Region:North America

Author(s):Shubham

Product Code:KRAA0737

Pages:81

Published On:August 2025

By Technology Type:The technology type segment encompasses a range of solutions that enhance warehousing operations. The leading sub-segment is Warehouse Management Systems (WMS), which streamline inventory management and order fulfillment processes. Automated Storage and Retrieval Systems (AS/RS) are gaining traction due to their efficiency in space utilization and labor reduction. Robotics and Automation Solutions are increasingly adopted for their ability to enhance productivity and accuracy in warehousing tasks. Material handling equipment, including conveyors and sortation systems, is essential for efficient movement of goods within warehouses. IoT and sensor-based solutions enable real-time monitoring and data-driven decision-making, while cold storage technologies address the needs of temperature-sensitive products. Inventory management solutions and other specialized technologies further support operational efficiency and compliance .

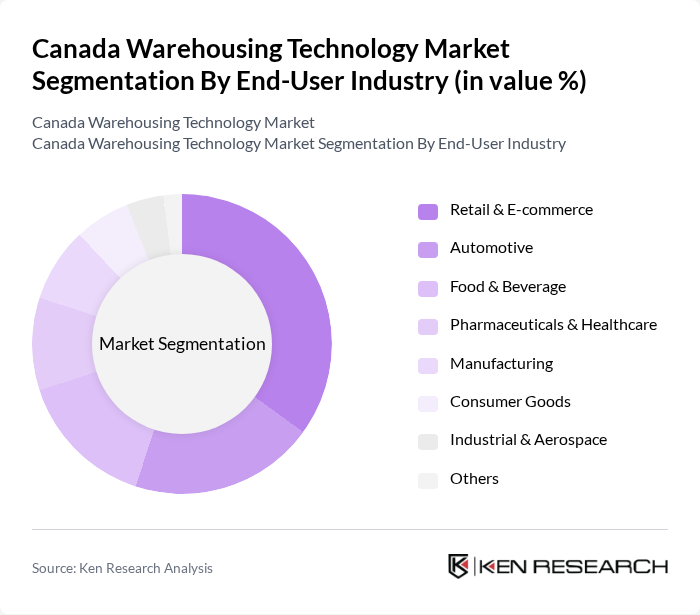

By End-User Industry:The end-user industry segment highlights the diverse applications of warehousing technology across various sectors. Retail & E-commerce is the dominant sub-segment, driven by the surge in online shopping and the need for efficient order fulfillment. The Food & Beverage and Pharmaceuticals & Healthcare industries also significantly contribute to the market, requiring specialized storage and handling solutions to maintain product integrity and regulatory compliance. Automotive, manufacturing, and consumer goods industries leverage warehousing technologies for streamlined logistics, while industrial and aerospace sectors demand advanced solutions for complex supply chains. Other industries, including third-party logistics providers, further drive adoption through value-added services .

The Canada Warehousing Technology Market is characterized by a dynamic mix of regional and international players. Leading participants such as Dematic, Honeywell Intelligrated, Swisslog, Siemens Logistics, Zebra Technologies, Murata Machinery, Knapp AG, Interroll Group, Tecsys Inc., Blue Yonder, Manhattan Associates, Infor, Oracle, SAP SE, Korber AG, Epicor Software, PSI Logistics, DB Schenker, DHL Supply Chain, Kuehne + Nagel contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Canadian warehousing technology market appears promising, driven by ongoing advancements in automation and data analytics. As companies increasingly adopt smart warehousing solutions, the integration of IoT technologies will enhance operational efficiency and inventory management. Furthermore, the focus on sustainability will likely lead to innovations in eco-friendly practices, positioning the market for significant growth. Overall, these trends indicate a dynamic evolution in warehousing technology, aligning with broader economic shifts in Canada.

| Segment | Sub-Segments |

|---|---|

| By Technology Type | Warehouse Management Systems (WMS) Automated Storage and Retrieval Systems (AS/RS) Material Handling Equipment (Conveyors, Sortation Systems, etc.) Robotics and Automation Solutions Inventory Management Solutions Cold Storage Technologies IoT and Sensor-Based Solutions Others |

| By End-User Industry | Retail & E-commerce Automotive Food & Beverage Pharmaceuticals & Healthcare Manufacturing Consumer Goods Industrial & Aerospace Others |

| By Application | Order Fulfillment Inventory Management Shipping and Receiving Returns Management Cross-Docking Value-Added Services Others |

| By Distribution Mode | Direct Distribution Third-Party Logistics (3PL) Providers E-commerce Fulfillment Centers Retail Distribution Centers Others |

| By Sales Channel | Direct Sales Distributors/Resellers Online Sales Others |

| By Region | Ontario Quebec British Columbia Alberta Other Provinces |

| By Technology Integration | IoT Integration AI and Machine Learning Cloud-Based Solutions Blockchain Technology Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Warehouse Management Systems | 60 | IT Managers, Operations Directors |

| Automation Solutions in Warehousing | 50 | Warehouse Managers, Technology Officers |

| IoT Applications in Logistics | 40 | Data Analysts, Supply Chain Managers |

| Cold Chain Logistics Technology | 40 | Logistics Coordinators, Quality Assurance Managers |

| Inventory Management Software | 50 | Procurement Managers, Inventory Control Specialists |

The Canada Warehousing Technology Market is valued at approximately USD 2.3 billion, driven by the increasing demand for efficient supply chain management, the rise of e-commerce, and the need for automation in warehousing operations.