Region:Central and South America

Author(s):Rebecca

Product Code:KRAB6433

Pages:98

Published On:October 2025

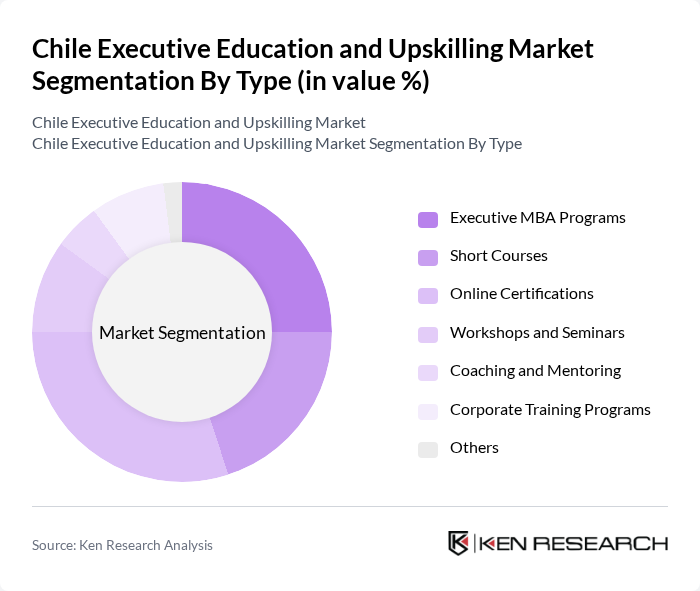

By Type:The market is segmented into various types of educational offerings, including Executive MBA Programs, Short Courses, Online Certifications, Workshops and Seminars, Coaching and Mentoring, Corporate Training Programs, and Others. Each of these sub-segments caters to different learning needs and preferences, with a notable trend towards online and hybrid learning formats due to their flexibility and accessibility.

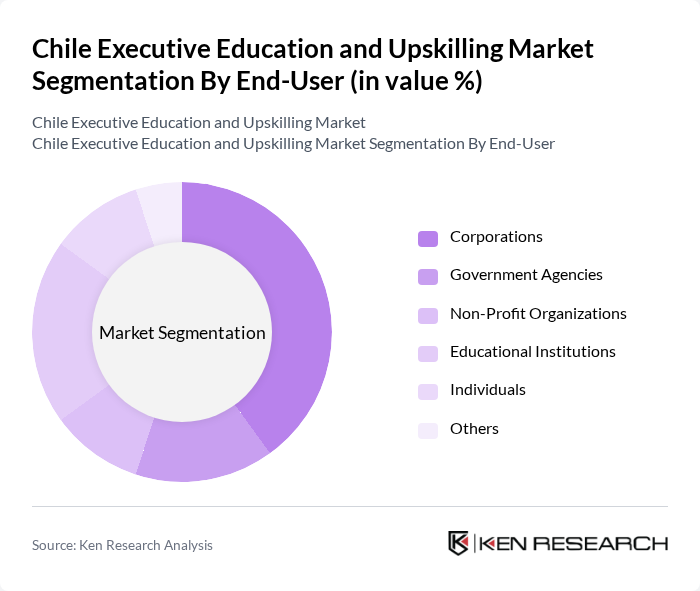

By End-User:The end-users of executive education and upskilling programs include Corporations, Government Agencies, Non-Profit Organizations, Educational Institutions, Individuals, and Others. Corporations are the largest segment, driven by the need for continuous employee development to maintain competitiveness in a rapidly changing business environment.

The Chile Executive Education and Upskilling Market is characterized by a dynamic mix of regional and international players. Leading participants such as Universidad de Chile, Pontificia Universidad Catolica de Chile, Universidad Adolfo Ibáñez, ESE Business School, INACAP, Universidad Técnica Federico Santa María, Universidad de los Andes, Universidad del Desarrollo, CEF - Centro de Estudios Financieros, Duoc UC, Universidad de La Frontera, Universidad de Talca, Universidad de Concepción, Universidad de Valparaíso, Universidad de Magallanes contribute to innovation, geographic expansion, and service delivery in this space.

The Chilean executive education and upskilling market is poised for significant transformation as digital learning continues to gain traction. With government support and increasing corporate investment in training, the landscape is shifting towards more flexible and accessible learning solutions. The integration of technology, such as AI and personalized learning experiences, will further enhance program effectiveness. As organizations recognize the importance of continuous skill development, the demand for tailored educational offerings will likely increase, creating a dynamic environment for growth and innovation.

| Segment | Sub-Segments |

|---|---|

| By Type | Executive MBA Programs Short Courses Online Certifications Workshops and Seminars Coaching and Mentoring Corporate Training Programs Others |

| By End-User | Corporations Government Agencies Non-Profit Organizations Educational Institutions Individuals Others |

| By Delivery Mode | In-Person Training Online Learning Hybrid Learning Blended Learning Others |

| By Duration | Short-Term Programs Medium-Term Programs Long-Term Programs Others |

| By Industry Focus | Technology Finance Healthcare Manufacturing Services Others |

| By Certification Type | Professional Certifications Academic Certifications Industry-Specific Certifications Others |

| By Pricing Model | Subscription-Based Pay-Per-Course Bundled Packages Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Executive Education Programs | 150 | HR Directors, Learning and Development Managers |

| Industry-Specific Upskilling Initiatives | 100 | Training Coordinators, Operations Managers |

| Online Learning Platforms for Professionals | 80 | Product Managers, Digital Learning Specialists |

| Government-Funded Upskilling Programs | 70 | Policy Makers, Educational Administrators |

| Networking and Leadership Development Workshops | 90 | Business Leaders, Executive Coaches |

The Chile Executive Education and Upskilling Market is valued at approximately USD 1.2 billion, reflecting a significant growth trend driven by the demand for skilled professionals and the rise of digital learning platforms.