Japan Food Acidulants Market Overview

- The Japan Food Acidulants Market is valued at USD 180 million, based on a five-year historical analysis. This growth is primarily driven by the increasing demand for processed and convenience foods, as well as a rising consumer preference for natural and clean-label ingredients. The market is further supported by the expanding food and beverage industry, which utilizes acidulants for flavor enhancement, preservation, and pH control .

- Key cities such as Tokyo, Osaka, and Yokohama dominate the Japan Food Acidulants Market due to their significant industrial activities and high population density. These urban centers are home to numerous food and beverage manufacturers, which contribute to the high demand for food acidulants. Additionally, the presence of advanced logistics and distribution networks in these cities facilitates efficient supply chain operations .

- In recent years, the Japanese government has implemented stricter regulations on food additives, including food acidulants, to ensure consumer safety and product quality. These regulations mandate comprehensive labeling and safety assessments for all food acidulants used in food products, aiming to enhance transparency and consumer trust in the food supply chain .

Japan Food Acidulants Market Segmentation

By Type:The market is segmented into various types of food acidulants, including Citric Acid, Lactic Acid, Acetic Acid, Phosphoric Acid, Tartaric Acid, Malic Acid, and Other Types. Each type serves distinct purposes in food preservation, flavor enhancement, and pH regulation .

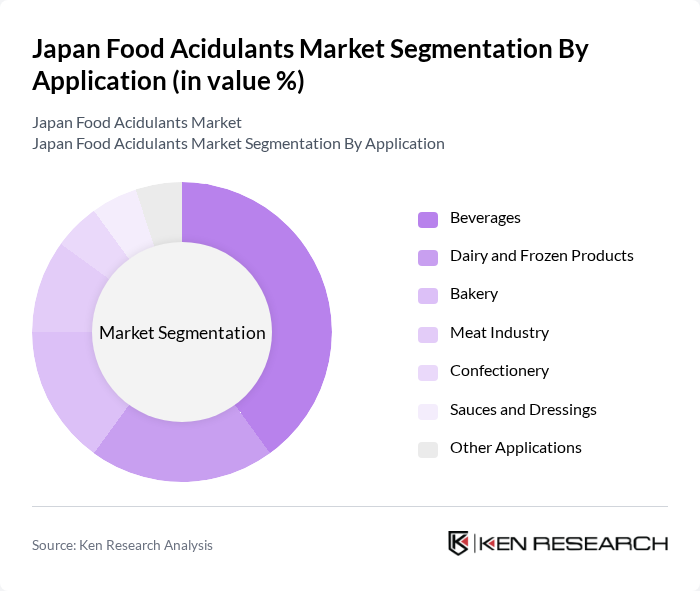

By Application:The applications of food acidulants include Beverages, Dairy and Frozen Products, Bakery, Meat Industry, Confectionery, Sauces and Dressings, and Other Applications. Each application utilizes specific acidulants to enhance flavor, preserve freshness, and improve product stability .

Japan Food Acidulants Market Competitive Landscape

The Japan Food Acidulants Market is characterized by a dynamic mix of regional and international players. Leading participants such as Ajinomoto Co., Inc., Tate & Lyle PLC, Cargill, Incorporated, Archer Daniels Midland Company (ADM), Jungbunzlauer AG, Corbion N.V., Mitsubishi Corporation, BASF SE, Ingredion Incorporated, Brenntag AG, Kemin Industries, Inc., Givaudan S.A., Sensient Technologies Corporation, Fufeng Group Company Limited, Morita Kagaku Kogyo Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space .

Japan Food Acidulants Market Industry Analysis

Growth Drivers

- Increasing Demand for Natural Preservatives:The Japanese food industry is witnessing a significant shift towards natural preservatives, driven by consumer preferences for healthier options. In future, the market for natural preservatives is projected to reach ¥150 billion, reflecting a 10% increase from the previous year. This trend is supported by the growing awareness of health risks associated with synthetic additives, prompting manufacturers to innovate and reformulate products using natural acidulants, which are perceived as safer and more appealing to health-conscious consumers.

- Rising Health Consciousness Among Consumers:Health consciousness among Japanese consumers is at an all-time high, with 70% of the population actively seeking healthier food options. This trend is expected to drive the demand for food acidulants, as they play a crucial role in enhancing the nutritional profile of products. The Japanese health food market is projected to grow to ¥1.2 trillion in future, indicating a robust opportunity for acidulants that align with these health trends, particularly in functional foods and beverages.

- Expansion of Processed Food Industry:The processed food sector in Japan is anticipated to grow significantly, with a market value expected to reach ¥5 trillion in future. This expansion is fueled by busy lifestyles and the increasing demand for convenient meal solutions. As processed foods often require acidulants for preservation and flavor enhancement, this growth directly correlates with a rising need for food acidulants, providing manufacturers with ample opportunities to innovate and cater to evolving consumer preferences.

Market Challenges

- Stringent Regulatory Framework:The Japanese food industry is governed by strict regulations regarding food additives, including acidulants. Compliance with the Food Safety and Standards Act requires manufacturers to adhere to rigorous testing and labeling standards. In future, the cost of compliance is projected to increase by 15%, posing a significant challenge for smaller manufacturers who may struggle to meet these requirements, potentially limiting their market participation and innovation capabilities.

- Price Volatility of Raw Materials:The price volatility of raw materials used in food acidulants, such as citric acid and tartaric acid, poses a significant challenge for manufacturers. In future, the cost of citric acid is expected to fluctuate between ¥200 and ¥250 per kilogram due to supply chain disruptions and global demand shifts. This unpredictability can impact profit margins and pricing strategies, forcing manufacturers to either absorb costs or pass them onto consumers, which may affect competitiveness.

Japan Food Acidulants Market Future Outlook

The future of the Japan food acidulants market appears promising, driven by evolving consumer preferences and technological advancements. As the demand for clean label and organic products continues to rise, manufacturers are likely to invest in innovative acidulant formulations that meet these criteria. Additionally, the expansion of the processed food sector will create new avenues for growth, particularly in functional foods that cater to health-conscious consumers. Collaborations with food manufacturers will further enhance product offerings and market reach.

Market Opportunities

- Development of Innovative Acidulant Products:There is a significant opportunity for manufacturers to develop innovative acidulant products that cater to the growing demand for natural and organic ingredients. By focusing on unique formulations, companies can differentiate themselves in a competitive market, potentially capturing a larger share of the health-conscious consumer segment, which is projected to grow by 12% annually.

- Expansion into Emerging Markets:Japanese food acidulant manufacturers have the opportunity to expand into emerging markets in Southeast Asia, where the demand for processed foods is rapidly increasing. With a projected market growth of 15% in these regions, companies can leverage their expertise in food safety and quality to establish a strong presence, tapping into new consumer bases and driving revenue growth.