Region:North America

Author(s):Shubham

Product Code:KRAC0669

Pages:86

Published On:August 2025

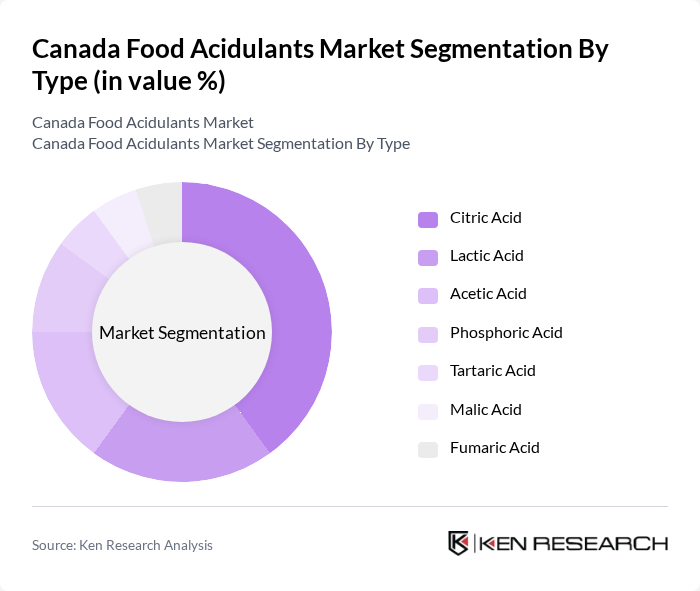

By Type:The food acidulants market can be segmented into various types, including Citric Acid, Lactic Acid, Acetic Acid, Phosphoric Acid, Tartaric Acid, Malic Acid, and Fumaric Acid. Each of these acidulants serves distinct purposes in food preservation, flavor enhancement, and pH regulation. Among these, Citric Acid is the most widely used due to its versatility and effectiveness in a range of applications across beverages, confectionery, and dairy, with industry sources consistently identifying citric acid as the leading type by usage share.

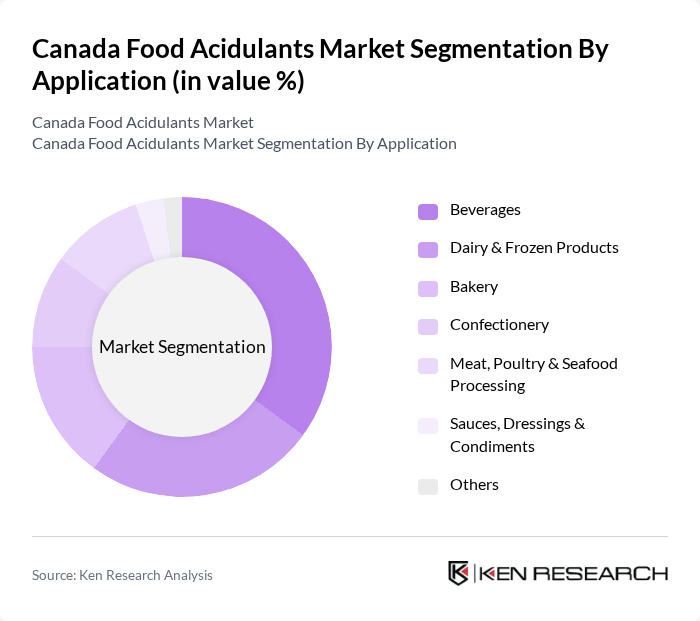

By Application:The applications of food acidulants are diverse, including Beverages, Dairy & Frozen Products, Bakery, Confectionery, Meat, Poultry & Seafood Processing, Sauces, Dressings & Condiments, and Others. The beverage sector is the largest consumer of food acidulants, driven by flavor modulation, shelf-life extension, and pH control in soft drinks, juices, and functional beverages. Dairy and frozen products, along with bakery, also represent significant demand centers for acidulants in texture control, leavening systems, and microbial stability.

The Canada Food Acidulants Market is characterized by a dynamic mix of regional and international players. Leading participants such as Archer Daniels Midland Company (ADM), Cargill, Incorporated, Tate & Lyle plc, Corbion N.V., Jungbunzlauer Suisse AG, Brenntag North America, Inc., Univar Solutions Inc., Ingredion Incorporated, BASF SE, DSM-Firmenich AG, Kerry Group plc, Bartek Ingredients Inc., Celanese Corporation, FBC Industries, Inc., Hawkins, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Canada food acidulants market appears promising, driven by the increasing consumer preference for natural ingredients and the expansion of the food and beverage sector. As health consciousness continues to rise, manufacturers are likely to innovate and develop new acidulant products that cater to these demands. Additionally, the integration of e-commerce platforms for food sales is expected to enhance market accessibility, allowing for greater distribution of acidulant products across diverse consumer segments.

| Segment | Sub-Segments |

|---|---|

| By Type | Citric Acid Lactic Acid Acetic Acid Phosphoric Acid Tartaric Acid Malic Acid Fumaric Acid |

| By Application | Beverages Dairy & Frozen Products Bakery Confectionery Meat, Poultry & Seafood Processing Sauces, Dressings & Condiments Others |

| By End-User | Food Manufacturers Beverage Producers Foodservice (HoReCa) Nutraceutical & Functional Foods Others |

| By Distribution Channel | Direct Sales (Producers to F&B Manufacturers) Specialty Chemical Distributors Wholesalers Online B2B Platforms Others |

| By Packaging Type | Bulk Packaging (Sacks, Super Sacks, Drums, IBCs) Industrial Bags & Liners Retail/Small Pack (for Foodservice) Eco-friendly Packaging Others |

| By Price Range | Economy Mid-range Premium |

| By Region | Western Canada Central Canada Eastern Canada Northern Canada Atlantic Canada |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Beverage Manufacturers | 120 | Product Development Managers, Quality Control Analysts |

| Dairy Product Producers | 90 | Food Technologists, R&D Directors |

| Confectionery Manufacturers | 80 | Operations Managers, Ingredient Sourcing Specialists |

| Food Safety Regulators | 50 | Compliance Officers, Regulatory Affairs Managers |

| Natural Food Additive Suppliers | 60 | Sales Managers, Market Analysts |

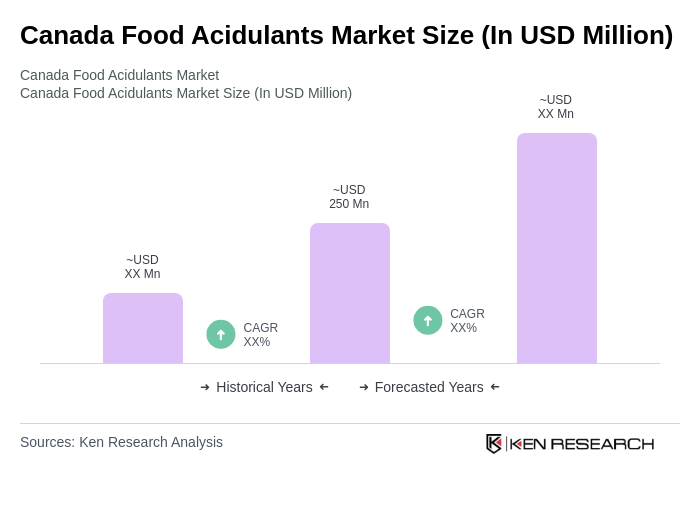

The Canada Food Acidulants Market is valued at approximately USD 250 million, based on a five-year historical analysis. Recent valuations suggest it is in the mid-hundreds of millions, driven by the demand for processed foods and beverages.