Region:Europe

Author(s):Geetanshi

Product Code:KRAA1946

Pages:81

Published On:August 2025

By Type:The market is segmented into various types, including Automated Storage and Retrieval Systems (AS/RS), Warehouse Management Systems (WMS), Material Handling Equipment (Conveyors, Palletizers, AGVs), Robotics and Automation Solutions (Robotic Picking, AMRs), Inventory Management Software, Warehouse Execution Systems (WES), and Others (e.g., Voice Picking, Wearables). Among these, Warehouse Management Systems (WMS) hold the largest share, driven by their essential role in optimizing warehouse operations, improving inventory accuracy, and supporting real-time data analytics for decision-making.

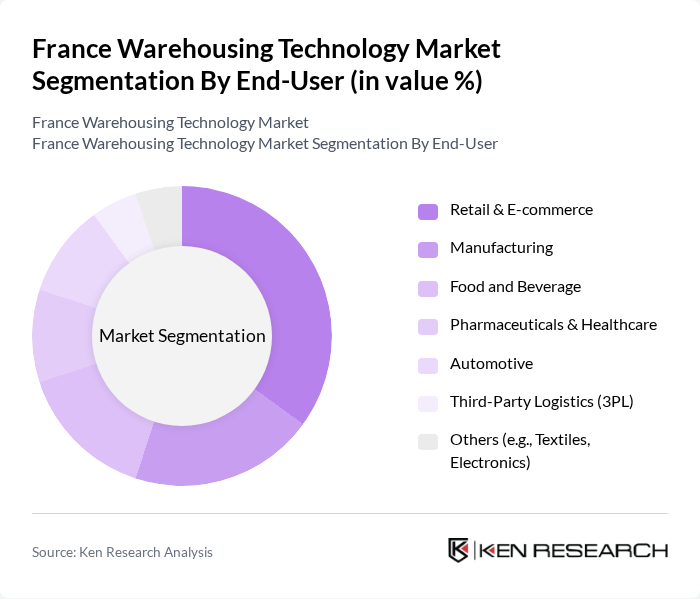

By End-User:The end-user segmentation includes Retail & E-commerce, Manufacturing, Food and Beverage, Pharmaceuticals & Healthcare, Automotive, Third-Party Logistics (3PL), and Others (e.g., Textiles, Electronics). The Retail & E-commerce sector is the dominant end-user, propelled by the surge in online shopping, omnichannel retail strategies, and the heightened need for rapid, accurate order fulfillment.

The France Warehousing Technology Market is characterized by a dynamic mix of regional and international players. Leading participants such as Kuehne+Nagel, DB Schenker, XPO Logistics, GEODIS, DSV, CEVA Logistics, Bolloré Logistics, DHL Supply Chain, ID Logistics, FM Logistic, SNCF Logistics, GXO Logistics, Savoye, Mecalux, SSI SCHÄFER contribute to innovation, geographic expansion, and service delivery in this space.

The future of the warehousing technology market in France appears promising, driven by ongoing advancements in automation and a growing emphasis on sustainability. As companies increasingly adopt IoT and AI technologies, operational efficiencies are expected to improve significantly. Furthermore, the integration of advanced analytics will enable better decision-making and resource allocation. The focus on sustainable practices will also shape the market, as businesses seek to reduce their carbon footprints while enhancing their logistics capabilities, ensuring a competitive edge in the evolving landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Automated Storage and Retrieval Systems (AS/RS) Warehouse Management Systems (WMS) Material Handling Equipment (Conveyors, Palletizers, AGVs) Robotics and Automation Solutions (Robotic Picking, AMRs) Inventory Management Software Warehouse Execution Systems (WES) Others (e.g., Voice Picking, Wearables) |

| By End-User | Retail & E-commerce Manufacturing Food and Beverage Pharmaceuticals & Healthcare Automotive Third-Party Logistics (3PL) Others (e.g., Textiles, Electronics) |

| By Application | Order Fulfillment Inventory Management Shipping and Receiving Returns Management Cross-Docking Others |

| By Distribution Mode | Direct Distribution Third-Party Logistics (3PL) E-commerce Fulfillment Centers Others |

| By Pricing Strategy | Cost-Plus Pricing Value-Based Pricing Subscription/As-a-Service Pricing Competitive Pricing Others |

| By Service Type | Consulting Services Implementation & Integration Services Maintenance and Support Services Training Services Others |

| By Region | Northern France Southern France Eastern France Western France Central France Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automated Warehousing Solutions | 100 | Warehouse Operations Managers, IT Directors |

| Cold Chain Logistics | 60 | Supply Chain Managers, Quality Assurance Heads |

| Inventory Management Technologies | 70 | Inventory Control Specialists, Procurement Managers |

| Warehouse Management Systems (WMS) | 90 | Logistics Coordinators, Software Implementation Leads |

| Last-Mile Delivery Innovations | 50 | Last-Mile Delivery Managers, Operations Analysts |

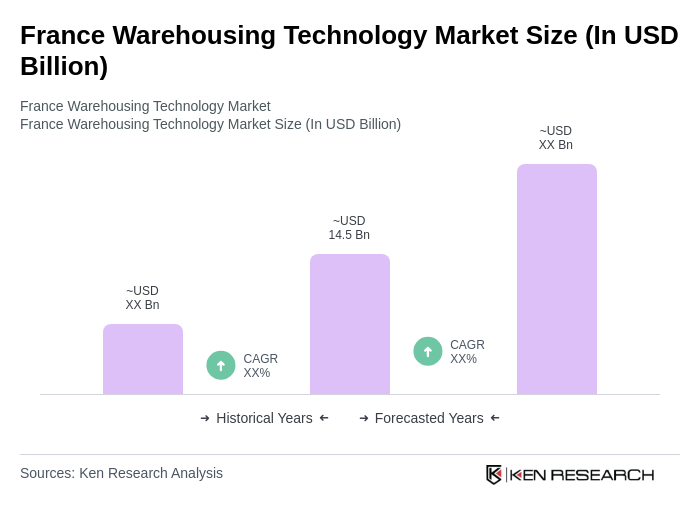

The France Warehousing Technology Market is valued at approximately USD 14.5 billion, reflecting significant growth driven by the demand for efficient supply chain management, e-commerce expansion, and advancements in automation technologies.