Region:North America

Author(s):Geetanshi

Product Code:KRAA1941

Pages:89

Published On:August 2025

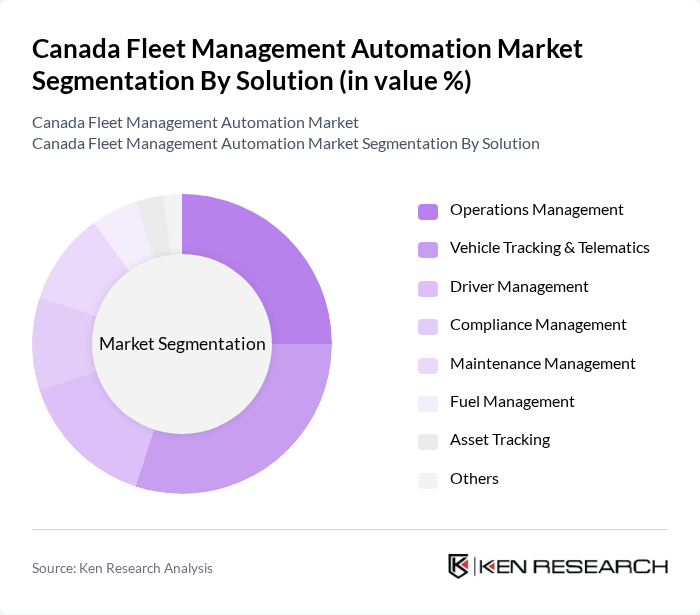

By Solution:The market is segmented into various solutions that address different aspects of fleet management. The primary solutions include Operations Management, Vehicle Tracking & Telematics, Driver Management, Compliance Management, Maintenance Management, Fuel Management, Asset Tracking, and Others. Each solution plays a crucial role in enhancing the efficiency, safety, and regulatory compliance of fleet operations. Operations Management and Vehicle Tracking & Telematics are especially prominent, driven by the need for real-time data, route optimization, and predictive analytics.

The Vehicle Tracking & Telematics sub-segment is currently dominating the market due to the increasing demand for real-time data and analytics in fleet operations. Companies leverage telematics solutions to monitor vehicle performance, driver behavior, and fuel consumption, resulting in improved operational efficiency and cost savings. The growing emphasis on safety, regulatory compliance, and predictive maintenance is driving the adoption of these technologies, making them essential for modern fleet management.

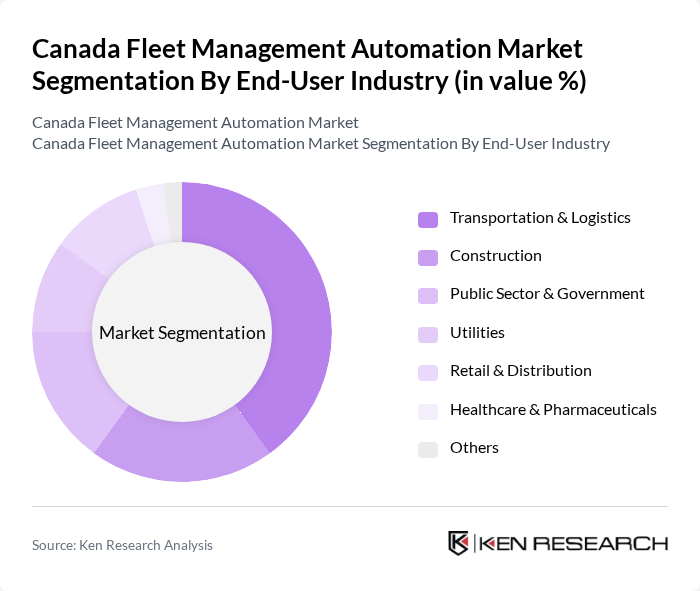

By End-User Industry:The market is segmented based on various end-user industries, including Transportation & Logistics, Construction, Public Sector & Government, Utilities, Retail & Distribution, Healthcare & Pharmaceuticals, and Others. Each industry faces distinct operational challenges and regulatory requirements that fleet management solutions address. Transportation & Logistics remains the largest segment, driven by high volumes of goods movement, complex supply chains, and the need for real-time tracking and compliance management.

The Transportation & Logistics sector is the leading end-user industry, accounting for a significant portion of the market. This dominance is attributed to the high volume of goods transportation, the need for efficient fleet management to reduce operational costs, and the increasing complexity of supply chains. Real-time tracking, regulatory compliance, and sustainability initiatives further drive the adoption of advanced fleet management solutions in this sector.

The Canada Fleet Management Automation Market is characterized by a dynamic mix of regional and international players. Leading participants such as Geotab Inc., Fleet Complete, Teletrac Navman, Omnicomm, Verizon Connect, Samsara Inc., Zubie, Motive Technologies Inc. (formerly KeepTruckin), Fleetio, Trimble Inc., Microlise, Nauto, Lytx, TMW Systems, Element Fleet Management Corp. contribute to innovation, geographic expansion, and service delivery in this space.

Sources:

The future of the Canada fleet management automation market appears promising, driven by ongoing technological innovations and a growing emphasis on sustainability. As businesses increasingly prioritize efficiency and cost reduction, the integration of advanced analytics and IoT solutions will become more prevalent. Additionally, the shift towards electric vehicles is expected to reshape fleet operations, encouraging the adoption of automated systems that enhance performance and compliance with environmental regulations, ultimately fostering a more sustainable transportation ecosystem.

| Segment | Sub-Segments |

|---|---|

| By Solution | Operations Management Vehicle Tracking & Telematics Driver Management Compliance Management Maintenance Management Fuel Management Asset Tracking Others |

| By End-User Industry | Transportation & Logistics Construction Public Sector & Government Utilities Retail & Distribution Healthcare & Pharmaceuticals Others |

| By Fleet Size | Small Fleets (1-50 vehicles) Medium Fleets (51-500 vehicles) Large Fleets (501+ vehicles) |

| By Deployment Mode | On-Premises Cloud-Based |

| By Region | Ontario Quebec British Columbia Alberta Others |

| By Service Type | Consulting Services Maintenance and Support Training Services |

| By Pricing Model | Subscription-Based One-Time Purchase Pay-Per-Use Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Transportation Fleet Management | 100 | Fleet Managers, Operations Directors |

| Construction Equipment Automation | 60 | Site Managers, Equipment Supervisors |

| Public Sector Fleet Optimization | 40 | Government Fleet Coordinators, Policy Makers |

| Logistics and Supply Chain Automation | 80 | Logistics Managers, Supply Chain Analysts |

| Technology Providers in Fleet Management | 50 | Product Managers, Business Development Executives |

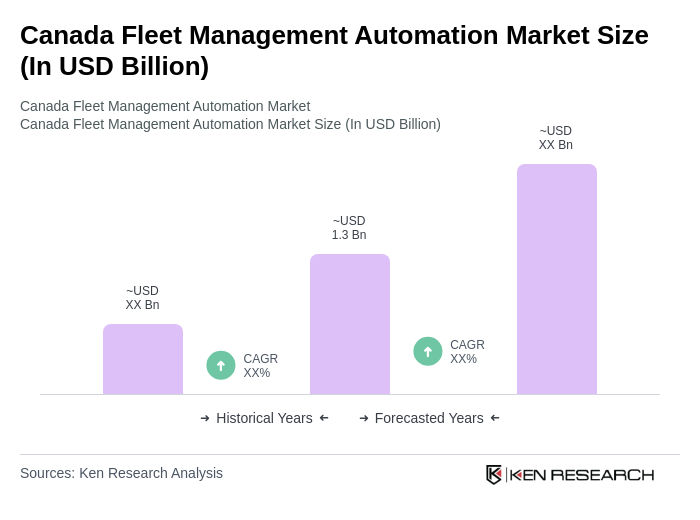

The Canada Fleet Management Automation Market is valued at approximately USD 1.3 billion, reflecting a significant growth driven by the need for operational efficiency, cost reduction, and enhanced safety measures in fleet operations.