Region:Asia

Author(s):Geetanshi

Product Code:KRAB1674

Pages:97

Published On:October 2025

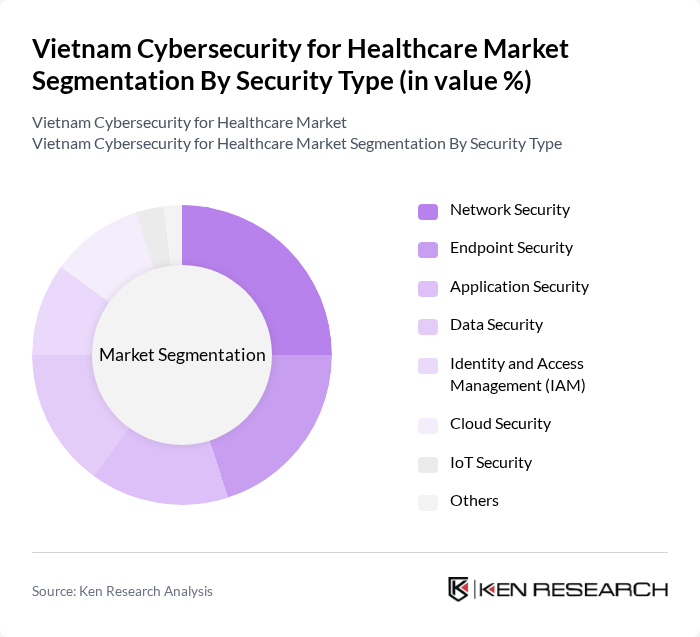

By Security Type:The market is segmented into various security types, including Network Security, Endpoint Security, Application Security, Data Security, Identity and Access Management (IAM), Cloud Security, IoT Security, and Others. Each of these segments plays a crucial role in addressing specific cybersecurity challenges faced by healthcare organizations. Network Security is particularly vital as it protects the integrity of data transmitted across networks, while Endpoint Security focuses on securing devices that access healthcare systems. Cloud-deployed security solutions are experiencing the fastest growth, expanding at significant rates as healthcare enterprises migrate workloads to local hyperscale datacenters.

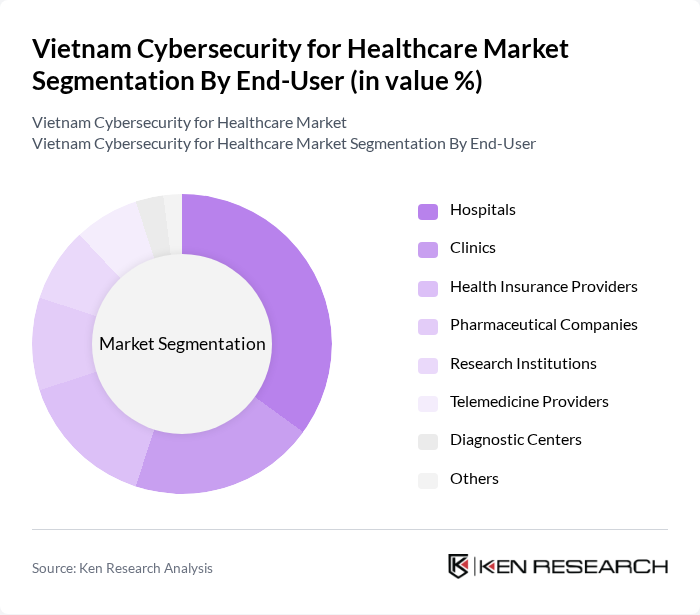

By End-User:The end-user segmentation includes Hospitals, Clinics, Health Insurance Providers, Pharmaceutical Companies, Research Institutions, Telemedicine Providers, Diagnostic Centers, and Others. Hospitals are the leading end-users due to their extensive use of electronic health records and the need for secure patient data management. Healthcare represents the fastest-growing vertical in Vietnam's cybersecurity market, driven by increasing digitalization and regulatory compliance requirements. The increasing adoption of telemedicine has also led to a rise in demand for cybersecurity solutions among Telemedicine Providers.

The Vietnam Cybersecurity for Healthcare Market is characterized by a dynamic mix of regional and international players. Leading participants such as Viettel Cyber Security, BKAV Corporation, CMC Cyber Security, FPT Information System (FPT IS), VNPT Cyber Immunity, CyStack, VSEC (Vietnam Security Network), MobiFone Cyber Security, VNG Corporation, TMA Solutions, NCS Technology, CMC Telecom, Savis Technology Group, Athena Cyber Security, VNISA (Vietnam Information Security Association) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Vietnam cybersecurity for healthcare market appears promising, driven by increasing digitalization and the need for enhanced data protection. As healthcare providers continue to adopt innovative technologies, the demand for robust cybersecurity solutions will intensify. Additionally, the government's commitment to improving healthcare IT infrastructure will likely foster a more secure environment. The integration of artificial intelligence and machine learning in cybersecurity practices is expected to further enhance threat detection and response capabilities, shaping the market's evolution.

| Segment | Sub-Segments |

|---|---|

| By Security Type | Network Security Endpoint Security Application Security Data Security Identity and Access Management (IAM) Cloud Security IoT Security Others |

| By End-User | Hospitals Clinics Health Insurance Providers Pharmaceutical Companies Research Institutions Telemedicine Providers Diagnostic Centers Others |

| By Deployment Mode | On-Premises Cloud-Based Hybrid |

| By Service Type | Consulting Services Implementation Services Managed Security Services Training & Awareness Services |

| By Region | Northern Vietnam Southern Vietnam Central Vietnam |

| By Compliance Standards | Vietnam Law on Cybersecurity HIPAA Compliance ISO/IEC 27001 GDPR Compliance |

| By Investment Source | Private Investments Government Funding International Aid |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospitals and Healthcare Systems | 100 | IT Security Managers, Chief Information Officers |

| Private Clinics and Practices | 60 | Healthcare Administrators, Practice Managers |

| Telemedicine Providers | 40 | Technical Leads, Compliance Officers |

| Healthcare IT Vendors | 50 | Product Managers, Sales Directors |

| Regulatory Bodies and Associations | 40 | Policy Makers, Cybersecurity Analysts |

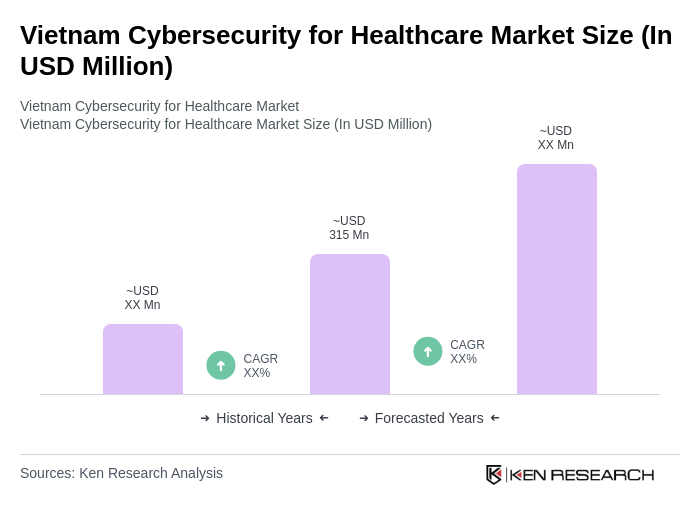

The Vietnam Cybersecurity for Healthcare Market is valued at approximately USD 315 million, driven by increasing digitization, rising cyber threats, and compliance with stringent data protection regulations. This growth reflects the sector's shift towards electronic health records and telemedicine.