Region:Global

Author(s):Shubham

Product Code:KRAA0715

Pages:93

Published On:August 2025

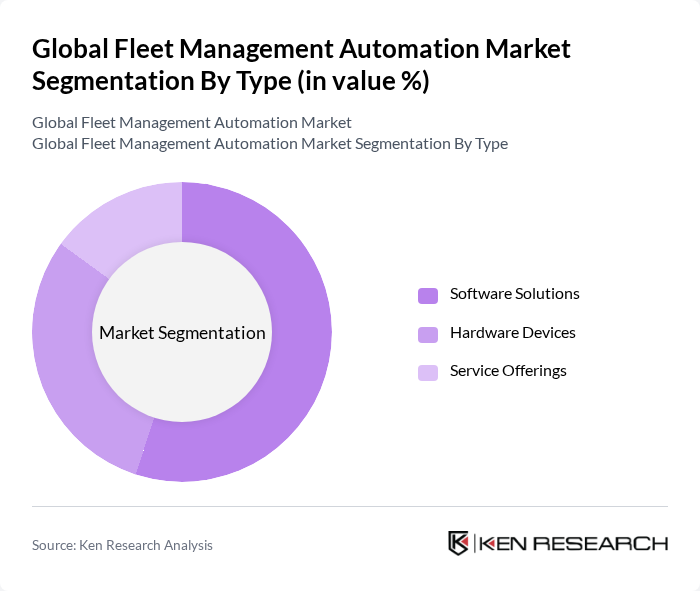

By Type:The market is segmented into Software Solutions, Hardware Devices, and Service Offerings. Each of these subsegments plays a crucial role in the overall market dynamics. Software solutions are the leading segment, driven by their ability to deliver comprehensive data analytics, real-time vehicle tracking, route optimization, and integration with telematics platforms. Hardware devices, such as GPS trackers and sensors, provide the necessary infrastructure for data collection, while service offerings include consulting, maintenance, and support to ensure optimal system performance .

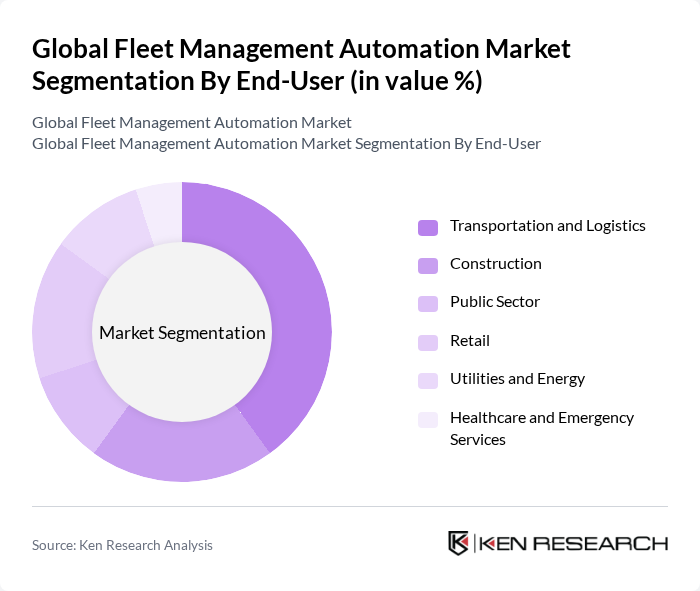

By End-User:The end-user segmentation includes Transportation and Logistics, Construction, Public Sector, Retail, Utilities and Energy, and Healthcare and Emergency Services. The Transportation and Logistics sector is the most significant contributor, driven by the increasing demand for efficient supply chain management, real-time tracking of goods, and compliance with safety and regulatory requirements. Construction companies leverage fleet automation for equipment monitoring and project efficiency, while the public sector focuses on optimizing municipal and emergency fleets. Retail, utilities, and healthcare sectors adopt fleet management solutions to enhance delivery reliability, asset utilization, and service responsiveness .

The Global Fleet Management Automation Market is characterized by a dynamic mix of regional and international players. Leading participants such as Geotab Inc., Verizon Connect, Samsara Inc., Trimble Inc., TomTom Telematics (now Webfleet Solutions), Fleet Complete, Teletrac Navman, Motive Technologies Inc. (formerly KeepTruckin), Gurtam, Chevin Fleet Solutions, MiX Telematics Ltd., Element Fleet Management Corp., Donlen Corporation (a Hertz company), GPS Insight, Omnicomm contribute to innovation, geographic expansion, and service delivery in this space .

The future of fleet management automation is poised for significant transformation, driven by technological advancements and evolving market demands. As companies increasingly prioritize sustainability, the adoption of electric vehicles is expected to rise, with an estimated 25% of fleets transitioning to electric in future. Additionally, the integration of AI and machine learning will enhance predictive maintenance capabilities, further optimizing fleet operations. These trends indicate a robust growth trajectory for the market, fostering innovation and efficiency.

| Segment | Sub-Segments |

|---|---|

| By Type | Software Solutions Hardware Devices Service Offerings |

| By End-User | Transportation and Logistics Construction Public Sector Retail Utilities and Energy Healthcare and Emergency Services |

| By Fleet Size | Small Fleets (1-50 vehicles) Medium Fleets (51-500 vehicles) Large Fleets (500+ vehicles) |

| By Deployment Mode | On-Premises Cloud-Based |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Application | Route Optimization Fuel Management Driver Behavior Monitoring Asset Tracking & Diagnostics Compliance Management (ELD, HOS, etc.) |

| By Pricing Model | Subscription-Based One-Time Purchase Freemium Pay-As-You-Go |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Fleet Management | 100 | Fleet Managers, Operations Directors |

| Public Transportation Systems | 60 | Transit Authority Officials, Fleet Supervisors |

| Logistics and Delivery Services | 80 | Logistics Coordinators, Supply Chain Managers |

| Construction and Heavy Equipment Fleets | 50 | Project Managers, Equipment Managers |

| Technology Providers in Fleet Automation | 40 | Product Managers, Business Development Executives |

The Global Fleet Management Automation Market is valued at approximately USD 32 billion, driven by the increasing demand for operational efficiency, cost reduction, and enhanced safety measures in fleet operations.