Region:Asia

Author(s):Shubham

Product Code:KRAA4963

Pages:90

Published On:September 2025

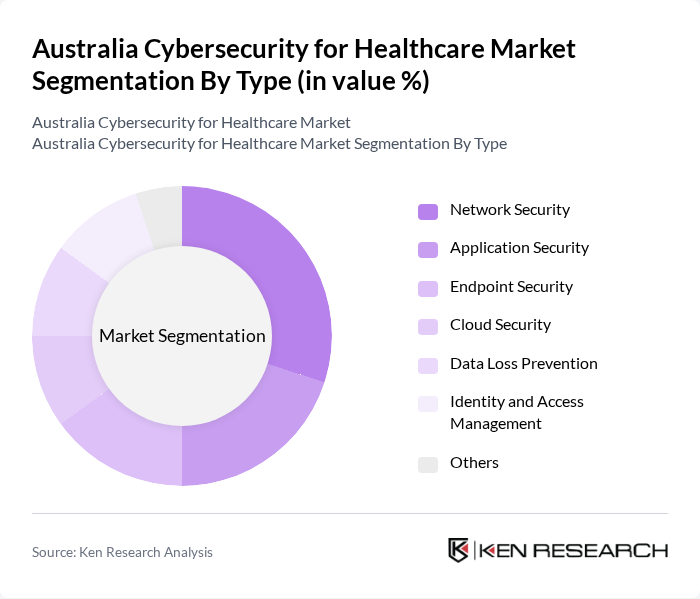

By Type:The cybersecurity solutions for healthcare can be categorized into several types, including Network Security, Application Security, Endpoint Security, Cloud Security, Data Loss Prevention, Identity and Access Management, and Others. Among these, Network Security is currently the leading sub-segment due to the increasing need to protect healthcare networks from unauthorized access and cyberattacks. The rise in remote healthcare services has further amplified the demand for robust network security solutions.

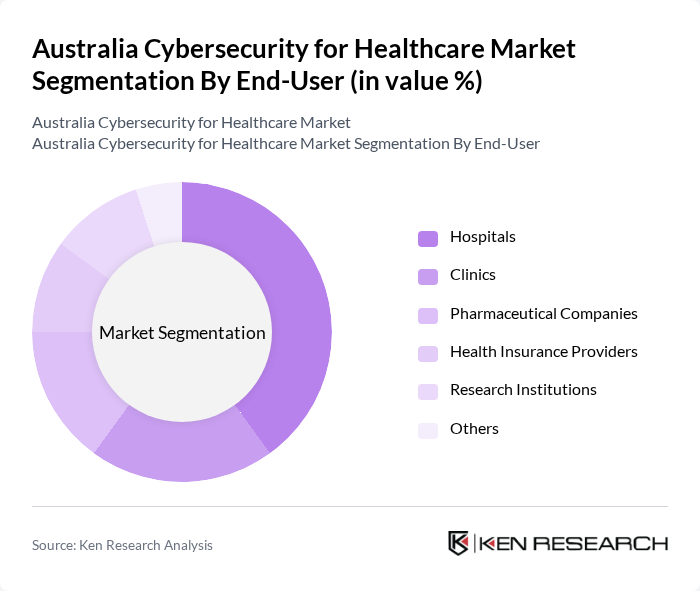

By End-User:The end-users of cybersecurity solutions in healthcare include Hospitals, Clinics, Pharmaceutical Companies, Health Insurance Providers, Research Institutions, and Others. Hospitals are the dominant end-user segment, driven by the critical need to protect patient data and ensure compliance with healthcare regulations. The increasing number of cyberattacks targeting hospitals has led to a heightened focus on implementing comprehensive cybersecurity measures.

The Australia Cybersecurity for Healthcare Market is characterized by a dynamic mix of regional and international players. Leading participants such as Palo Alto Networks, Fortinet, Check Point Software Technologies, Cisco Systems, McAfee, Trend Micro, IBM Security, Symantec (Broadcom), FireEye, CrowdStrike, Sophos, RSA Security, Proofpoint, CyberArk, Splunk contribute to innovation, geographic expansion, and service delivery in this space.

The future of the cybersecurity landscape in Australia's healthcare sector appears promising, driven by technological advancements and increasing investments. As healthcare organizations prioritize data protection, the integration of artificial intelligence and machine learning into cybersecurity strategies is expected to enhance threat detection and response capabilities. Additionally, the expansion of telehealth services will necessitate ongoing investments in cybersecurity, ensuring that patient data remains secure in an increasingly digital environment, fostering trust and compliance across the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Network Security Application Security Endpoint Security Cloud Security Data Loss Prevention Identity and Access Management Others |

| By End-User | Hospitals Clinics Pharmaceutical Companies Health Insurance Providers Research Institutions Others |

| By Deployment Mode | On-Premises Cloud-Based Hybrid |

| By Service Type | Consulting Services Implementation Services Managed Services |

| By Compliance Standards | ISO/IEC 27001 HIPAA Compliance GDPR Compliance |

| By Security Solution | Firewalls Intrusion Detection Systems Antivirus Software |

| By Region | New South Wales Victoria Queensland Western Australia South Australia Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospitals Cybersecurity Practices | 100 | IT Security Managers, Chief Information Officers |

| Healthcare Clinics Cybersecurity Needs | 80 | Clinic Administrators, IT Directors |

| Telehealth Security Measures | 60 | Telehealth Program Managers, Cybersecurity Analysts |

| Healthcare Cybersecurity Training Programs | 50 | Training Coordinators, Compliance Officers |

| Cybersecurity Software Adoption in Healthcare | 70 | Procurement Managers, IT Consultants |

The Australia Cybersecurity for Healthcare Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by increased digitization, rising cyber threats, and heightened awareness of data privacy among healthcare providers and patients.