Region:Europe

Author(s):Dev

Product Code:KRAA0416

Pages:86

Published On:August 2025

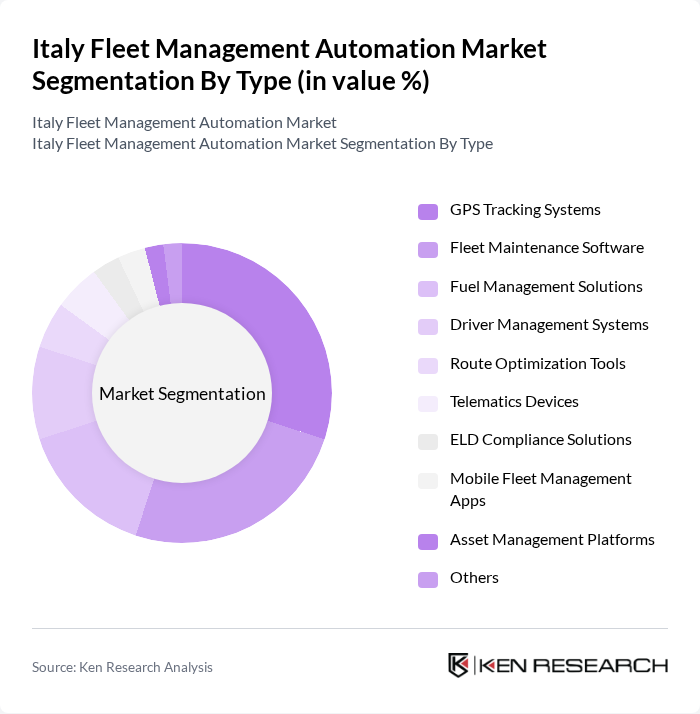

By Type:The market is segmented into various types of fleet management automation solutions, including GPS tracking systems, fleet maintenance software, fuel management solutions, driver management systems, route optimization tools, telematics devices, ELD compliance solutions, mobile fleet management apps, asset management platforms, and others. Among these, GPS tracking systems and fleet maintenance software are particularly prominent due to their critical role in enhancing operational efficiency and reducing costs .

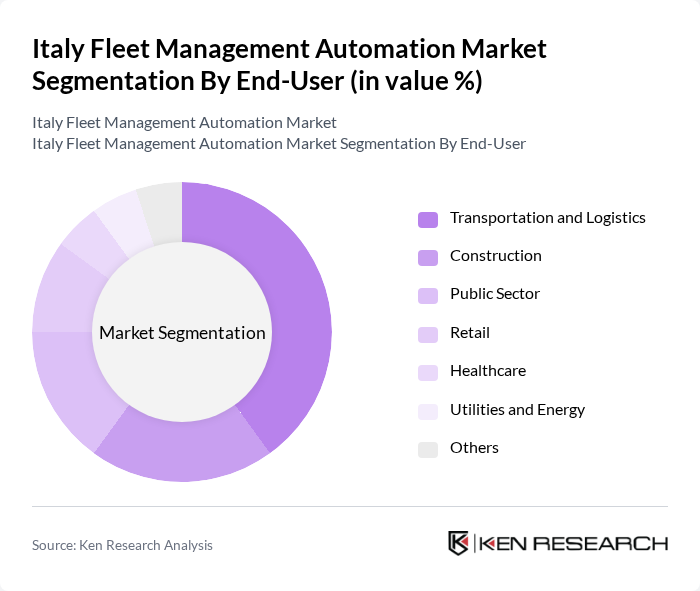

By End-User:The end-user segmentation includes various industries such as transportation and logistics, construction, public sector, retail, healthcare, utilities and energy, and others. The transportation and logistics sector is the largest end-user, driven by the need for efficient fleet operations and real-time tracking capabilities to enhance service delivery and customer satisfaction .

The Italy Fleet Management Automation Market is characterized by a dynamic mix of regional and international players. Leading participants such as Geotab, Verizon Connect, TomTom Telematics (now Webfleet Solutions), Teletrac Navman, Fleet Complete, Omnicomm, Gurtam, Microlise, Chevin Fleet Solutions, Inseego, ABAX, Mix Telematics, Viasat Group (Italy), Quartix, Fleetmatics (now part of Verizon Connect) contribute to innovation, geographic expansion, and service delivery in this space.

The future of fleet management automation in Italy appears promising, driven by technological advancements and regulatory pressures. As companies increasingly adopt real-time data analytics and telematics solutions, operational efficiencies are expected to improve significantly. Additionally, the shift towards sustainable practices will likely accelerate the adoption of electric and hybrid fleets. With government incentives supporting modernization, businesses are poised to embrace innovative solutions that enhance productivity while complying with stringent environmental regulations.

| Segment | Sub-Segments |

|---|---|

| By Type | GPS Tracking Systems Fleet Maintenance Software Fuel Management Solutions Driver Management Systems Route Optimization Tools Telematics Devices ELD Compliance Solutions Mobile Fleet Management Apps Asset Management Platforms Others |

| By End-User | Transportation and Logistics Construction Public Sector Retail Healthcare Utilities and Energy Others |

| By Fleet Size | Small Fleets (Less than 100 Vehicles) Medium Fleets (100-500 Vehicles) Large and Enterprise Fleets (500+ Vehicles) Others |

| By Geographic Coverage | National Coverage Regional Coverage Local Coverage Others |

| By Service Model | Software as a Service (SaaS) On-Premise Solutions Hybrid Solutions Cloud-based Solutions Others |

| By Industry Vertical | Automotive Manufacturing Energy Telecommunications Food & Beverage Others |

| By Integration Level | Standalone Solutions Integrated Solutions Others |

| By Mode of Transport | Heavy Commercial Vehicles Light Commercial Vehicles Passenger Cars Electric Vehicles Internal Combustion Engine Vehicles Others |

| By Communication Range | Long Range Communication Short Range Communication Others |

| By Lease Type | On-Lease Without Lease Others |

| By Deployment Model | Cloud On-Premise Hybrid Others |

| By Hardware | GPS Tracking Devices Data Loggers Bluetooth Tracking Tags Dash Cameras Others |

| By Technology | RFID GNSS Cellular Systems Electronic Data Interchange (EDI) Remote Sensing Computational Method & Decision Making Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Logistics Fleet Management | 100 | Fleet Managers, Operations Directors |

| Public Transport Fleet Automation | 80 | Transport Planners, Fleet Supervisors |

| Corporate Fleet Optimization | 60 | Procurement Managers, Sustainability Officers |

| Technology Adoption in Fleet Management | 70 | IT Managers, Technology Officers |

| Small Business Fleet Solutions | 50 | Business Owners, Operations Managers |

The Italy Fleet Management Automation Market is valued at approximately USD 740 million, driven by the need for operational efficiency, cost reduction, and enhanced safety measures in fleet operations, alongside the adoption of advanced technologies like IoT and AI.