Region:Middle East

Author(s):Dev

Product Code:KRAC4869

Pages:93

Published On:October 2025

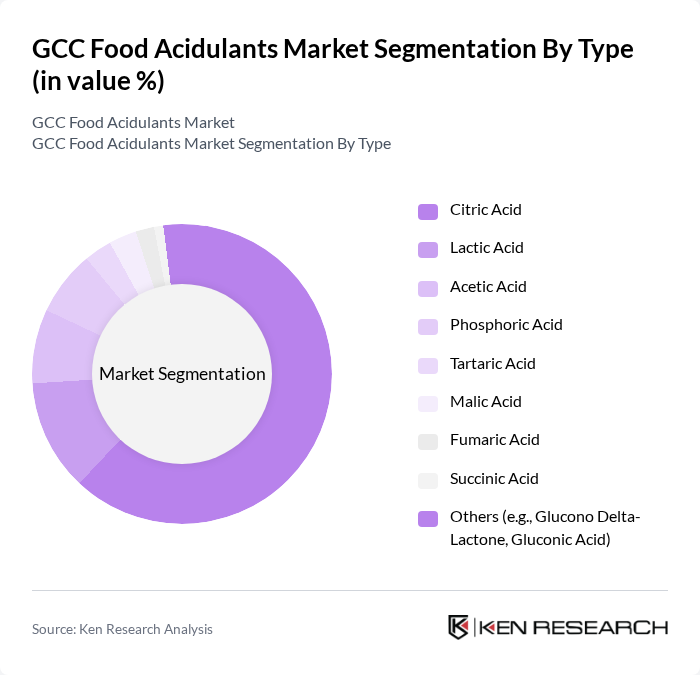

By Type:The market is segmented into various types of food acidulants, including Citric Acid, Lactic Acid, Acetic Acid, Phosphoric Acid, Tartaric Acid, Malic Acid, Fumaric Acid, Succinic Acid, and Others (e.g., Glucono Delta-Lactone, Gluconic Acid). Each type serves distinct purposes in food preservation, flavor enhancement, and pH regulation. Citric acid dominates due to its wide use in beverages and processed foods for its preservative and flavoring properties. Lactic acid is primarily used in dairy and bakery products, while acetic acid finds application in sauces and dressings. Phosphoric acid is common in carbonated beverages, and other acidulants are utilized for specialized functions such as gelling, chelation, and antimicrobial activity .

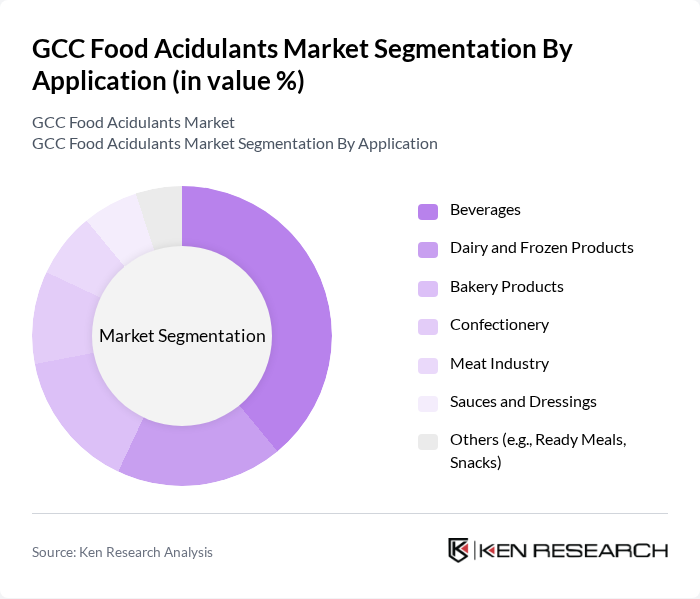

By Application:The applications of food acidulants include Beverages, Dairy and Frozen Products, Bakery Products, Confectionery, Meat Industry, Sauces and Dressings, and Others (e.g., Ready Meals, Snacks). Acidulants are primarily used to enhance flavor, preserve freshness, regulate pH, and improve product stability. Beverages represent the largest application segment, particularly carbonated drinks and juices, followed by dairy, bakery, and confectionery. Meat industry applications focus on preservation and microbial control, while sauces and dressings utilize acidulants for taste and shelf life extension .

The GCC Food Acidulants Market is characterized by a dynamic mix of regional and international players. Leading participants such as ADM (Archer Daniels Midland Company), Cargill, Incorporated, Tate & Lyle PLC, Jungbunzlauer Suisse AG, Brenntag AG, Corbion N.V., FBC Industries, Inc., Bartek Ingredients Inc., Gadot Biochemical Industries Ltd., IFF (International Flavors & Fragrances Inc.), Tate & Lyle Ingredients Gulf FZCO, Univar Solutions Inc., Roquette Frères, Kerry Group plc, BASF SE contribute to innovation, geographic expansion, and service delivery in this space.

The GCC food acidulants market is poised for significant growth, driven by evolving consumer preferences and technological advancements. As the demand for clean label products rises, manufacturers are likely to innovate with natural acidulants that meet health-conscious consumer needs. Additionally, the expansion of e-commerce platforms will facilitate broader distribution channels, enabling companies to reach a wider audience. This dynamic environment presents opportunities for growth and adaptation in the food acidulants sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Citric Acid Lactic Acid Acetic Acid Phosphoric Acid Tartaric Acid Malic Acid Fumaric Acid Succinic Acid Others (e.g., Glucono Delta-Lactone, Gluconic Acid) |

| By Application | Beverages Dairy and Frozen Products Bakery Products Confectionery Meat Industry Sauces and Dressings Others (e.g., Ready Meals, Snacks) |

| By End-User | Food Manufacturers Beverage Producers Retailers Food Service Providers Households Others |

| By Distribution Channel | Direct Sales Distributors Online Retail Supermarkets/Hypermarkets Specialty Stores Others |

| By Region | Saudi Arabia UAE Qatar Kuwait Oman Bahrain Others |

| By Price Range | Economy Mid-Range Premium |

| By Packaging Type | Bulk Packaging Retail Packaging Custom Packaging |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food Processing Companies | 120 | Production Managers, Quality Assurance Officers |

| Retail Food Outlets | 85 | Store Managers, Category Buyers |

| Food Ingredient Suppliers | 75 | Sales Representatives, Product Managers |

| Food Safety Regulatory Bodies | 45 | Regulatory Affairs Specialists, Compliance Officers |

| Food Research Institutions | 65 | Food Scientists, Research Analysts |

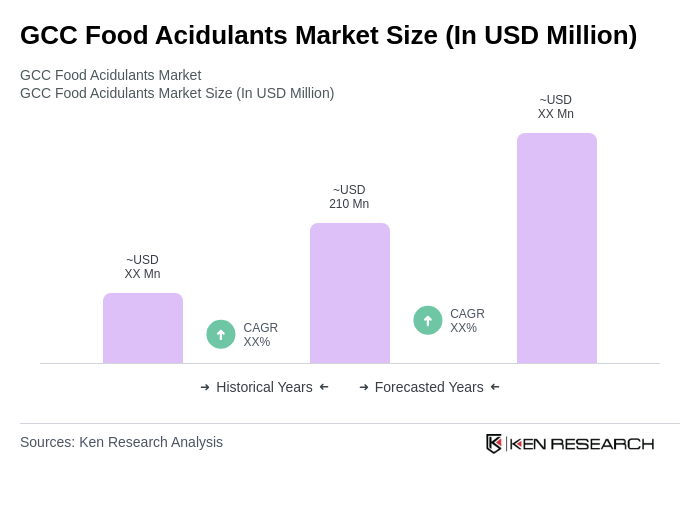

The GCC Food Acidulants Market is valued at approximately USD 210 million, reflecting the region's share of the global market, which is driven by increasing demand for processed foods and beverages, as well as a preference for natural and organic products.