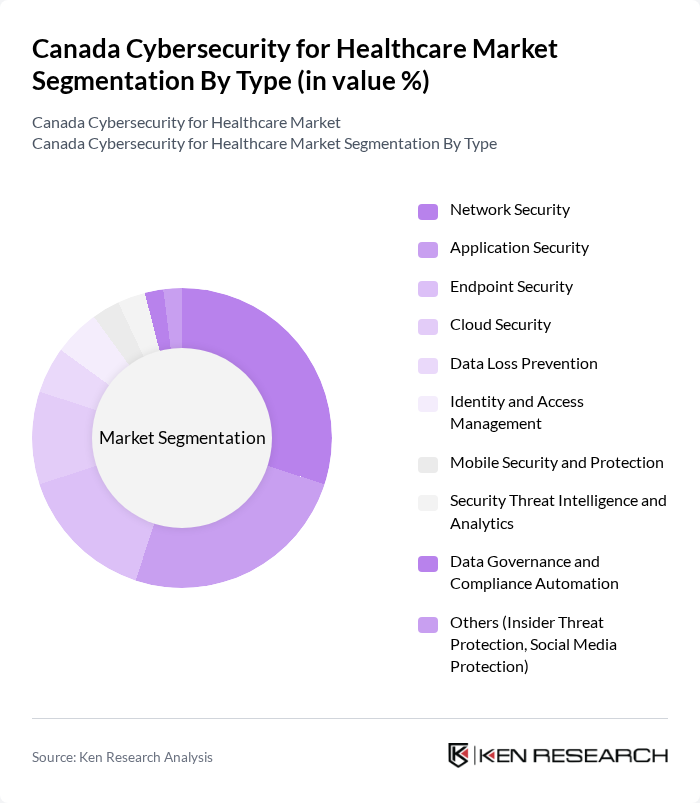

By Type:The market is segmented into various types of cybersecurity solutions, including Network Security, Application Security, Endpoint Security, Cloud Security, Data Loss Prevention, Identity and Access Management, Mobile Security and Protection, Security Threat Intelligence and Analytics, Data Governance and Compliance Automation, and Others (Insider Threat Protection, Social Media Protection). Among these, Network Security and Application Security are particularly significant due to the increasing number of cyber threats targeting healthcare networks and applications. Cloud Security and Identity and Access Management are also gaining traction, reflecting the sector’s shift to cloud-based health records and the need for robust access controls.

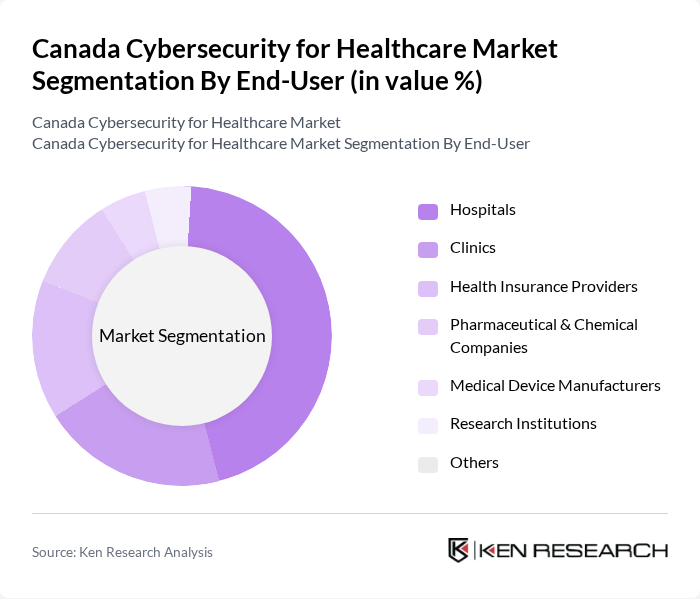

By End-User:The end-user segmentation includes Hospitals, Clinics, Health Insurance Providers, Pharmaceutical & Chemical Companies, Medical Device Manufacturers, Research Institutions, and Others. Hospitals are the dominant end-user segment, driven by the need for comprehensive cybersecurity solutions to protect sensitive patient data and comply with stringent regulations. Pharmaceutical & Chemical Companies are the fastest-growing segment, reflecting the sector’s increasing focus on data integrity and intellectual property protection.

The Canada Cybersecurity for Healthcare Market is characterized by a dynamic mix of regional and international players. Leading participants such as Cisco Systems, Inc., Palo Alto Networks, Inc., Fortinet, Inc., Check Point Software Technologies Ltd., McAfee Corp., IBM Security, Trend Micro Incorporated, CrowdStrike Holdings, Inc., Proofpoint, Inc., Sophos Group plc, RSA Security LLC, CyberArk Software Ltd., Splunk Inc., Zscaler, Inc., Medigate (Claroty), Kaspersky Lab, Gen Digital Inc. (formerly NortonLifeLock), Imperva, Inc., Censinet, Inc., TELUS Health (Canada) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Canada cybersecurity for healthcare market appears promising, driven by technological advancements and increasing regulatory pressures. As healthcare organizations continue to adopt digital solutions, the demand for robust cybersecurity measures will intensify. Furthermore, the integration of artificial intelligence and machine learning into cybersecurity protocols is expected to enhance threat detection and response capabilities. This evolution will likely lead to a more resilient healthcare infrastructure, ensuring patient data protection and compliance with regulatory standards.

| Segment | Sub-Segments |

|---|---|

| By Type | Network Security Application Security Endpoint Security Cloud Security Data Loss Prevention Identity and Access Management Mobile Security and Protection Security Threat Intelligence and Analytics Data Governance and Compliance Automation Others (Insider Threat Protection, Social Media Protection) |

| By End-User | Hospitals Clinics Health Insurance Providers Pharmaceutical & Chemical Companies Medical Device Manufacturers Research Institutions Others |

| By Deployment Mode | On-Premises Cloud-Based Hybrid |

| By Service Type | Consulting Services Implementation and Integration Services Managed Security Services Risk Assessment Services Training and Support |

| By Organization Size | Micro Enterprises Small Enterprises Medium Enterprises Large Enterprises |

| By Region | Ontario Quebec British Columbia Alberta Rest of Canada |

| By Compliance Standards | HIPAA Compliance ISO/IEC 27001 NIST Cybersecurity Framework Canadian Health Infoway Standards |

| By Pricing Model | Subscription-Based Pay-Per-Use One-Time License Fee |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospitals Cybersecurity Strategies | 100 | IT Security Managers, Chief Information Officers |

| Healthcare IT Solution Providers | 60 | Product Managers, Sales Directors |

| Telehealth Security Measures | 50 | Telehealth Program Directors, Compliance Officers |

| Healthcare Cybersecurity Compliance | 40 | Regulatory Affairs Managers, Risk Management Officers |

| Cybersecurity Training Programs in Healthcare | 40 | Training Coordinators, HR Managers |

The Canada Cybersecurity for Healthcare Market is valued at approximately USD 1.5 billion, driven by the increasing digitization of healthcare services and the rising number of cyber threats targeting healthcare institutions.