Region:Asia

Author(s):Geetanshi

Product Code:KRAA0209

Pages:85

Published On:August 2025

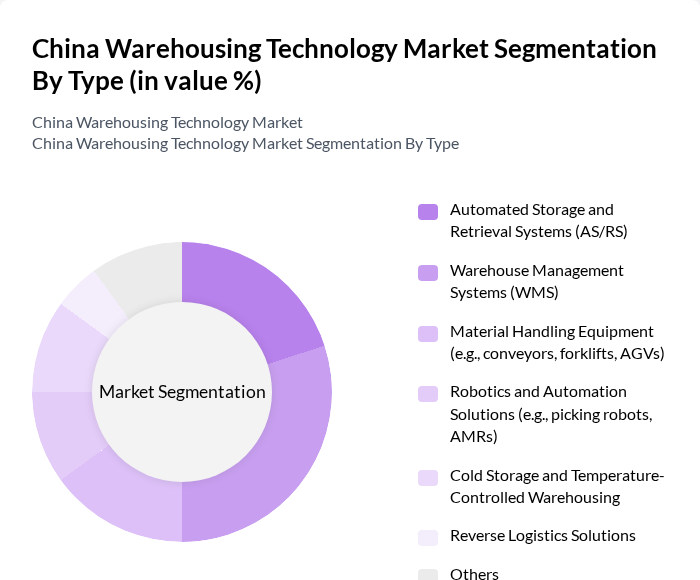

By Type:The market is segmented into Automated Storage and Retrieval Systems (AS/RS), Warehouse Management Systems (WMS), Material Handling Equipment, Robotics and Automation Solutions, Cold Storage and Temperature-Controlled Warehousing, Reverse Logistics Solutions, and Others. Among these, Warehouse Management Systems (WMS) and high-standard automated warehouses are leading segments, reflecting their critical role in optimizing inventory management, improving throughput, and supporting the rapid scaling of e-commerce and retail logistics operations .

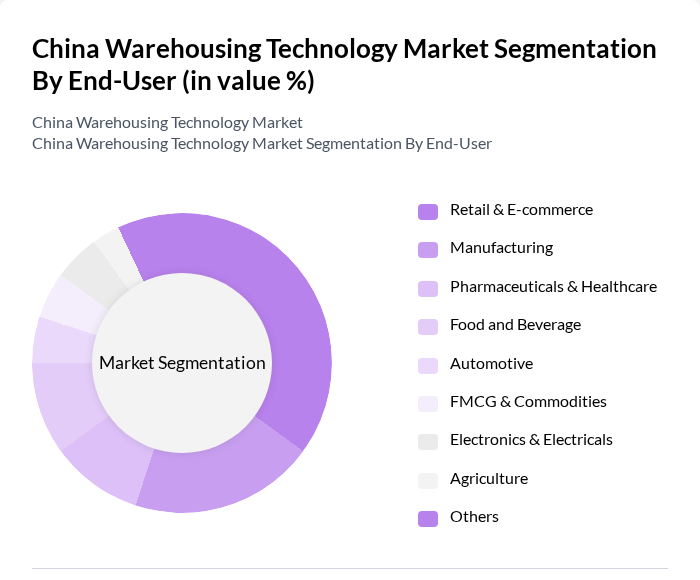

By End-User:The end-user segmentation includes Retail & E-commerce, Manufacturing, Pharmaceuticals & Healthcare, Food and Beverage, Automotive, FMCG & Commodities, Electronics & Electricals, Agriculture, and Others. The Retail & E-commerce sector is the dominant end-user, driven by the explosive growth of online shopping and the need for rapid, efficient logistics solutions. The FMCG and Commodities sector also represents a significant share, reflecting the critical role of warehousing in supporting fast-moving consumer goods and bulk commodity distribution .

The China Warehousing Technology Market is characterized by a dynamic mix of regional and international players. Leading participants such as GLP China Holdings Limited, Vanke Logistics Development Co., Ltd., JD Logistics, Cainiao Network (Alibaba Group), SF Express, Sinotrans Limited, YTO Express, ZTO Express, Best Logistics, China National Postal Group, Prologis China, Goodman China, DB Schenker China, Kuehne + Nagel China, Nippon Express China contribute to innovation, geographic expansion, and service delivery in this space.

The future of the China warehousing technology market appears promising, driven by ongoing advancements in automation and the integration of AI and IoT technologies. As companies increasingly adopt smart warehousing solutions, operational efficiencies are expected to improve significantly. Furthermore, the expansion of cold chain logistics will cater to the growing demand for perishable goods, enhancing supply chain resilience. These trends indicate a robust evolution in warehousing practices, positioning the sector for sustained growth and innovation in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Automated Storage and Retrieval Systems (AS/RS) Warehouse Management Systems (WMS) Material Handling Equipment (e.g., conveyors, forklifts, AGVs) Robotics and Automation Solutions (e.g., picking robots, AMRs) Cold Storage and Temperature-Controlled Warehousing Reverse Logistics Solutions Others |

| By End-User | Retail & E-commerce Manufacturing Pharmaceuticals & Healthcare Food and Beverage Automotive FMCG & Commodities Electronics & Electricals Agriculture Others |

| By Region | North China (e.g., Beijing, Tianjin, Hebei) South China (e.g., Guangdong, Guangxi, Hainan) East China (e.g., Shanghai, Jiangsu, Zhejiang) West China (e.g., Sichuan, Chongqing, Shaanxi) |

| By Technology | Cloud-Based Solutions AI-Driven Analytics Internet of Things (IoT) Blockchain Technology Drone and Automated Guided Vehicle (AGV) Integration Others |

| By Application | Inventory Management Order Fulfillment Shipping and Receiving Returns Management Cold Chain Monitoring Others |

| By Investment Source | Private Investments Government Funding Venture Capital Public-Private Partnerships Foreign Direct Investment (FDI) Others |

| By Policy Support | Tax Incentives Grants for Technology Adoption Subsidies for Infrastructure Development Regulatory Support for Innovation Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automated Warehousing Solutions | 100 | Warehouse Managers, Technology Implementers |

| Cold Chain Logistics | 60 | Operations Managers, Supply Chain Analysts |

| Last-Mile Delivery Innovations | 55 | Logistics Coordinators, Delivery Operations Managers |

| Inventory Management Systems | 70 | IT Managers, Inventory Control Specialists |

| Warehouse Safety Technologies | 50 | Safety Officers, Compliance Managers |

The China Warehousing Technology Market is valued at approximately USD 119 billion, driven by the rapid growth of e-commerce, demand for automated warehouses, and investments in digital transformation and automation technologies.