Region:North America

Author(s):Dev

Product Code:KRAB0431

Pages:95

Published On:August 2025

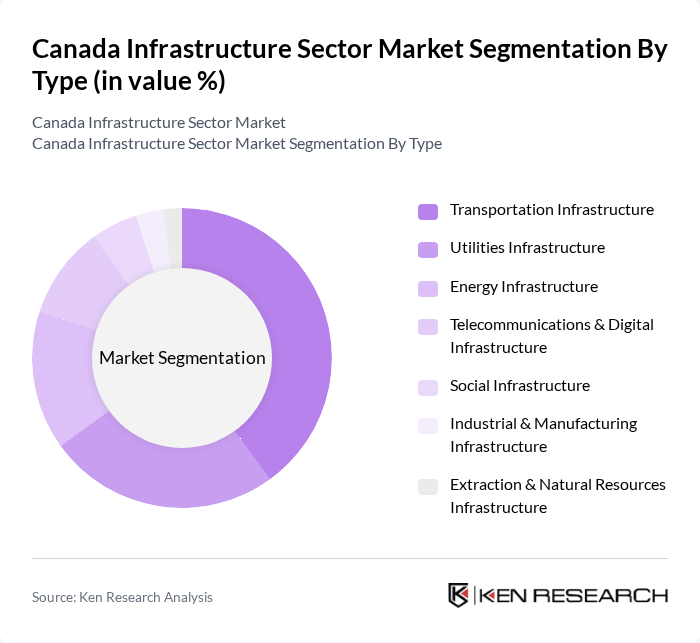

By Type:The infrastructure sector can be segmented into various types, including transportation, utilities, energy, telecommunications, social, industrial, and extraction infrastructure. Each type plays a crucial role in supporting the overall economic framework and addressing the specific needs of urban and rural populations.

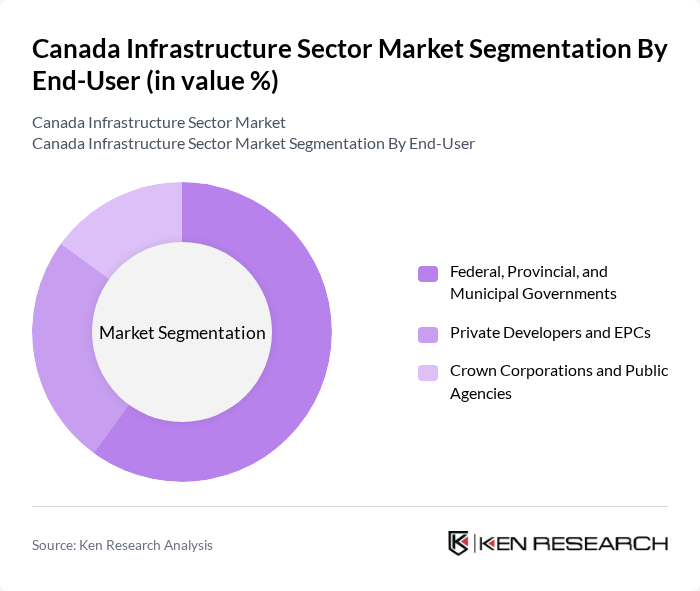

By End-User:The end-users of infrastructure projects include federal, provincial, and municipal governments, private developers, and crown corporations. Each of these entities plays a significant role in funding, developing, and maintaining infrastructure projects across Canada.

The Canada Infrastructure Sector Market is characterized by a dynamic mix of regional and international players. Leading participants such as SNC-Lavalin Group Inc. (AtkinsRéalis), EllisDon Corporation, PCL Constructors Inc., Aecon Group Inc., Graham Construction, Kiewit Corporation, Bird Construction Inc., Ledcor Group, Stantec Inc., WSP Global Inc., AECOM, Jacobs Solutions Inc., Tetra Tech, Inc., HDR, Inc., Golder Associates Ltd. (WSP acquired), CRH Canada Group Inc. (Dufferin Construction), Green Infrastructure Partners Inc. (GIP), Bantrel Co., Graham Management Services LP, Hatch Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Canadian infrastructure sector appears promising, driven by ongoing government investments and a focus on modernization. As urbanization continues, cities will increasingly adopt smart technologies to enhance efficiency and sustainability. Furthermore, the integration of green infrastructure practices will likely gain momentum, aligning with global sustainability goals. These trends indicate a robust pipeline of projects aimed at improving resilience and adaptability in the face of climate change and population growth challenges.

| Segment | Sub-Segments |

|---|---|

| By Type | Transportation Infrastructure (roads and highways, bridges, rail, mass transit, airports, ports and waterways) Utilities Infrastructure (water supply, wastewater, stormwater, solid waste) Energy Infrastructure (power generation, electricity transmission & distribution, oil & gas pipelines) Telecommunications & Digital Infrastructure (fiber networks, mobile networks, data centers) Social Infrastructure (schools, hospitals, defense, public buildings) Industrial & Manufacturing Infrastructure (industrial parks, metal/ore production, petroleum refining, chemical manufacturing) Extraction & Natural Resources Infrastructure (power for extraction, water management, gas, logistics) |

| By End-User | Federal, Provincial, and Municipal Governments Private Developers and EPCs Crown Corporations and Public Agencies |

| By Investment Source | Public Funding (federal, provincial/territorial, municipal) Private Capital (corporate capex, infrastructure funds, pension funds) Foreign Direct Investment (FDI) Public-Private Partnerships (PPP/P3) |

| By Application | Urban Development (transit, housing, utilities) Rural and Northern Development (transport links, broadband, community facilities) Asset Rehabilitation & Maintenance |

| By Project Size | Megaprojects (CAD 1B+) Large Projects (CAD 100M–1B) Small & Medium Projects (below CAD 100M) |

| By Funding Type | Grants and Transfers Loans and Credit Facilities Equity and Project Finance |

| By Policy Support | Subsidies and Incentive Programs Tax Incentives Regulatory and Permitting Facilitation |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Transportation Infrastructure Projects | 140 | Project Managers, Civil Engineers |

| Utility Infrastructure Development | 110 | Utility Executives, Regulatory Affairs Managers |

| Social Infrastructure Initiatives | 90 | Community Development Officers, Urban Planners |

| Public-Private Partnerships (PPPs) | 70 | PPP Project Leads, Financial Analysts |

| Infrastructure Policy and Regulation | 80 | Government Officials, Policy Advisors |

The Canada Infrastructure Sector Market is valued at approximately CAD 200 billion, driven by increased public investment, urbanization, and modernization needs across various infrastructure types, including transportation, energy, and utilities.